Visa Inc. (V) and Mastercard Incorporated (MA) report earnings this week, with analysts expecting strong results from two financial giants, supported by the acceleration of the transition to digital, the processing of payments following the COVID-19 pandemic. Similarly, neither the stock has rallied back to its first quarter high because the overall transaction volumes have fallen due to the Main Street economic uncertainty, driven by high levels of unemployment.

Key Takeaways

- Visa and Mastercard have outperformed rival American Express in 2020.

- The financial sector is not likely to recover until the pandemic runs its course.

- Wall Street remains very optimistic about the Visa and Mastercard stocks.

These issues have done better than rival American Express Company (AXP) so far this year, less encumbered by the collapse of business and leisure travel. However, fewer plane tickets, hotel reservations, and restaurant costs are taking a toll on all three operations, which tend to rally during periods of economic boom and sell during downturns and recessions. As a result, breakouts to new highs is unlikely until a vaccine is produced or the pandemic runs its course.

Wall Street consensus on the Visa and Mastercard stocks remains very optimistic, with “Strong Buy” ratings powered by 18 “Buy” recommendations for each question. Mastercard provided a bullish update on the second quarter, the operating metrics at the end of June, noting that the” volume, continues to show an improving trend since the week ending May 28, due in part to the continuation of the relaxation of social distancing measures in many markets and the impact of the fiscal stimulus in the united States.”

A cyclical is a stock whose price is affected by macroeconomic or systematic changes in the economy as a whole. Cyclical values are known to follow the cycles of the economy through expansion, peak, recession, and recovery. The most cyclical stocks involve companies that sell consumer discretionary items that consumers buy more in a booming economy, but spending less during a recession.

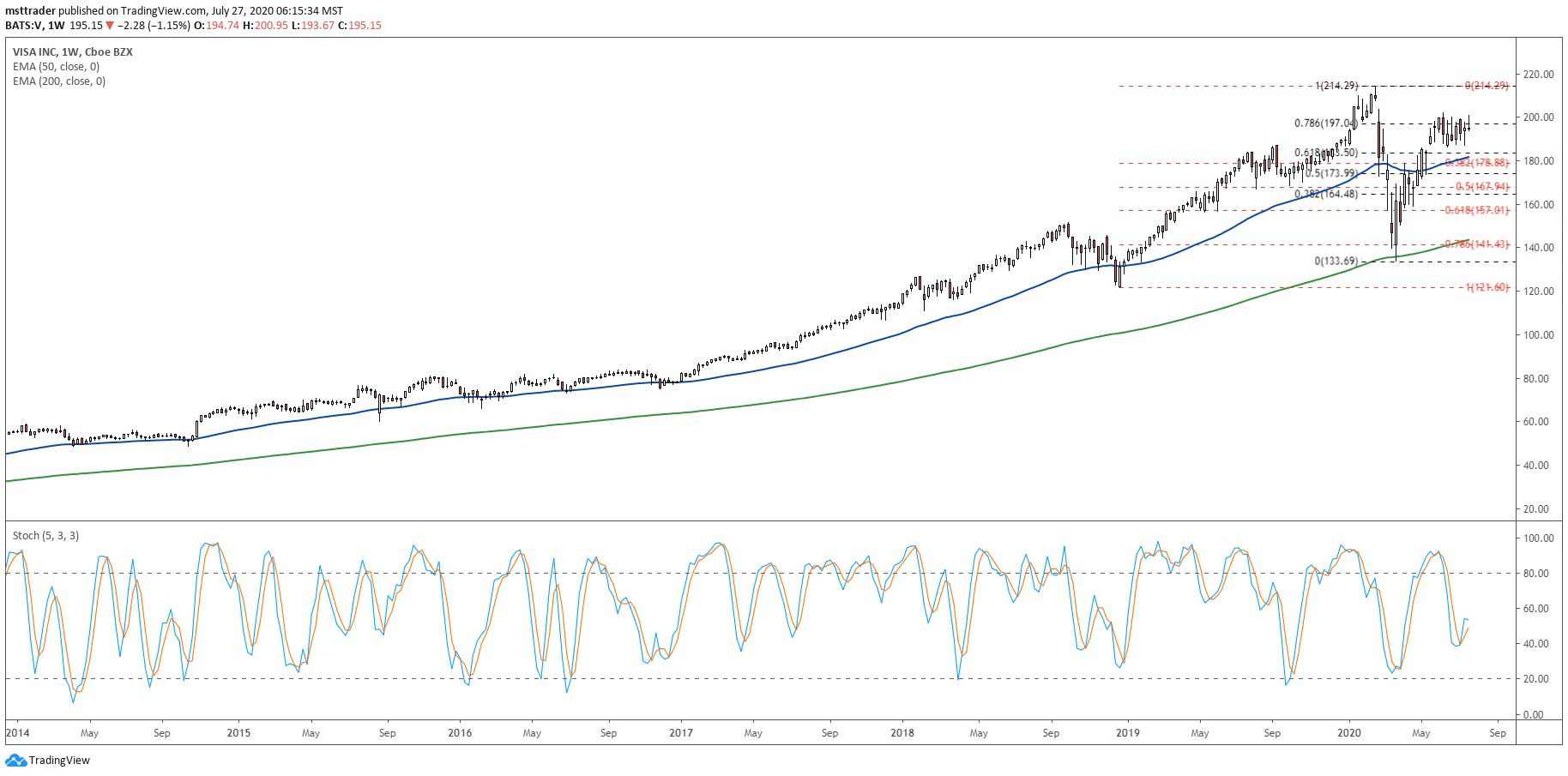

Visa Weekly Chart (2014 – 2020)

TradingView.com

The stock has been engaged in a strong upward trend since 2011, when it broke out above the resistance at a split-adjusted $24.30. The rise of the carved just two small pullbacks before 2020, with the two cuts find support at the 50-week exponential moving average (EMA). The rally of the trajectory increased in 2017 and again in 2019, culminating in February 2020 from the ascension of an all-time high at $214.17. It then fell 80 basis points in March, to come to rest at a 14 month low.

