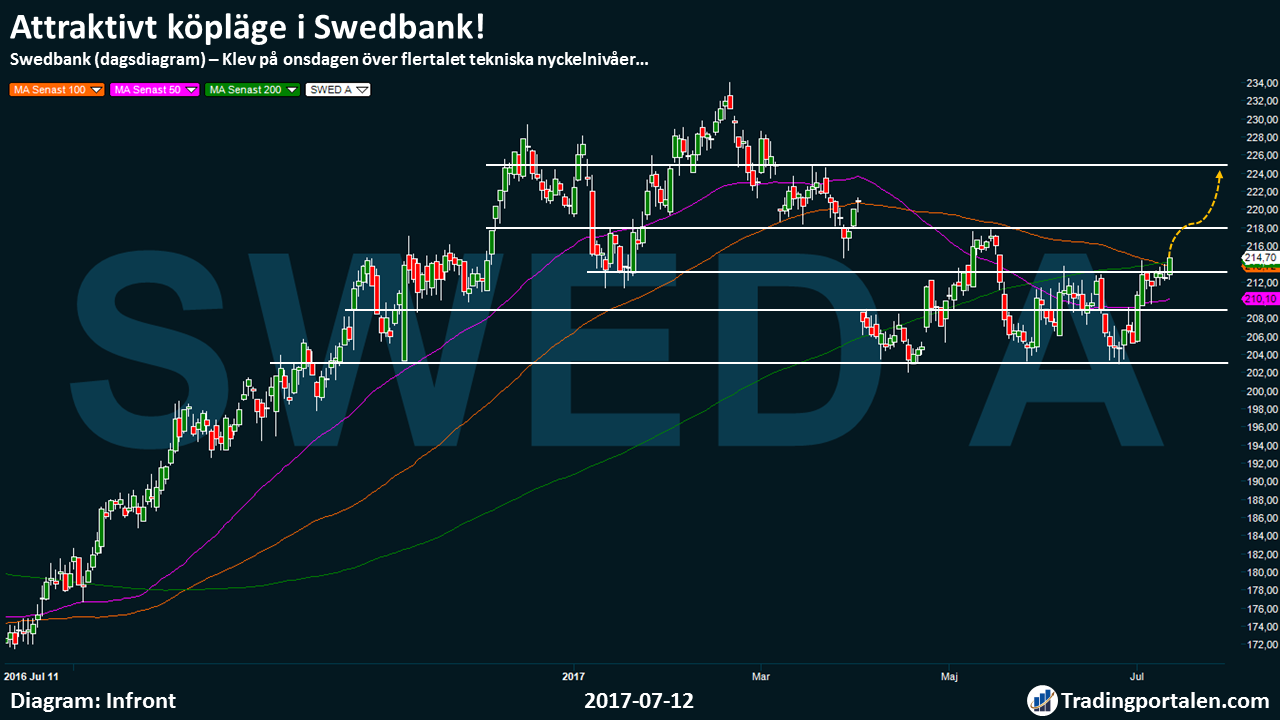

A positive sign of strength occurred on Wednesday, after the eruption and establishment of the technical nyckelnivån at 212 kronor. An underlying positive momentum in the stock market stepped in for a return visit in a week, will strengthen our faith that, while Swedbank is on the way further north…

Get Minianalys Swedish Shares automatically to your e-mail every day before the stock market opens!

As late as just over a month ago we analyzed Swedbank. We asked ourselves, positive already then, but was unfortunately not step over the technical resistance level at 212 kronor.

Instead we got a rebound and we had to take our stop loss at an early stage. This is also something we often emphasize how important it is to actually take a loss quickly when a deal goes against us. It is so we will come out as the winner in the long run, then the losses are actually a part of the rules of the game.

Swedbank succeeded, however, now on Wednesday to step over the technical resistance level at 212 sek, which is the price at which notes the highest volume since a year back.

We also now clearly established ourselves over the short term, the 50 day moving average has been a further positive underlying factor in the back.

Even if we now believe that an attractive köpläge occurred at 214 crowns, we run after Wednesday’s trading in a battle with MA 100 and 200.

The long-term 200-day moving average, pointing, however, to the north, which further signals a continued positive journey.

However, we choose to take a initially position already now, in order not to miss out on a big part of the trip to the north which is raised.

We leave a målkurs on the 225 crowns, but even if we expect a lot of resistance from sellers here, we can come to be a initially, the opposition is already at 218 dollars.

If we are against all odds received a false buy signal is generated, is placed, preferably a stop loss already at 211.50 crowns.

Soon it is also time for Swedbank to leave the interim report, and already tomorrow, Friday, puts SEB sentiment for the banking sector.

Swedbank leave yourself interim report for the second quarter of the year on 19 July, a day when several indextunga companies leaving the interim report.

As we previously reported, Swedbank has recently acquired betalningstjänstföretaget Payex, which includes a number of companies in Sweden, Norway, Denmark and Finland.

The company shall be run as a wholly-owned subsidiary, and currently has its headquarters in Visby.

The stock is traded on the stockholm stock exchange, under the symbol SWED A.

Swedbank

Entrance buy

214.00 £

Ticker

SWED A

Målkurs

225.00 kr

Market

The OMXS Large Cap

Emergency exit

211.50 £

P/E

11.7

Latest

214.70 kr

Direct avk.

6.2%

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!

More about technical analysis:

- Common concepts in technical analysis

- Moving averages – lagging indicator, which filters out the noise

- MACD – technical indicator, which fits well into the trends

- RSI – a classic momentumindikator that is a ”must” in swingtrading