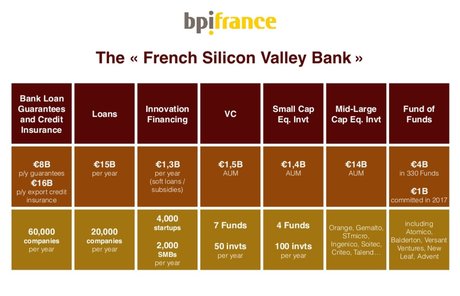

“The new French revolution” : this is described as well as Nicolas Dufourcq, ceo of Bpifrance, the rise of a new generation of talents, a culture of pro-entrepreneurs and the venture capital industry from the top speed. The public investment Bank, which will celebrate the end of the year its five years, has played a critical catalytic role in the ecosystem of startups French in recent years and its ebullient boss, tireless VRP of the French Tech, does not lack to know. Two weeks ago, he himself “pitché” in front of the who’s who of venture capital, the board of directors of the Association of venture capital companies in the us (NVCA) in Washington, presenting the BPI as ” the French version of the Silicon Valley Bank. “

Has the nuance that the SVB is a commercial bank, which is listed on the stock Exchange, while the BPI is both a sovereign wealth fund, a bank of co-financing and venture capital investor, owned 50/50 by the French State and the Caisse des dépôts.

[Bpifrance, the Silicon Valley Bank to the French. Credit : Bpifrance]

Has shots quotes laudatives of Mark Zuckerberg or the founder of the accelerator, Y-Combinator, photos of Station F and the school code of Xavier Niel 42, of graphs illustrating the explosion of the amounts invested, Nicolas Dufourcq, showed France as the most ” bankable. “Without hiding an evil French persistent, but curable : the difficulty of financing large round table to help companies become global champions.

The average size of venture capital funds French has, of course, doubled from 80 million to 160 million euros between 2012 and 2016, but it is still insufficient in the light of the larger fund raisers such as the $ 250 million of the giant roubaisien cloud OVH or 150 million of the king of the Internet of things Sigfox.

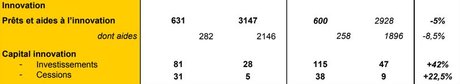

[The challenge of today : the growth phase. Credit : Bpifrance]

“The biggest venture capital funds French”

However, the latest figures reveal a number of fund-raising record of venture capital companies in france, even exceeding those of their british counterparts for the first time. For all that, Nicolas Dufourcq argued on Monday, presenting to the press the first half of the year, ” the BPI is the largest venture capital funds French “. Including Sofinnova Partners (€1.6 billion under management) and Partech Ventures (€1.2 billion) :

“Bpifrance is the largest management company in france, with € 2 billion under management. We manage our own funds (700 million euros), of the funds that the State or the Caisse des Dépôts have entrusted to us, as well as funds from private companies, such as Sanofi and Roche in the fund InnoBio, ” he noted.

Last June, the investment capacity of its fund-Wide Venture companies in hypergrowth with significant capital requirements) has been increased from 600 million to one billion euros ” to increase the tickets, fund and foster the lifted important.” Investments in direct Bpi climbed from 42% to 115 million euros in the first half-year (the funds City of tomorrow, French Tech Acceleration and Wide Venture). However, the activity of financing of innovation as a whole decreased 5% to 600 million euros, mainly on the side of aid, reflecting the lower endowments of the State.

[Activity of Bpifrance in the financing of innovation in the first half of 2017. Credit : BPI]

Convince american pension funds

If the funds raised by the VC French are now closer to the needs of the ecosystem, the BPI will not only meet the challenge of financing the hypergrowth of young companies in france. His role on the venture capital market goes through its indirect investments : in the first half, ” the activity of fund-of-funds has a known intensity history that contributes to the rise in power of the French investment fund “, the public bank who purchased in 29 funds to € 487 million (+95%).

“For the first time, we’ll put this year of 1.1 billion euros in the French funds, half of which in venture capital,” said Nicolas Dufourcq. “We would like some management companies are merging and creating of fund of growth [capital-growth ticket in the tens of millions of euros, ed] world-size to a brand,” he pleaded.

A necessary evolution in the face of the emergence of mega-funds around the world, the image of that of SoftBank (almost 100 billion dollars). To strengthen the French venture capital will involve and bring in new investors :

“Today, the French venture capital is 80% financed by the French investors [large institutional asset managers like Amundi, insurers, etc], 10% by the european investment Bank (EIB), and 10% by family offices [managers of large fortunes, ed.] in europe. It is an anomaly : the risk capital of israel is 80% financed by american investors, in India it is the same thing “, has analysed Nicolas Dufourcq.

“The cause is a problem of reputation : it is necessary to persuade american pension funds, foundations of american universities and the funds of funds to invest in the French venture capital. “

The boss of Bpifrance has cited the example of Israel, where create significant fund Growth, ” otherwise they are big american funds such as Accel, who have been buying up all the value. We prefer that Americans invest in Serena Capital, rather than they buy back Blablacar in France “, he summarized.

What can attract investors in the us, beyond a better picture of the France which requires a lot of work, it is the return on investment, in particular the prospect of an exit with a juicy plus-value. The director general of the BPI had come with some ammunition in his presentation to the VC in the us :

“The slide that kills for the Americans is that of the 10 exits of more than € 100 million [or almost] in the past, trips to forts multiple (valuation). The Americans have said to me : we are back in France ! “

[The most important outputs, by acquisition or ipo, of businesses, of the French Tech in the last twelve months, in millions of dollars. Credit : BPI]