[Article published at 12: 35 and updated at 18.40]

The world of the payment is definitely in full swing. One, or even several, mergers, emerging between the major players of the online payment systems : the british Worldpay revealed on Tuesday he had been approached for a buyout by the american Vantiv Inc, and JPMorgan Chase Bank. The action WorldPay has soared on Tuesday on the London stock Exchange (+27,7%), bringing its capitalization to $ 8 billion pounds (9.1 billion euros. The news has supported all of the values of the sector, including its competitor, French Worldline (+3,5%), controlled by Atos Origin, who had tried to put a hand on Worldpay in 2010, or even the German Wirecard (+7%).

In the summer of 2015, it is another French, Ingenico (+3.7% on Tuesday), who had tried without success to purchase Worldpay. Gemalto has also gained 3.15 per cent.

On the 1st of July, it was the Danish Net A/S, which was confirmed to investors that he had been approached and assessed its options (+10,9% on Monday, +2.7% Tuesday). The number one scandinavian payments, founded by banks in the region, has been introduced on the Copenhagen stock Exchange last September by its shareholders, the private equity fund Advent International and Bain Capital. It is valued more than 4 billion euros.

The area is both very lucrative and full recomposition : the traditional players from processing payments by card and have switched over to digital, are being challenged by new players 100% digital, such as the unicorn Dutch Adyen or the startup american Stripe.

The fund, Bain and Advent to the maneuver

Born in the bank National Westminster under the name of Streamline at the end of the 1980s, then acquired by Royal Bank of Scotland, the payment system Worldpay, the number one in the Uk, was taken over in 2010 by the same Advent and Bain Capital, which have been introduced on the stock Exchange in October 2015 and want to get out of the capital. Worldpay is part of the index feature FTSE100 of the London Stock Exchange.

“There is no certainty about the filing of an offer or on terms and conditions of a potential offer” highlights Worldpay in his brief statement.

The announcement was made without the consent of Vantiv or JP Morgan.

This is the site, Wall Street Wires, who suggested on Tuesday morning that Worldpay was the target of an acquisition.

At the end of may, a noted analyst of Barclays mentioned the ” M&A (merger and acquisition) as an option “, but rather for the u.s. economy, led by a new team, while not rejecting that Worldpay ‘ to be part of a concentration “, then its growth slows down. The note found his business e-commerce considered as strategic for the “buyers” e-money americans (the acquirer is the financial institution responsible for the collection of money in the context of a distance selling or through a physical terminal).

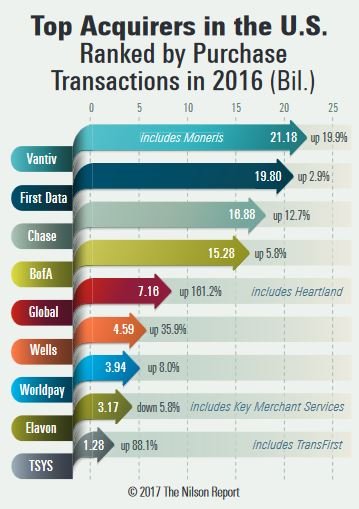

Gold Vantiv, which capitalizes more than $ 12 billion, is the first u.s. acquiror for traders in terms of volume, according to the latest Nilson report, in front of First Data and Chase, a subsidiary of JP Morgan, with which he would have views on Worldpay, which is ranked seventh on the american market.

If the discussions result in an offer, the landscape of the payment could be disrupted. They could mainly generate counter-offers, and a battle market. Last spring, PayPal, chinese, Ant Financial, was forced to increase his offer to $ 1.2 billion over the number two in the global money transfer MoneyGram, after the overvaluation of the texan Euronet.