Broad downs dominated trading on Thursday. European stock indexes fell sharply, which continued both in the united states but also in Asia during the night. Storbolagsindexet OMXS30 fell the whole -1.09 percent to 1613 points, this at the same time as the sales force increased properly. The turnover on the stockholm stock exchange, amounted also to the whole of the 20.2 billion. The short-term OMXS30 index is now oversold, and leading futures point to weak positive progressions with a few hours left until the Swedish trade open.

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

Worrying sales force looked forward on Thursday, and OMXS30 index managed to close sharply down on dagslägsta 1613 points.

This means that we not only stepped in 1630 in connection with that, we got a significantly growing sales force, but also when the turnover amounted to just over sek 20 billion.

The OMXS30 climbed even during the short-term technical support level 1616 points, which also was the price level, which quoted the second highest volume on Thursday, which in itself confirms their short-term importance.

Despite the fact that we had a negative development in both the united states but also in overnight trading in Asia, experienced slightly positive attitude among the futures.

The OMXS30 climbed on Thursday down to now be in a short-term oversold territory, which can contribute to some positivity on Friday.

Despite the fact that indextunga H&M delivered a surprisingly positive report, it was enough not to turn the vibes.

This means that after the worrying sales force arose, that we now have additional a negative warning sign.

The risk is now elevated that we are about to challenge the 1600 points card, which means that we become much more cautious.

At the same time, it means that styrketecknet that occurred on Wednesday, totally gone, swept away, then the negativity that arose on Thursday was much more marked.

However, just because a negative warning signs have emerged, shall we not count that it can be a false eruption.

So long as we do not step over 1600 points, there is still hope on the rise, but the situation has been a cumbersome wet blanket over right now.

We are looking for an establishment over 1630 with a stronger köpstyrka than the previous sales force on Thursday, to give new hope that it was a false outbreak we experienced.

Rapportsäsongen is growing properly about a little more than a week, and maybe this can be the underlying positive momentum needed to lift mood.

Also the oil continues to show a sign of strength, by maintaining the land around 48 dollars.

The u.s. S&P 500 semester has fluctuated around zero during the morning, but traded for the moment, somewhat negative, which could possibly be a preview on the that we have a more cautious start to the Friday.

Before today’s trade is awaiting technical resistance levels already in 1616, 1630, 1640, 1650, 1658, and 1670 points. Underlying levels of support are found, in particular at 1600, then 1594, and 1588 1580 points.

What hålltider and the company reports the next weeks you can read here.

Yesterday’s main börshändelser.

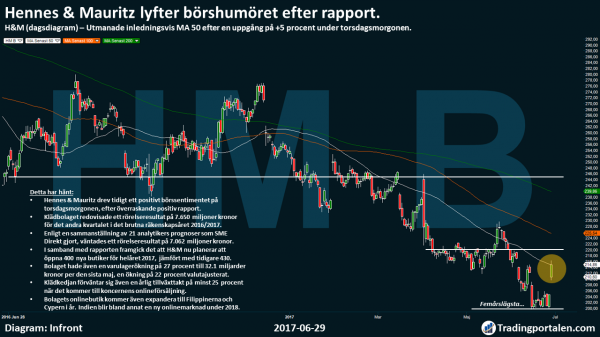

Hennes & Mauritz highlights the börshumöret after the report.

Challenged initially MA 50 after a rise of +5% during the morning.

Hennes & Mauritz drove early a positive börssentiment on Thursday morning, after a surprisingly positive report.

Klädbolaget reported operating income to 7,650 million for the second quarter of the split financial year 2016/2017.

According to a compilation of 21 analyst forecasts that the SME made, expected an operating profit of 7.062 million.

In conjunction with the report, it was revealed that H&M now plans to open 400 new stores for the full year 2017, compared with the previous 430.

The company also had a varulagerökning in 27% to 32.1 billion at the end of may, an increase of 22 per cent adjusted for currency effects.

Clothing chain also expects an annual growth rate of at least 25% when it comes to the group’s online sales.

The company’s online store will also expand to the Philippines and Cyprus in the year. India is becoming among other things a new online market place in 2018.

Soon time for Telia to challenge the $ 40?

Get the fuel to rise on Thursday, after Dagens Industri, on Wednesday wrote that the company is at the forefront for investors.

Telia step initially +2 percent on Thursday, with the fuel from the DI who already wrote on Wednesday that the company is at the forefront for investors.

”Telia is a very hot case in the market, both among investors who want to make more rapid changes in the company and among the more long-term players who see potential in the company is at the forefront of consolidation in the industry,” said a source to the newspaper.

Potential stakeholders can be found Christer Gardells Cevian Capital, which already may have taken a position in the company through a depot in London.

According to aktieägartjänsten Holdings has shares in Telia for a little over a billion were implemented, through the pits during april and may of this year.

According to the source shall Christer Gardell also held a meeting with Teliasonera’s chairman Marie Ehrling during the same period.

Avanza step over medeltalstrio on the news about the new ceo.

