Key Takeaways

- EPS is$1.70, against$0.81 analysts expected.

- Gross bookings for Wrinkles have decreased by a year, for the first time, but less than analysts expected.

- Revenue matched expectations.

- Uber-posed of 3 700 full-time employees in order to reduce costs, or about 14% of the total workforce of the company.

What Happened

Uber reported significantly greater loss per share than expected in the May 7, 2020. Uber has always struggled with profitability and took some severe measures to try to achieve the threshold of profitability, the layoff of 3 700 of its employees, or about 14% of the total. The income has been roughly in line with expectations, but gross bookings for his “Walks” segment decreased by one year for the first time. All of this comes from the California Attorney General, Xavier Becerra, sued Uber and Lyft. The lawsuit alleges that the ride-hailing companies are misclassifying their drivers as sub-contractors under California Assembly Bill 5.

(Below, Investopedia’s original earnings preview, published 5/5/20.)

What to Look for

Uber Technologies Inc. (UBER), the tower-originally a service that was made public in 2019, has published a long series of losses, and this year, the coronavirus pandemic is not likely to help the issue. People have been originating from many less cabins in the middle of a shelter in place measures to limit the spread of COVID-19, a concern that has contributed to Uber’s stock down more than 60% of reduction by 2020 of a high, earlier this year. Investors will be looking at how Uber ride-hailing business has been affected when it reports Q1 2020 earnings on May 7, 2020 after the close of the market. Despite the negative impact of the pandemic, analysts expect the company to report a significant reduction in losses year-on-year even as revenue growth slows sharply.

Investors will also be focusing strongly on the company’s Gross Bookings in midway, a key measure used by Uber to assess the total number of trips to be provided to the clients through its Walks segment. Analysts expect Uber to report the first decline of this parameter in at least 8 quarters. Due to the uncertainty resulting from the pandemic, the company announced several weeks ago that it was withdrawing its 2020 guidance for the whole of the Gross Bookings as well as its adjusted net sales and adjusted EBITDA.

