Interview of Jakub Zabłocki, owner of the broker Polish XTB

Interview of Jakub Zabłocki, owner of the broker Polish X-Trade Brokers

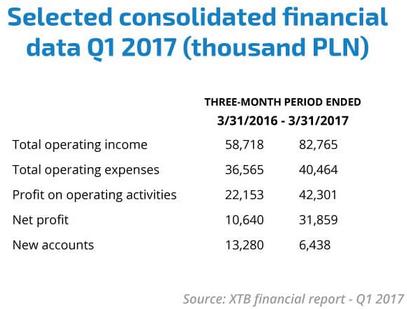

According to the latest financial report of XTB, for the first three months of 2017, the broker has totaled a turnover of 15.1 million ($58.7 million PLN). The figure is a decrease of 29 % compared to the same period last year.

Here is an interview of Jakub Zabłocki, the owner of the dealer Polish X-Trade Brokers about the turmoil regulatory, the decision to leave the Turkish market and activity has increased in Latin America.

Warsaw or London – who is closer to you now ? At this stage, you concentrate more on the oversight of retail trading (XTB) or institutional (the X Open Hub) ?

On a daily basis, I live and work in London. However, I often travel to Warsaw to see how business is going and to discuss with the board of directors on key decisions to be taken to manage the retail trading and institutional.

XTB has decided to exit the Turkish market two months after the regulatory changes in Turkey. What has happened in the past ?

Well, after the entry into force of the new regulations, we tried to optimize our operations and adapt to the new market situation that has suddenly become more difficult to do business. We just wanted to take a little time to see how the market would consolidate and what it would mean for us. However, the analyses performed by XTB have shown that the limitations implemented by the regulator in Turkish led to a significant decrease in the number of customers and therefore, a significant limitation of the operations of the group XTB Turkey. Our current approach is that if a unit does not work or does not have the perspective, we are reducing quickly.

Regulatory changes occur everywhere in Europe. The regulator in poland has established new rules to fight against the entities without a license. The last regulatory measure will it be able to remedy this plague, or will she become another dead letter ?

The regulatory changes are necessary to ensure the safety of investors. However, the regulatory agencies should mainly focus on the unfair practices of sales and marketing used by many brokers and on the other hand, imposing more control on the unauthorized entities. In relation to the final decision of the KNF, I think it is a step in the right direction.

As an experienced investor, would you like to see that the regulations are too specific, or that the oversight committees will leave the choice to the traders ?

As I have already said, the regulatory changes are necessary, they should keep the market order and protect investors from fraudulent practices. However, I believe that the traders should always be able to choose their broker. The risk is always there, in regards to the financial markets, in particular for complex derivative products.

Recently, XTB has faced some internal problems, are you satisfied with the new CEO ?

The supervisory board has decided changes to the composition of the management board. We believe that the pace of achievement of the strategic objectives and the development of the group have not been sufficient. I am satisfied with the progress made by the company in the framework of the supervision of Omar Arnaout. We finally received a new blood to our organization and I really like the spirit of the new board of directors.

In the financial report for the first quarter of 2017, we see an increase in the number of new accounts and a reduction in operating costs of about 10% compared to last year. So what is the cause of the decline in revenues and profits ?

The first quarter of 2017 in terms of new clients has been very good for XTB compared to the previous quarters. The volumes in the first quarter were also higher, the decrease of revenues is mainly based on the decrease in profitability of the batch. Given the growth of our customer base, our trading activity and deposits, I am satisfied that operationally, we are moving towards the right direction. As regards costs, due to changes that occur in the industry, we believe that the market is entering a consolidation phase where only the most efficient will remain. The decrease of costs comes from different activities, it is based on a thorough analysis of the place where the funds can be saved without having a significant influence on the whole enterprise.

XTB has also reported on its developments in Latin America, focusing on Chile and Belize. Latin America is a new field of interest ?

We have observed for a long time the Latin American market and we see the development potential of the activity Forex / CFD in this part of the world.

Are you ready to continue the consolidation of the market and taken control in 2017 ? Can you share your projects ?

We believe that 2017 will be the year of consolidation marked. Many brokers have problems with the costs of acquiring new customers. The marketing is extremely expensive and is not effective today. We believe that only a few brokers powerful and efficient will remain on the market. The other will be acquired, merged, or they will have to leave the market. I think XTB is an excellent platform for dealers of the average size to combine their forces and merge with one of the best players in the FX market and CFD. We are one of the most technologically advanced, with a cost base low. In addition, we are a publicly traded company that makes our shareholders liquids. Currently, we analyze the market and we are looking for complementary partners.

Do you think that market volatility is an important factor that affects the business of brokerage ? Events such as the Brexit, the american elections / French and crashes instant attract investors on the market or do they prefer calmer periods with fluctuations of stable prices ?

In principle, the level of earnings XTB is positively affected by increased volatility on the financial markets, because in periods of increased volatility, clients will see more opportunities. On the other hand, what is important to the businesses of our industry is not volatility, but the clarity of the market trends. When markets move in trends horizontal, it is more difficult for traders to anticipate the movement and that is why the clarity is very important in terms of market movements.

The latest observations show that the mobile trading is slowly gaining market share on the desktop platforms – institutional traders are also joining in the growing trend. You will also notice a change in technology in your clients. What are the statistics ?

With the proliferation of smartphones and tablets, as well as the consumption of mobile data, the mobile trading is gaining in popularity, especially among people on the move. Those who use computers to trade, do so because of more functionalities. However, the trading platforms for mobile devices are constantly evolving and adopting newer technologies.

In XTB, we strongly believe in mobile trading. We are developing our own technology for several years and we provide our clients with trading solutions mobile for smartphone, tablet or even smart Watch. Currently, more than 50 % of our active customers use its solutions for mobile trading.

As regards the trends of the market, the Bitcoin has become one of the main themes of economic. Given the increasing popularity of cryptocurrencies, are you going to provide the BTC ?

It is true that the Bitcoin and other cryptocurrencies have gained popularity especially because of the dynamic growth of the value and of the clear trends as I mentioned previously. We observe, of course, the demands of our customers, both from the technological point of view and from the point of view of the product. In conclusion, we observe a constant source of new products and the potential markets that could be added to our offer.

The price of the shares XTB on the Warsaw stock exchange is currently away increases historical obtained just after the introduction last year. Do you plan improvements in the financial performance and the confidence of investors in the coming quarters ?

The price of our shares has declined over the last few months, it is true. The decrease in profitability is the result of the characteristics of the business model of the group XTB, which is characterized by a high volatility of short-term revenues. This fact that the profitability per lot for some quarters may be subject to significant fluctuations. Over the horizon of analysis is long, the results are stable. We will do our best to maximize the revenue and increase the confidence of our investors.