Positive momentum dominated Tuesday’s trading, which lifted storbolagsindexet OMXS30, +0.60% to 1648.61. The turnover on the stockholm stock exchange amounted to 16.6 billion. The positive tongång that prevailed in Europe, spread to the united states, which gave broad gains ahead of tonight’s interest rate announcement from the Fed. Leading futures pointing to an opening above the resistance level at 1650 points, which bodes well for today’s development, and possibly challenging of the high for the year…

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

Mainly after noon stepped buyers are clearly back into the picture, to lift the OMXS30 index to over 1650 points. Dagshögsta on Tuesday became 1653.50 points, which means that we are well on the way to challenge the high for the year.

A clear positive momentum behind the scenes is perceived, which confirms that the decline on Monday was temporary.

Leading futures indicates that we have a slightly positive börsöppning about a couple of hours on the stockholm stock exchange. Us senior semester, the S&P 500 traded however faint negative after overnight trading in Asia, which may give slightly more subdued effect on the sentiment remains.

Since the american minimum bid rate will not until the kvällssidan, we expect no effect from any statement from the Fed until tomorrow Thursday.

The market expects a rate hike by 25 basis points to a range in the 1.00-1.25%, but it feels a bit like the market has already taken a certain lead, and reckoned home this expected increase in interest rates, including u.s. dollar touched last week, but also the gold that is clearly backed down.

In line with that, we stepped over 1650 on Tuesday, we would have got to experience a somewhat stronger volume and interest from the buyers, which make that the movement is somewhat more uncertain in its character. Of course, we expect that the year high will be hard to beat, and that a minor rebound is not entirely unexpected.

We are still in ”square one” as we wrote in Tuesday’s morgonrapport, even after yesterday’s close, which means that we traded within a range of 1640-1650, but particularly in 1630-1650, which is the primary handelsintervallet experienced for the OMXS30 during the last few weeks.

We are looking for a closure that establishes itself clearly over 1650 with the proper sign of strength, please review the high for the year 1657, which would then provide a confirmation of the further rise in the card. In the short term, we are not overbought, which means that the space is there for a rebound also from a technical perspective.

Otherwise the risk is that we get the fake outbreak out of the range of 1640-1650, similar to those previously experienced recent trading days.

Nevertheless, the case of the same scenario at an establishment during the kanalbotten 1640 and 1630 points, which would then highlight a negative scenario.

However, don’t fall our assessment of such a development on the basis of a short-term perspective, then we rather believe that we experience the underlying positive momentum, pointing to a trip further north, in recurrent cases that challenge the high for the year.

Technical resistance levels during the day, we keep track of the particular 1650, 1654, and the high for the year 1657, before we turn its eyes north to 1670 points. In the short term may 1646 and 1644 provide somewhat less support, but the primary support levels await at 1640, 1630 and then at 1600 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

Volvo joins forces facing new heights…?

Exhibit signs of underlying positive momentum.

Volvo continues further to the north on Tuesday, with an initially increase of over +1.5%.

The company’s share, therefore, continues its journey with the recurring challenge the high for the year, and the technical resistance level at 148 sek.

Volvo, which enjoyed a rise of more than +38% since the end of the year, is trading slightly below all time high of 153 kronor from 2007.

Fuel to Tuesday’s rise was Christer Gardell from Cevian Capital, who said that the Volvo can reach higher than Scania in an interview with the Svenska Dagbladet Näringsliv.

Technically, Volvo, out to recharge for the new heights, at the same time that resistance in the form of the high for the year at 148 sek, sentimental heltalsnivån at 150, and the all time high of 153 kronor, all awaiting behind the corner…

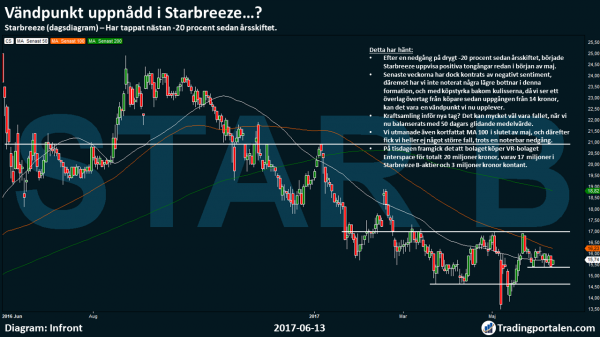

Turning point reached in Starbreeze…?

After a decline of over -20% since the end of the year, began Starbreeze show a positive attitude in the beginning of may.

In recent weeks, however, have kontrats of negative sentiment, however, we have not noted any lower bottoms in this formation, and with köpstyrka behind the scenes, then we see an overall advantage from the buyer since the rise from sek 14, it can be a turning point we are now experiencing.

Forces before new tag? It may very well be the case, as we are now balanced with the 50 day moving average.

