The stockholm stock exchange managed with a positive momentum to break further to the north on Friday. Large part of trade was carried out over technical resistance at 1650 points, but closed finally at 1646.67, a rise of +0.33%. Turnover amounted to just over sek 17 billion on Friday. With again a shortened week, then we will be closed tomorrow, Tuesday as a result of the Swedish national day, we expect that trading activity will be somewhat lower. We are therefore somewhat cautious today, despite the fact that we are expected to usher in slightly positive territory this Monday. Leading futures suggests that we may have an opening just below the resistance 1650…

Get morgonrapporten to your e-mail daily before the stock market opens!

Today’s analysis

Very true, we gained a positive momentum that dominated Friday’s trading. We got early over the resistance at 1650 and achieved a dagshögsta at 1656 points.

We ended up in a situation where we are short term intraday was overbought, but as we closed just below the technical nyckelnivån 1650, we find ourselves in now ahead of today’s trading just below a short-term overbought scenario.

Although we expect that trading activity will be somewhat lower in the week as a whole, then we will be closed on Tuesday due to national holiday, we will continue to keep its eyes to the north.

However, we are slightly cautious ahead of today’s börsöppning.

Leading futures point this morning that we can get an opening just below the 1650 points, with a couple hours left until the stockholm stock exchange opens.

However, we see a possible negative signal from the u.s. the semester, the S&P 500, which after the night’s trade is noted slightly less. It is not unusual that this term can give a preview on the positive or negative momentum in the face börsöppningen in Europe, which is why we are somewhat cautious.

However, we see Friday’s outbreak of 1650, and the challenging of the high for the year as a positive sign of strength.

It is not so strange that after we challenged the high for the year, that we are late in Friday’s trading was a bit of profit taking in the last moment.

Just below the high for the year, we received even after Friday’s trading a short-term resistance at 1654, when we noticed clearly with the volume at this price level. This means that when we re-step over 1650, is expected this price level to give a less resistance, before the journey continues further north.

Sure, we got the negativity when Brent oil on Friday climbed over the 50 dollars, but since we saw a recovery, and re-listing just over $ 50 dollars this morning, it may have been a temporary avskakning of the disappointment that was experienced after the previous OPEC meeting. We saw no contributing effect on the Swedish storbolagsindexet the OMXS30, which we previously touched was the case for a little more than a year ago.

In Europe, both the Copenhagen and the Oslo stock exchange closed on Monday, while Sweden will be closed on Tuesday, which is expected to contribute with a slightly lower trading activity this week.

We also has no heavy makrobesked this Monday, but the week’s big focus will be especially on Thursday, when we get the interest rate announcement from the european central bank ECB. Also, british parliamentary elections are in focus on Thursday.

Before today’s trading, waiting for technical resistance levels already at 1650, and in the short term 1654, followed by 1670 points. Thereafter, in 1682, followed by the particular sentimental price level 1700 and the previous all-time high at 1720 points.

Technical support levels await at 1640, 1630 and then the 1600 points.

Due to the fact that the exchange is closed on Tuesday, will return morgonrapporten on Wednesday.

What hålltider and the company reports the next weeks you can read here.

Friday’s main börshändelser.

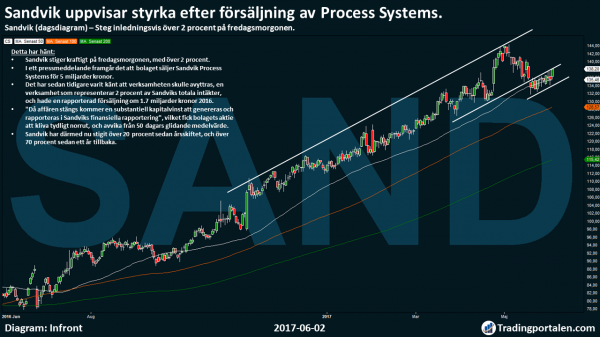

Sandvik to exhibit the strength of the after sales of the Process Systems.

Rose initially by over 2 per cent on Friday morning.

Sandvik rose sharply on Friday morning, with over 2 per cent.

In a press release, it appears that the company sells Sandvik Process Systems, 5 billion.

It was previously known that the business would be disposed of, a business that represents 2% of Sandvik’s total revenue, and had a reported sales of 1.7 billion in 2016.

”When the deal closes, a substantial capital gain to be generated and reported in the Sandvik financial reporting”, which got the company’s share to climb clear to the north, and to deviate from the 50-day moving average.

Sandvik has thus now risen over 20% since the end of the year, and over 70 per cent since a year back.

From the bottom to the top, Elekta rises above the 3.5%!

Going from being one of Thursday’s big losers on the rapportbesvikelse, to be the early winner on Friday morning.

Elekta dropped clearly with the mark on Thursday, when the company reported a lower-than-expected ebita-earnings before non-recurring items of 779 million in the fourth quarter of its broken fiscal year 2016/2017.

Expected, according to SME Direkt prognossammanställning 1.018 million.

Just one day later, yesterday, Swedbank is now out and raises its recommendation for the company to strong buy from a previous purchase. Riktkursen reduced to 105 from the previous sek 115. Also Handelsbanken lowered riktkursen to 111 crowns from the previous 121 crowns, and repeated at the same time, recommendation is buy.

