Friday’s trading in Europe ended with a clear positive momentum and strength. Storbolagsindexet OMXS30 index closed just below the high for the year, and a heavy resistance level, which was up +0.67% to get a closure at 1654.80 points. The turnover on the stockholm stock exchange was sek 16.5 billion. After overnight trading in Asia is clearly negative attitude that prevails, which is expected to be infected initially, when the european stock exchanges open in a couple of hours…

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

Positive momentum occurred already initially on a Friday, and the OMXS30 stepped directly over the resistance at 1650 points.

In the short term challenged we year high at 1657 points, but never managed to step over this level, to note a new.

We have now experience clear köpstyrka during the last three trading days, and also if the leading futures pointing to an initially weak fall on Monday, it is still positive momentum that exists.

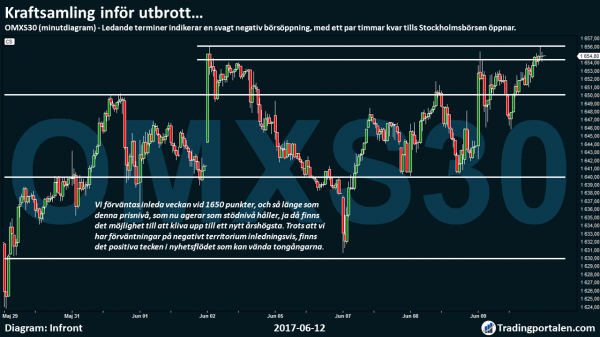

We expected to start the week at 1650 points, and as long as this price level, which now acts as the support level holds, well then, there is the opportunity to step up to a new high for the year.

Despite the fact that we have expectations in negative territory initially, there are positive signs in the news that can turn the vibes.

Not least is the French president, Emmanuel Macron on the road against the big parliamentary majority, which is considered to be positive for the EU. Even some of the Uk’s prime minister Theresa Mays more senior ministers are planning for a softer Brexit.

We have no heavy makrobesked, or reports from indextunga company, which means that we do not expect any significant movements from this perspective.

However, we get a little more larger ones later in the week, including German sentiment index ZEW on Tuesday, the u.s. interest rate announcement on Wednesday, and last but not least, the british interest rate announcement on Thursday.

On Monday we are however an extra eye on that we do not establish ourselves in 1650, as this increases the risk that we will return to a handelsintervall within the 1630-1650, but primarily short-term down to 1640 points.

We’ve found such strength and momentum of the last few days is considered to be positive, and we will challenge now on the seriously high for the year, which sends signals that we may be on the way towards the next significant resistance level at 1670 points.

In the short term, we are now after Friday’s trading overbought, at the same time, there is space for the additional a couple of minor uppgångsdagar.

The trends are still positive, and we note the higher bottoms and tops then we, on 18 may at the moment was down and turned at 1604 points.

On a clear outbreak over the high for the year at 1657 points, we expect if so a little more powerful movement, which means that we see the challenging of 1670 points possible during the same day.

On the basis of a bit longer perspective is still an all-time high at the 1720 is within reach, but short-term deviations, together with certain political concerns and the question mark means that we are slightly more cautious and on the alert.

For today’s trading we have thus technical resistance levels already in 1654, and the high for the year 1657 points. Then we hold a more significant resistance at 1670 points. Technical levels of support at 1650, followed by 1640 and 1630 points, followed by heavy sentimental heltalsnivån 1600 points.

What hålltider and the company reports the next weeks you can read here.

Friday’s main börshändelser.

Fingerprint find land over $ 35…?

Notes, now a the rise during the last week of nearly 20 percent.

Fingerprint Cards continues further north on Friday, which means that the company’s shares a week ago has risen more than 20 percent.

The upswing in Friday, at 5 per cent, at the same time means that the stock climb over $ 35 for the second day in a row, and may be on the way to find land of this price level, which has acted in the clear support earlier in april this year.

Positive indications have been revealed in the news in recent days.

As previously noted is the company’s sensor in order that the company’s partner in the field of biometric payment solutions, Zwipe has received, from the two stakeholders in the payment card.

Handelsbanken wrote as late as on Thursday in its morgonbrev that ”the impression that the Fingerprint Cards have taken back some of the lost market share from, among others, chinese Goodix”.

Despite the bank’s earlier conservative forecasts, mean the bank that the stock is ”very attractively priced”, and repeated while the recommendation to increase.