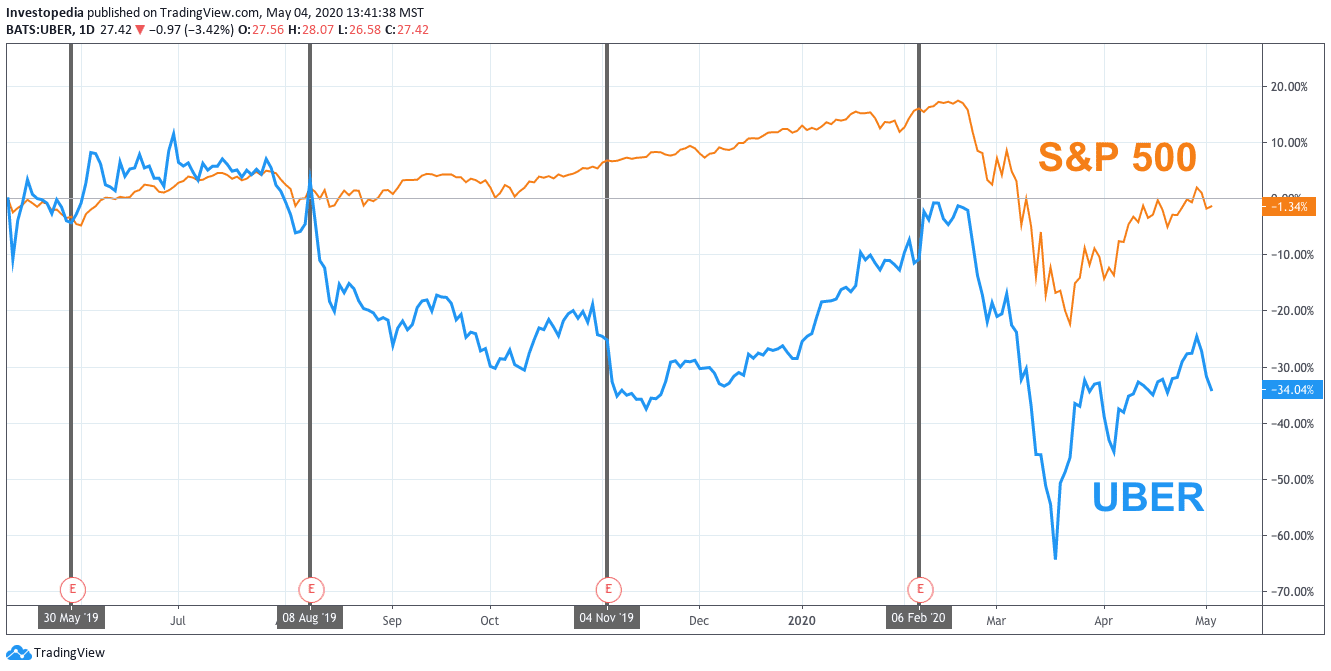

Uber has largely been a disappointment for investors since the public in one of the most anticipated public offerings (Ipo) last year. Its shares have underperformed the broader market, with a total return of -34% compared to the S&P 500 index total return of about -1% over the past 12 months.

Source: TradingView.

Uber has posted four consecutive quarters, the account of losses per share in the past year. The good news is that the adjusted earnings per share (EPS) in both Q3 and Q4 of 2019 were not as bad as analysts expected, and reversed a three-quarter trend of accelerating losses that began before Uber formally made public. The adjusted EPS has -0,68$and -0,64$for Q3 and Q4, respectively, compared to$4.72 in Q2.

In contrast, revenues have been showing a positive growth of 29.5% and 36.8% in the third and fourth quarter, respectively. Those who have the highest rate of revenue growth, Uber has posted since Q3 2018.

The outlook for the 1st quarter is mixed. Analysts expect both earnings and revenue growth to worsen in Q1 2020 compared to the previous quarter, which was Q4 2019. To be sure, adjusted EPS, expected to be$0.81, would be a dramatic improvement compared to$2.23 in Q1 2019. But the revenue growth is expected to grow at the slowest pace in the last two years, 11.4% year-over-year (yoy).

Uber Key Measures

The estimate for the Q1 2020

Real for the 1st quarter of 2019

Actual for Q1 2018

Adjusted Earnings Per Share ($)

-0.81

-2.23

7.89

Revenue ($B)

3.5

3.1

2.6

Gross Bookings ($B)

10.7

11.4

9.4

Source: Visible Alpha

Investors will be also focusing on another key Uber metric, which is the Gross Bookings from its towers business. This metric is defined as the total value in dollars, including applicable taxes, rights and fees generated from Uber Rides segment. The metric excludes any consumption reductions and refunds, as well as the driver of revenues and incentives. Uber Rides consists of 75% of total Gross Bookings, as of the last quarter of 2019.

The locks introduced in order to limit the spread of COVID-19 means that people move less than they would normally. That means fewer taxis are being hailed and Uber Gross Bookings in hiking is likely to be negatively affected. However, the damage could be worse in Q2 to 2020, due to locking of the measures have been introduced in the last weeks of Q1.

Gross bookings in the rides has reached a record of $ 13.5 billion in Q4 2019. But the growth has slowed over the past two years, from 17.7% yoy in Q4 2019 compared to a 44.1% increase year-on-year in the 1st quarter of 2018. Now, the analysts expect Gross Bookings in the rides to fall in Q1 2020 6.7% year-on-year to $ 10.7 billion. This is the lowest Gross Booking level in at least 5 quarters, since Q3 2018.

On a positive note, the company, Uber Eats delivery business can actually receive a boost in Gross Bookings. This is because a lot of sheltering in place, consumers may find it more convenient to use Uber, the food delivery service that venturing out to the local grocer. However, Uber Eats has only 24% of the total share of Gross Bookings in Q4 2019. This means that it is unlikely that delivery of food can compensate for a possible significant drop of the Uber core ride-hailing business.

Source: investopedia.com