We challenged even briefly MA 100 at the end of may, and then we got not any larger case, despite a notable decline.

On Tuesday, it emerged that the company buys VR company Enterspace for a total of 20 million, of which sek 17 million in Starbreeze B-shares and sek 3 million in cash.

Securitas challenge the high for the year!

Securitas, the journey continues further north on Tuesday, with an initially increase of over +2%.

The share is in spite of the outbreak and the increase of almost +6 per cent since the beginning of June, however, only up +3.63% since the end of the year.

Tuesday’s rise at the same time means that Securitas ‘ challenge the high for the year at sek 149 seriously, at the same time as the underlying positive momentum indicates that we may well be on the road to the north, to challenge the all time high on gravity at 153 crowns.

The past decline of the company’s share now taken back, occurred in the beginning of may in connection with the rapportbesvikelse.

Hålltider during the day

Company reports

- Arc Aroma Pure, Inditex

Ex-dividend

- Hancap (0:87 £ on a quarterly basis in preferred stock), Sdiptech (2:00 sek on a quarterly basis in preferred stock ), Hexagon (2:25 sek, on a quarterly basis in preferred stock)

Macro statistics

- China: retail sales, industrial production, fixed investments may at 4.00

- Japan: industrial production (def) in april at 6.30

- Finland: CPI, may 8: 00 am

- The TNS Prospera: inflation expectations – great survey 8.00

- Germany: CPI (def) may at 8.00

- Germany: wholesale prices of may at 8.00

- Uk: unemployment rate (ILO) april at 10: 30 a.m.

- EMU: industrial production april at 11.00

- EMU: employment 1 kv 11.00

- United states: CPI may at 14.30

- United states: retail sales in may at 14.30

- United states: stock of unsold goods of april at 16.00

- USA: oil stocks (DOE), weekly statistics at 16.30

Other

- Oil: the IEA monthly report at 10: 00 am

- The Fed interest rate announcement and new projections at 20: 00

- The Fed press conference with Janet Yellen at 20: 30

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange was traded again to the rising share prices on Tuesday after the sura, the beginning of börsveckan. The rise naggades a bit in the edge during the final hours of trading.

Storbolagsindexet the OMXS30 was at closing up 0.6 per cent to 1,649 u.s.. Turnover reached approximately 16.6 billion kronor on the stockholm stock exchange.

On makrofronten surpassed the Swedish CPI expectations and the krona strengthened against the dollar and euro, while interest rates rose.

German ZEW index did not meet expectations.

North sea oil lost a part, after Opec production had risen in may and the metals listed consistently lower courses.

Volvo-storägaren and aktivistfonden Cevians figurehead Christer Gardell believes that Volvo can achieve higher profitability than the Scania. The stock rose more than 2 percent.

Klädjätten H&M jumps up just under 3 percent. Worse developed the mining company Boliden, with a decline of 1 per cent.

Olof Persson, ceo of Volvo between 2011 and 2015 and now, among other things chairman of the board in New Wave, has acquired 35.000 shares in diversehandlaren. The stock was up 9 percent.

Starbreeze has purchased the vr-the company Enterspace for a total of 20 million. Spelaktien rose 2.6 per cent.

Diamyd Medicals did not demonstrate a difference in a prövarinitierad preventionsstudie with diabetesvaccinet Diamyd compared to placebo. According to Diamyds ceo Ulf Hannelius alters the outcome in the study, however, is not the company’s strategy. Bioteknikaktien fell by 17 per cent after the failure of the study.

Doro dropped nearly 1 percent after insiders continued selling shares.

Danske Markets will take up the guarding of Nordax, TF Bank, Resource, and Collector by putting a purchase for the first two, while the keep and sell is put on the latter two. Nordax and TF Bank rose less than 3 percent. Resource Holding was down 0.1 per cent while the Collector declined 0.6 per cent.

Handelsbanken Capital Markets has raised the riktkursen for Leo Vegas something with the repeated “strong buy” recommendation. Spelaktien rose just under 7 per cent.

Swedbank has lowered its recommendation for the Electrolux to neutral from buy. Shares lost 0.3 per cent.

Eurocine Vaccines climbed 12% after results from a influensastudie.

After the close of trading com drönarbolaget Now, with the news that the capital for the operation of the company is expected to be exhausted in the end of June if not more capital brought to the company. The share had a closing on Tuesday looking up 1.6 per cent.

On Wednesday night, the Federal Reserve with an interest rate announcement. The expectation is to increase by 25 basis points to the range of $ 1.00-1.25 per cent.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1648.61

3557.87

12764.98

7500.44

2440.35

21328.47

6220.37

19914.52

25786

1.12

9.74

8.69

45.98

48.3

0.60%

0.39%

0.59%

-0.15%

0.45%

0.44%

0.73%

0.08%

-0.26%

0.04%

0.03%

0.01%

-1.03%

-0.86%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com