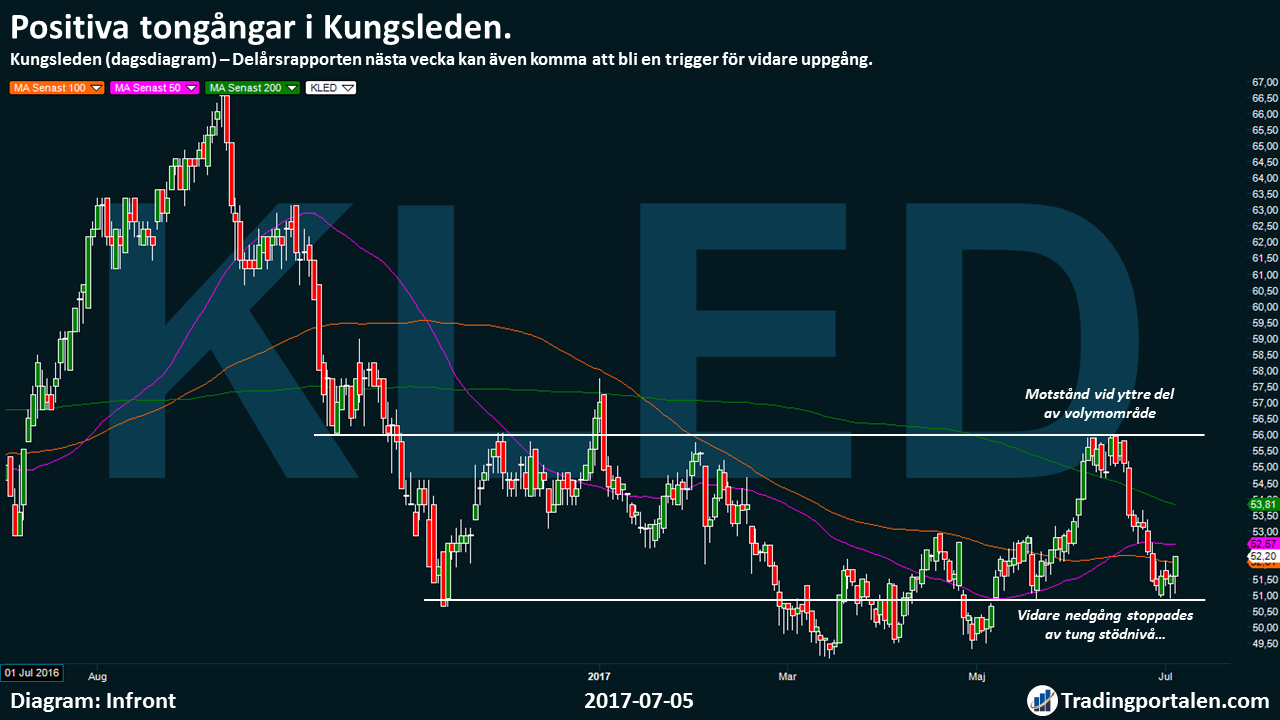

The real estate company Kungsleden has since the end of June turned on the vibes, after heavy technical support level halted a continuation of the journey to the south. With renewed köpstyrka indicates underlying momentum that we are now gearing up for a continued rise. The share climbed even on Wednesday over the medium MA 100, signaling further strength…

Get Minianalys Swedish Shares automatically to your e-mail every day before the stock market opens!

After a rather boring introduction of the current year, stemming from Kungsleden first released in the beginning of the second quarter.

Here just waiting for a heavy technical support level at 51 crowns, which a few years ago noted the significant volume. This is also confirmed from the chart below, especially at the end of 2016, but also during the second quarter of this year.

This price level was also a bottenfas, after we briefly managed to get up to 59 kronor earlier in the end of June, also a resistance level with significant volume last year.

Underlying köpstyrka have now also looked back at this price level, and indicates instead that we have found a turning point, that can take us further north.

We therefore believe that an initial köpläge are already in sek 52.

Next week presents, however, the company interim report, 12 July at 07:00, which means that we only recommend an initial position, and instead folded up position in case of a positive report, in order to limit a possible wet blanket from the report.

Tentatively placed a stop loss already at 50.75 kroner, just under the heavy intensity 51 sek.

Even if the company’s share now found an initial support above the MA 100, would an establishment above the MA 50 further help with the positivity, as just now quoted at 52.57.

We estimate that the probability is good, that we can experience a renewed travel up to 56 sek, which is also our målkurs this time.

As late as the middle of June, it was revealed that SEB, which holds a buy recommendation on the company, believe that Kungsleden compared with colleagues in their sector is the ”most attractively valued”.

The stock is traded on the stockholm stock exchange, under the symbol KLED.

Kungsleden

Entrance buy

52.00 £

Ticker

KLED

Målkurs

56.00 kr

Market

The OMXS Large Cap

Emergency exit

50.75 kr

P/E

4.9

Latest

52.20 kr

Direct avk.

3.9%

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!

More about technical analysis:

- Common concepts in technical analysis

- Moving averages – lagging indicator, which filters out the noise

- MACD – technical indicator, which fits well into the trends

- RSI – a classic momentumindikator that is a ”must” in swingtrading