A Fibonacci grid extending through impulse buying, which began in December 2018 instead of the March lows to the .786 rally retracement level, which marks a high odds turning point. In the second quarter, an increase of the impasse, in June, at the .786 sale of retracement, highlighting symmetrical activity, which is a common occurrence measure in 2020. Given this pricing structure, the stock need to break out above $200 after this week’s confession or risk a decline in the $170.

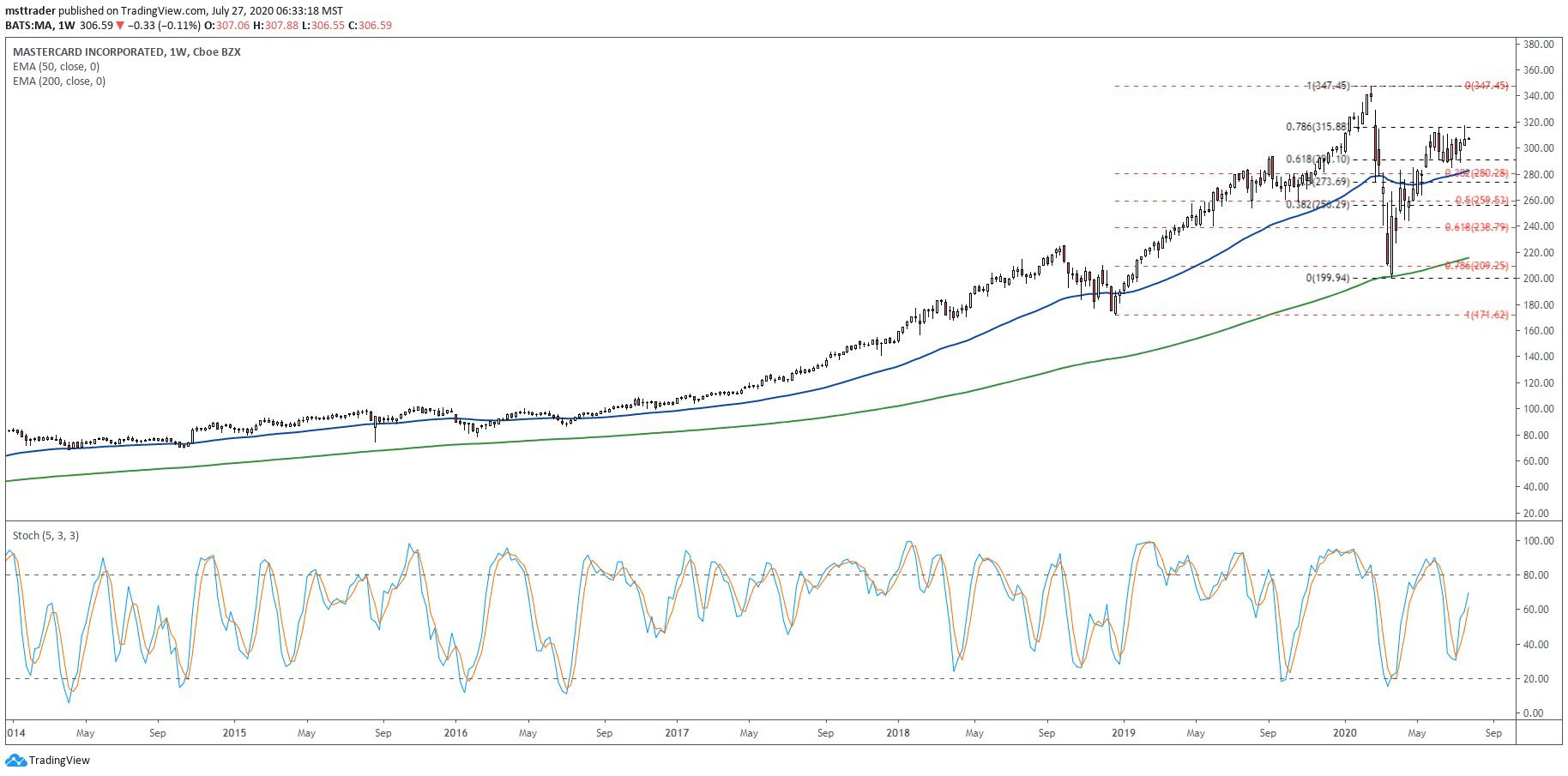

Mastercard Weekly Chart (2014 – 2020)

TradingView.com

The stock broke out to new highs after the presidential election of 2016, entering in a strong uptrend that topped out near $225 in October 2018. It fell to an eight-month low in December and turned over in 2019, breaking once more in the month of March. The rally took a break in July and resumed in October, giving a final purchase of wave in February 2020 all-time high of $347.25. It then fell by nearly 150 points in March to 14 month low.

The model for 2018 is almost identical to that of its rival, with a decline in the .786 Fibonacci rally retracement and 200-day EMA, followed by a recovery in the .786 sale of retracement. The Accumulation of readings are similar as well, positioned relatively high in the seven months of the beaches. Accordingly, the configurations in the item gains are the same – that is to say, a rally above $316 would be in favour of a 100% retracement February high, then a sale would open the door to the $280s.

An exponential moving average (EMA) is a type of moving average (MA) which puts more weight and importance on the most recent data points. The exponential moving average is also known as the exponential weighted moving average.

The Bottom Line

Visa and Mastercard report earnings this week, with the odds split evenly between the higher and lower stock prices after the news.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com