Here is again the idea of a deposit-guarantee fund european, “a missing link essential to banking union,” according to the european Commission. Brussels unveiled on Wednesday new proposals to put in place a system ensuring the same protection to all citizens in the event of a bank failure, its initial project being at a standstill since November 2015.

In the Face of resistance from Germany, which doesn’t have to pay for the trials and tribulations of the banks most vulnerable (typically Italian, Spanish or Greek), the european Commission has put on the table a mechanism of risk-sharing “more progressive” and “more limited”, and conditioned to the cleaning of banks ‘ balance sheets more exposed to bad debts.

“All the depositors within the banking union should be afforded the same level of protection, regardless of their geographic location,” stresses the Commission.

Clean up the balance sheets of bad debts

In a first phase, the european system of deposit guarantee (SEGD, or EDIS for European Deposit Insurance Scheme, in English) “would provide coverage only of liquidity in the national systems of deposit guarantee”, in a temporary way, “if a bank is in crisis”, a kind of loan that would be repaid later by the banking sector.

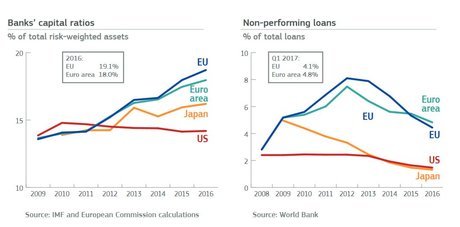

In a second phase of so-called “co-insurance”, from 2020, the single european system would address also the losses if the guarantee fund national may not repay all the depositors. Access to this common fund would be conditioned on passage of a test of the quality of banks ‘ assets, obliged to reduce their balance sheets the amount of their “non-performing loans” (NPL), at the latest in 2021. Because the level of bad debt has fallen since the crisis, but remains high in Europe.

[Capital Ratios of banks in Europe, Japan and the United States, and the percentage of non-performing loans on total loans since 2009. Credit : european Commission]

Guarantee of 100,000 euros maximum

Currently, all the countries of the Union are required to have their own deposit guarantee fund, which protects up to € 100,000 maximum per customer and per institution (a threshold that is harmonized by a directive in 2010).

In France, it is the deposit guarantee Fund and resolution (FGDR), created in 1999, which is responsible for the compensation of depositors in case of bank failure. Current accounts and savings are covered, including the booklets or LDD by a guarantee from the State, but not life insurance or the species and objects in the safety deposit, or deposits with payment institutions, Account type-Nickel or PayPal.

If the recent bank failures date back to the mid-1990s in France, with the bankruptcy filing of Pallas Stern in 1995 and the rout of the Credit Martinique in 1998, the FGDR has intervened four times since its creation, for example, in the case of the European de Gestion Privée (EGP) and in the bankruptcy of the dealer in lille Dubus.

The minister of Economy and Finance, Bruno Le Maire, has reacted to the announcements of the Commission :

“It is an important project to strengthen our resilience, collective response to crises and to create a banking market more integrated, more solid, better able to meet the expectations of our economy and our citizens. I am determined to make rapid progress in this strategy to strengthen the banking Union the outcome of which will also contribute to the consolidation of the euro-zone defended by the President of the Republic. “

Germany’s inflexible ?

In recent months, the near-bankruptcy of two banks of veneto and Banco Popular in Spain have left many small carriers on the tile. Intesa Sanpaolo announced on Tuesday the creation of a fund of 100 million euros for its clients who have lost all their investment, and thus their economies, in the rescue of the institutions of Banca Popolare di Vicenza and Veneto Banca (€15,000 per person maximum).

The latest figures from the ECB showed that Italian banks hold only 28% of bad debts across the EU, nearly 250 billion euros.

Also Germany, through the voice of Wolfgang Schäuble, the Finance minister, does it not hidden that there was no question that the German banks pay for the south that would be less virtuous. The Commission has deleted the last stage planned in its initial project, in 2024, which was tantamount to a pooling of risks across the EU. The Commission proposal must be approved by the Parliament and the member States.

Berlin seems always to be inflexible. A spokesman for the German Finance ministry told AFP that the position of the government of Angela Merkel “has not budged. […] The proposals of the Commission are not enough up here, absolutely not”.

During his speech on the state of the Union, the 13 September, the president of the Commission, Jean-Claude Juncker, emphasised that :

“The banking union can only work if the reduction and sharing of these risks go hand-in-hand. […] There shall not be a deposit guarantee common only from the time where everyone will be placed in order on the national plan.”