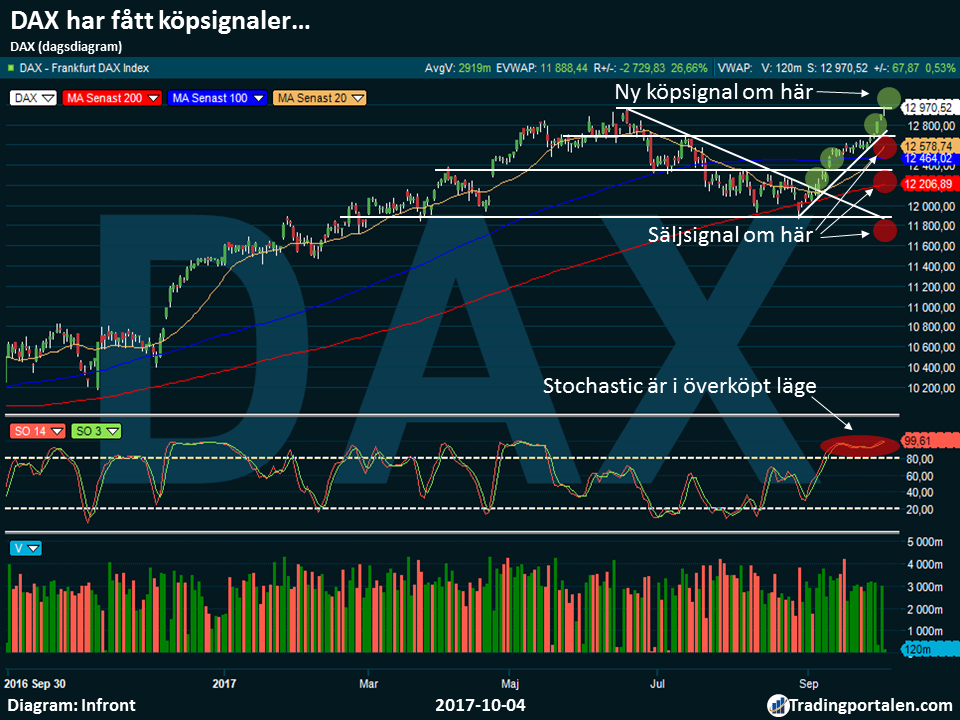

The DAX has in the past week, got new buy signals and has also continued in its upward trend. New buy signals are obtained if the DAX can clearly establish itself over the old the peak level at 12 951. The German stock exchange, however, is overbought, handelsvolymsambanden is negative and säsongsmönstret in October is challenging. Therefore, it may be important to note if uppgångstrenden is broken, and if DAX would instead get sell signals in an increasing trading activity. The development can be volatile. Sell signals are obtained if the DAX establish themselves in the aid of about 12 850 and about 12 650.

The German DAX index has the last week gone up by as much as 2.9 percent and closed yesterday at 12 970,52. The rise for the DAX is thus 13.0%.

DAX was also that at the top of the 12 976,24 which is a new peak for the index. The upturn has come as a result of a general tillväxtoptimism and risk-on behavior in the financial markets.

The decline of the u.s. dollar has also stopped and instead turned to an upward recoil. A dollaruppgång strengthens the majority of German companies ‘ international competitiveness and is therefore positive for the development of the DAX.

Get the DAX-the analysis automatically to your e-mail every week!

Dollaruppgången vis-à-vis the euro will be on hand after the result of the German förbundsvalet made that it becomes very complicated to form a new government in Germany. The earlier positive momentum in Europe after the election of the reformist Macros to the president of France has come to a standstill. And the other hand, after increased hopes on Donald Trump, after all, get through his fiscal reform with significant tax cuts. These would then be able to both stimulate the economy and make u.s. companies to take back their large foreign cash to the united states. Which would be positive for the dollar.

In the weekly chart we can see that the DAX index remains in its upward trend after having previously scored a number of buy signals. New buy signal is obtained if the DAX manage to establish themselves properly over the old peak level at 12 951. The DAX closed then, yesterday at about 12 970, marginally above this level. But we’d prefer that the index closes above this resistance with a bit more margin than just 0.15 percent before a clear köpsignalen can be considered to have been received.

The increases continue to take place in a relatively modest trading activity. Which is a sign that the really high net worth and long-term investors are quite passive on the market. It is possible, in principle, up to the short-term players become more risk averse and buy. And for the long-term kapitalplacerarna not selling.

To a rise to see the long-term really dependable out to you that even the big long-term investors nettoköper on a large scale. Such is the rise that takes place during a relatively low börsaktivitet is, however, entirely dependent on the short-term stakeholders ‘ risk appetite. The rise may therefore turn to decline with very short notice.

So, even if the short term just to keep up with the rise so it is therefore important to be observant of if the upward trend is broken. And, in particular, if the index then get to sell signals in an increasing trading activity. Nedgångspotentialen can then be large.

The traditional säsongsmönstret for the month of October also indicates at a high risk for increased volatility in the stock market. Especially during the second half of October, the trend can often be dramatic.

In the day chart we see that the DAX will get a sell signal on the supports at about 12 650-12 680, ca 12 300-12 340, 12 400 and of about 11 850-11 868 is broken. Also the area for the DAX 200-day medeltalskurvan, which at the time of writing is at the 12 207, is an interesting support level to monitor. Would any of these support levels be broken in an increasing trading activity thus becomes the säljsignalen extra strong.

The Stochastic indicator shows that the German stock market is overbought. That in itself is no sell signal. But it reinforces how this would be received of a possible future ”basic” sell signal in the actual indexdiagrammet.

In the even shorter term timdiagrammet we see that the DAX also it scored a number of buy signals in the past. Would, however, support at ca 12 850 break obtained an interesting short-term sell signal. After that we are aiming for in this case, in particular, in a test of the support at about 12 650.

Short-term oriented investors who acted on the buy signals are generated and, thus, is for the rise, we recommend to carefully monitor their stop losser. Preferably can a stop loss be located just below support at about 12 850. Then move also be happy to up the stops as the position is proving more and more profit.

Obtained sell signals, especially if these are obtained in an increasing trading activity, can instead act for the decline. The development can then become extremely volatile. So a carefully balanced risk management becomes particularly important.

More long-term oriented investors, we recommend continued caution. The trend is upward but handelsvolymmönstret is negative. And seasonally speaking, October is often a challenging month.

So as long as uppsvingen continues to take place in a relatively low volume of trading proposed to the försiktige investor is that the time step for step sell of the holdings in the peaks. Or maybe you can put out the stop losser, gradually moving upwards, even for their long-term investments.