Elekta got fuel to the positive turning point after Thursday, and stepped up early to partner with the 200 day moving average on Friday morning.

In connection with Thursday’s report gave the company’s ceo also positive news. ”We are at a turning point and I look 2017/18 as the year when we, through the mainly volume growth, once again, achieve profitable growth and reach an EBITA margin of over 20%.”

Gaming companies get the fuel of the Pareto…

Several gaming companies may köpstämpel, when by taking up coverage.

”There are some kärntrender that benefits these companies, as the migration from offline to online gambling (even if the online penetration in Europe already stands at around 40-45%), mobile penetration, and that more and more markets are regulated … Overall, we see regulation that is well,” wrote Pareto.

Kindred Group had a guide price of 110 dollars, while the Catena Media got a guide price of 125 crowns, and Cherry got a price target of sek 400, and last but not least was Mr. Green, even a guide price of 55 crowns.

Hålltider during the day

Macro statistics

- Japan: services PMI may at 2.30

- China: the services PMI may at 3.45

- Silf/Swedbank: services PMI may at 8.30

- Uk: services PMI may at 10: 30 a.m.

- United states: productivity, unit labour costs (def) 1 kv at 14.30

- United states: Markit services PMI may at 15: 45

- The US: ISM service PMI may at 16.00

- USA: industrial orders april at 16.00

Other

- Copenhagen helgstängd

- The oslo stock exchange helgstängd

All börshändelser and estimates for the week can be found here!

Latest börsnyheterna

The stockholm stock exchange fell back below the Friday afternoon, but did anyway a week with a certain degree of recovery, even if it could not keep pace with the major european exchanges. Fingerprint and Sandvik was strong while oil prices pressured Lundin Petroleum.

At the time of closing had storbolagsindexet OMXS30 has risen 0.3% to 1.647. The turnover on the stockholm stock exchange stopped at just under 17 billion.

Out in the Europahandeln step Paris 0.5 per cent while the Frankfurt lifted 1.3 per cent driven by the automotive industry in the wake of personbilsförsäljningen in may proved itself stronger than förhandstipsen.

Sandvik has sold Process Systems to Wallenbergbolaget FAM for 5 billion. Sandvikaktien rose more than 2 per cent and low in the and with this high up on the winning side of the OMXS30.

The best in the index, it went for the Fingerprint Cards, up 3 percent. The company still expect that stocks, which have had a negative effect in the last quarters, should be back on normal levels at the end of the second quarter.

”As we previously stated, we expect inventories in the value chain shall be normalized at the end of this quarter,” said the Fingerprints ceo Christian Fredrikson in an interview with Redeye.

At the bottom of the index parked for the day, Boliden, Nordea and Lundin Petroleum, the latter continued to be pressured by a falling oil price, where Brenten took down over $ 50 the keg. Also the other oil companies dropped including Enquest, which was 4.8 percent down.

One of the GHP Specialty Care’s major shareholder, Annedalskliniken, has sold its holding of nearly 9.2 million shares of GHP for the course 12:10 sek per share. Shares lost 9.7 per cent to the 12:10 sek.

Terranet, among others, have kriminologen Leif GW Persson and Sigmagrundaren Dan Olofsson in ägarlistan, went up more than 11 per cent during the intense trading after its First North-debut earlier in the week.

Eltel has changed its medium – to long-term financial goals. According to the new objectives and strive to achieve an annual growth of eltel’s core activity of 2-4% and an ebita-margin of at least 5 per cent. Shares traded up 8.5 per cent.

Pareto has initiated coverage of several gaming companies that köprekommenderades. Among the shares which were listed higher after köpråden were Cherry and Mr. Green, which advanced 0.8% and 5.3%.

Swedbank has raised its recommendation for Elekta to strong buy from buy. Strålterapiaktien bounces up 1.8 per cent after Thursday’s weak financials, which lowered the share of 8 per cent.

Sensys Gatso, which have fallen sharply since peaking at 5:sek 70 in October 2015, had, at least temporarily, the momentum after an award decision in Latvia. The company has, together with partner Reck won the procurement of portable hastighetsövervakningssystem in the country. The value of the deal is not fixed but is estimated to be below 5 million. The share advanced more than 4 per cent to 0:85 sek.

Get morgonrapporten to your e-mail daily before the stock market opens!

Recent trends (~there is a 06:40)

The OMXS30

EURO STOXX 50

Frankfurt DAX

The London FTSE 100

THE S&P 500

The DJIA

The Nasdaq Comp.

The NIKKEI 225

HANG SENG

EUR/USD

EUR/SEK

USD/SEK

WTI Semester

Brent Semester

1646.67

3591.82

12822.94

7547.63

2439.07

21206.29

6305.8

20179.77

25838.21

1.13

9.72

8.63

48.25

50.55

0.33%

0.70%

1.25%

0.05%

0.37%

0.29%

0.94%

0.01%

-0.33%

-0.09%

0.08%

0.23%

1.24%

1.20%

Stock and Technical Analysis each day at 10.00 am

By: Michael Andersson for Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com