The kitchen manufacturer Nobia clear losers after the stock gets below the MA 100.

Challenges at the same time, after decline further to an intensity level at 88 dollars.

The kitchen manufacturer Nobia is one of the big losers on Friday, falling on the -3.5 per cent, a decline means that the share now step below the MA 100, as noted at 89.42 crowns.

The decline means in addition to an establishment 89.50 kronor, which previously acted clearly kanaltak earlier in the year, a decline that challenge the next support level at 88 dollars, and asks the question if we are on the road against sek 85 in the future…?

Danske Bank lowered its previous recommendation for the company to retain, from the purchase history so late as in the beginning of may.

Riktkursen was left unchanged at sek 100, but created nonetheless a trigger of decline…

Workshop delivers the strength on Friday!

Note the clear gains already initially in the morning.

We have previously noted that it can be sektorrotation at the time… Atlas Copco, which we released a buy recommendation early on Friday, was early ledarhunden on Friday morning among verkstadsbolagen.

Morgan Stanley lowered verkstadssektorn earlier in the middle of may, when by gave the recommendation ”careful”…

But several of the Swedish verkstadsbolagen bottomed out instead out at the moment, and may 18, instead became a turning point for the new tag the north…

Hålltider during the day

Ex-dividend

- SCA (shares in Essity)

Macro statistics

- Japan: machinery orders april at 1.50

- SEB: boprisindikatorn June at 8.30

- AF: the weekly statistics at 10.45

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange moved up on Friday in line with the leading european exchanges. The british election loss for Theresa Mays conservative party attracted investors ‘ attention. On the markets lost a pound land in the wake of the election results.

Among the larger companies in the OMXS30 that was the pattern from earlier in the week with the Fingerprint in the top, and with continued declines in an increasingly busy H&M. Some companies with big british exposure Nobia and Kopparberg Breweries was listed clearly below.

At the time of closing had the OMXS30 index increased by 0.7 per cent to the level of 1.655, with annual sales of around 16.5 billion.

The pound has lost around 2 percent against the dollar and the euro. The british elections ended with the conservative ruling party, the Tories losing 13 of its 331 locations in the british house of commons, and that the party therefore loses its current majority of the total 650 seats.

Among the companies listed in Stockholm with a big british exposure, backed kitchen com pany Nobia by 2.6 per cent while the Year was down nearly 2 percent. Elekta, which has costs in the pound appreciated 1 percent.

Fingerprint continued to rise 7 per cent, which sums up the latest week’s rise to a little over 26 per cent. The company’s sensor FPC1320 on the smart biometric card V2 from Mereal.

In the opposite part of the storbolagsindexet low H&M, a picture that is familiar from earlier in the week, with a decline of 1 per cent. Klädbolagsaktien is now trading at the same level as in summer 2012.

Among verkstadsbolagen found several winners with SKF, Sandvik and Atlas Copco, up by 2 percent or more. Defensive Astra Zeneca had it tougher, with a decline of 0.8 per cent.

Ögonstyrningsbolaget Tobii said on Thursday, after closing that there are now 15 new computer games with the support of the company’s eyetrackingfunktion. In total, there are thus more than 75 such games. The stock was up 0.4 per cent.

Wilson Therapeutics rose just over 2 per cent. Biotech company announced that the us FDA has granted särläkemedelsklassificering for WTX101 as the treatment of ALS.

Systemair advanced 3.6 percent after having fallen more than 5 percent on Thursday in the wake of its report. Swedbank believes that systemair’s operating margin target of 10 per cent is now within reach, and has raised its recommendation to buy (neutral).

Myfc advanced 17 percent after the bränslecellsbolaget announced plans to raise approximately sek 32 million through a directed issue. Handelsbanken Funds intend to purchase 2 million shares in the rights issue and increasing its stake in the company to the equivalent of 6.4% of the share capital and votes.

Medcap, which invests in hälsovårdsbolag, fell by 7 percent after the results in the company’s fourth quarter more than halved.

TC Connect made its debut on the First North. Before listing, have a new issue with a subscription price of sek 20 implemented. The share closed at the course 28:60 sek.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1654.8

3586.07

12815.72

7527.33

2431.77

21271.97

6207.92

19900.53

25712.55

1.12

9.76

8.71

46.1

48.45

0.67%

0.62%

0.80%

1.04%

-0.08%

0.42%

-1.80%

-0.56%

-1.22%

0.08%

0.05%

0.02%

0.59%

0.62%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com