Rikard Josefson, who starts at the latest within 6 months, is currently ceo of Länsförsäkringar Bank since 6 years back.

Avanza rises above the +2% on Thursday, after it revealed in a press release that the company appointed Rikard Josefson, president.

Josefson joins the service no later than within 6 months, and is currently the managing director of Länsförsäkringar Bank since 6 years back, but has a background on the SEB over 25 years.

”Richard has the knowledge and the love for the customers, technology and banking. Just as we on the Avanza. Therefore, we found each other very quickly and naturally,” said the avanza’s chairman of the board Sven Hagströmer.

The company’s shares step on Thursday above the MA 50, 100, 200, indicating positivity in the future if the establishment of the succeed.

Hålltider during the day

Company reports

- Nobina (8.00)

Ex-dividend

- Intrum Justitia (9:00 kr)

Macro statistics

- United kingdom: GfK consumer confidence June at 1.00

- Japan: unemployment may at 1.30

- Japan: industrial production (prelim) may at 1.30

- Japan: household consumption of may at 1.30

- Japan: CPI may at 1.30

- China: industry-PMI June at 3.00

- China: the services PMI June at 3.00

- Germany: retail sales in may at 8.00

- France: CPI (prelim) June at 8.45

- Denmark: GDP (def) 1 kv at 9: 00 am

- STATISTICS, salaries in the private and public sector april at 9.30 am

- SCB: lci april at 9.30 am

- Germany: unemployment rate June at 9.55

- Uk: GDP (def) 1 kv at 10: 30 a.m.

- EMU: CPI (prelim) June 11: 00 am

- United states: private income and private consumption may at 14.30

- U.S.: Chicago purchasing managers ‘ index June at 15: 45

- USA: Michiganindex (def) June at 16: 00

Other

- Cherry: the first day of trading after split 5:1

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange was down on Thursday like the general stock market performance globally.

Storbolagsindexet OMXS30 index closed 1.1 per cent lower at the level of 1.613,2, shares for more than the 20.2 billion were traded on the stockholm stock exchange on Thursday.

In Europe backing both the paris stock exchange as of the frankfurt stock exchange close to 2 per cent in the wake of concern for the hawkish central banks.

In Stockholm backed cyclical companies like Volvo, Atlas Copco and Electrolux, from more than 2 to close to 4 percent. Technology went weak in the united states when the New York trade was entered and the Fingerprint, declined 2.5 per cent.

H&M, which closed almost 3 per cent higher, was the most traded share. The company reported on Thursday morning for the period of march-may an operating margin of 14.9 percent (14.8), which surpassed the SME expectations by 1.2 percentage points. The company was also unusually clear with their expectations of e-commerce: it is believed to be able to grow by 25 percent per year and be as profitable as the physical stores.

H&M-competitor Kappahl showed its results for march-may. Also here, the operating margin was better than expected, to 9.8 to 9.0 percent, and the share opened up but closed just over 4 percent down. On the negative side, lifted president Danny Feltmann in a comment to be Directly presented to the comparable sales growth was weak during the quarter, plus 0.5%, because the weather and the competition has been challenging.

Telia rose just over 1 percent. According to Dagens Industri, there is a growing interest among venture capital firms to invest in the telecommunications operator, increased on the one hand, the hopes among the short-term players to be able to make rapid changes in the company, assumptions with more long-term stakeholders that Telia should be able to lead industry consolidation. Aktivistfonden Cevian shall, under the Di – the protagonist Christer Gardell decline the comments – may have taken a position in Telia via a depot in London.

By Edison has taken up Neurovive to the guard, with a risk-adjusted dcf valuation at sek 30 per share, which contributed to Neurovive climbed 61 percent, to 6:75 sek. Edison, based in London, has Neurovive as a so-called research client, which means He gets paid by the company for coverage.

THQ increased close to 5 percent after the Redeye published an order analysis, which showed kurspotential in the base scenario.

Packaging for Bergs Timber turned to profit for the third quarter of the split financial year: 16.1 million kronor, net profit and turnover increased significantly. The share was trading up more than 3 percent.

Avanza has appointed Länsförsäkringar Bank’s president Rikard Josefson, ceo of a recruitment process that was over in a couple of weeks instead of the roughly six months it took to find the representative. The new acquisition is reported to have ”the love of customers, technology and banking” according to the chairman of the board Sven Hagströmer, and its shares rose more than 3 percent.

The major banks were to fly in it something negative riskklimatet and all was around unchanged. On pluskontot was the european government bond rates up on Thursday, among other things, inflationsdata from several EU countries. American banking sector is lifted with the aid of återköpsprogramannonseringar after the given stress test results.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1613.22

3471.33

12416.19

7350.32

2419.7

21287.03

6144.35

19972.73

25754.84

1.14

9.68

8.46

45.21

47.91

-1.09%

-1.82%

-1.83%

-0.51%

-0.86%

-0.78%

-1.44%

-1.22%

-0.81%

0.01%

0.05%

0.01%

0.62%

0.59%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com