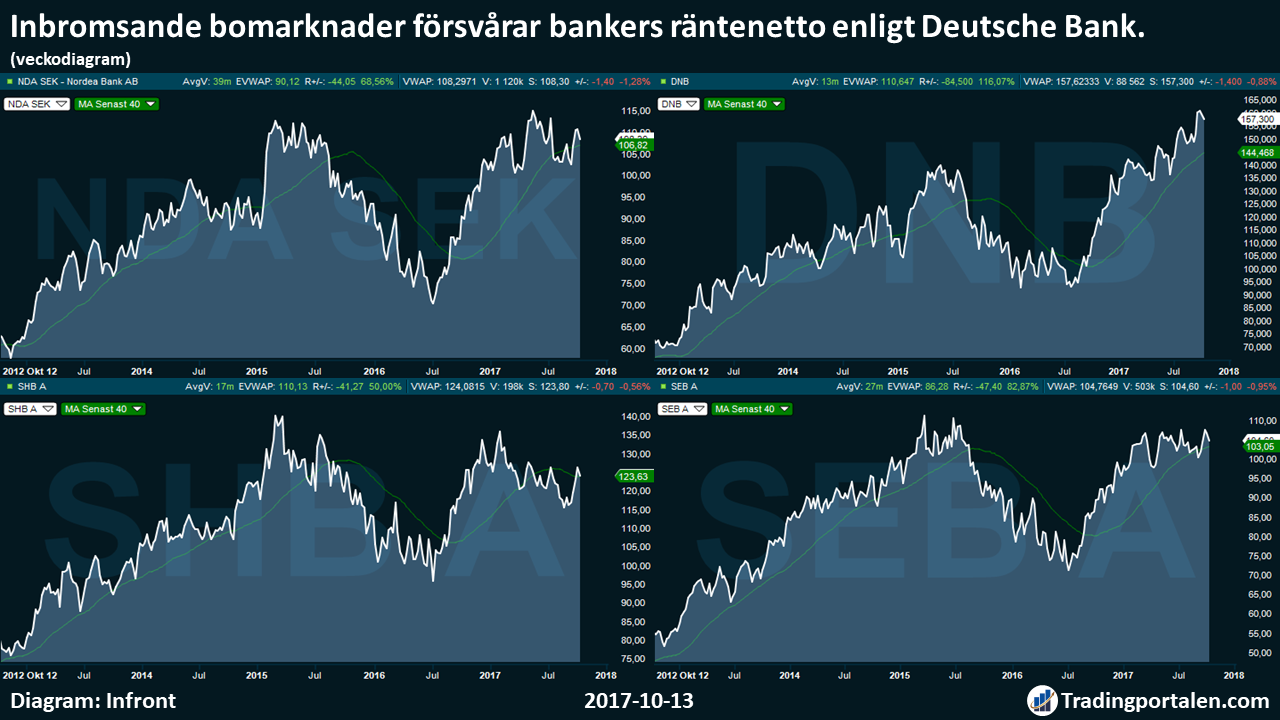

The Norwegian and the Swedish housing market hits the brakes makes it difficult for the nordic banks to show growth in net interest income.

It is the view of Deutsche Bank in a sektoranalys where Nordea and Swedbank both lowered to sell.

”Strong housing markets, and the accompanying growth in home loans has meant that not the least Swedish bolåneföretag had a very strong development in recent years,” writes Deutsche Bank.

In respect of Nordea to the bank ”meets the additional motvindar from the steady loss of market share.” Swedbank pointed out that the nordic bank most exposed to the american housing market and any potential margin squeeze.

Deutsche Bank believes that it is most likely to occur with a soft landing for the Swedish and Norwegian housing market.

”But there is always a risk of a hard landing with a negative impact on the general economy and potentially large negative spillover effect for the countries ‘ banks”, is it.

For the Norwegian major banks have DNB repeated keep and riktkursen raised to 156 Norwegian kroner (133).

Gained market share on the Swedish and Norwegian mortgage market is singled out as reasons to Danske Bank’s positive vinsttrend. The recommendation for the share is lowered to keep (buy).

For SHB and SEB, repeated keep with the new riktkurser of 125 (120) and 106 (97) dollars. Regarding SEB called it is that of the Swedish banks that are least exposed to the american mortgage market and in the place most exposed to the corporate sector and thus would benefit at the increased företagslånevolymer.

Tradingportalen/Agency Directly.

Questions and comments always welcome in the newsroom[at]tradingportalen.com