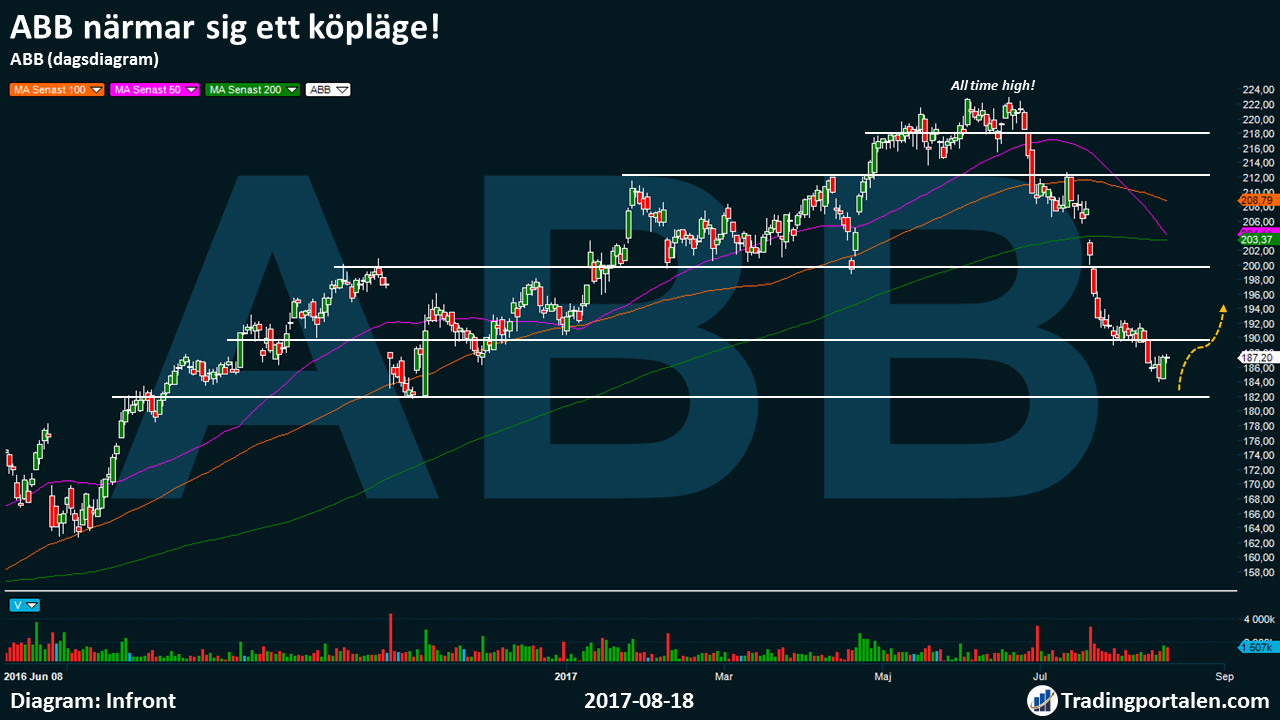

Former sign of weakness, which we revealed already by 31 July in the ABB proved to be correct. The stock has clearly lost ground with the lowest listing at 184 crowns since then. Further decline is expected to 182 kroner, which we consider to be an attractive köpläge.

Get Minianalys Swedish Shares automatically to your e-mail every day before the stock market opens!

ABB has since the summer of lost clearly with the land from the all time high around 222 dollars. The decline has been experienced in two stages, the first at the end of June, and the other at the end of July.

We released an analysis by ABB on July 31, when we revealed sign of weakness. Unfortunately, we never up to our entry level, but the journey has progressed well according to our forecast.

That we now, instead, begins to approach a köpläge, at our målkurs from 31 July at 182 sek is revealed clearly in our daily chart below.

Just 182 sek is a technical support level which clearly formed last year. This is where we are at this price level are in the outer and lower part of the large volume range that formed last year.

We estimate that the probability of a yank to the north, at this level of prices is large, thus leaving a price of 182 dollars.

A jolt of the north can take us further north, to the initially 190 sek. As long as köpstyrkan stands out when we are in such a position is traded around sek 190, then opened it up for a trip up to 199 dollars.

Målkursen at 199 crowns are set, not only because we are just over find the sentimental heltalsnivån at 200 crowns, but even then we during the first quarter of this year experienced difficulties when we tried to get a breakthrough on the downside.

There is always a risk with an outside in trade, even if it is often a very attractive entry point if we will check the right. The risk is that we will have less ”shake off”, and beats out the stops that are located at 182 dollars, and that we will have a further decline a couple of crowns before you get a trip to the north.

A stop loss is placed, preferably already at 176.50 million, for the to limit a false buy signal and potential further decline.

Last few weeks have been relatively quiet in the news feed. In August, revealed in a press release that the company won an order worth $ 30 million, for the supply and installation of a substation in a power plant in Bastra-region in the south of Iraq.

The stock is traded on the stockholm stock exchange, under the symbol ABB.

ABB

Entrance buy

182.00 £

Ticker

ABB

Målkurs

199.00 sek

Market

The OMXS Large Cap

Emergency exit

176.50 £

P/E

21.4

Latest

187.20 usd

Direct avk.

3.6%

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!

More about technical analysis:

- Common concepts in technical analysis

- Moving averages – lagging indicator, which filters out the noise

- MACD – technical indicator, which fits well into the trends

- RSI – a classic momentumindikator that is a ”must” in swingtrading