The transport sector is often closely watched by active traders and in particular those who follow the Theory of Dow as part of their strategy. In short, the Theory of Dow confirms broad market uptrends when one of his medium such that the transport of average advances above a previous swing high and is accompanied by a similar advance in the other indices.

The bullish momentum from the end has sent prices of the index keys, specifically the transport, above an influential level of resistance. Based on the chart patterns you can read about below, the past price action should not go unnoticed and could be an early sign of the continued moves higher over the coming days and weeks.

the iShares Transportation Average ETF (IYT)

Traders interested in the analysis of the transport sector often turn to exchange-traded products such as the iShares Transportation Average ETF (IYT). For those who don’t know, the IYT ETF is composed of 20 farms covering the UNITED states, airlines, railways and trucking companies.

As you can see below, the price of the fund has failed to make progress above the 200-day moving average on a couple of different times over the last few months. However, over the past 10 trading sessions were dominated by the bulls, and it is clear that the momentum is in their favor, with little reason to expect that it will reverse any time soon. The followers of technical analysis will pay particular attention to the 50-day and 200-day moving averages due to a bullish cross will probably be another catalyst for a move higher because it is a buy signal which often marks the beginning of a major long-term bullish trend.

StockCharts.com

Norfolk Southern Corporation (NSC)

As the top of the holding of the IYT ETF, Norfolk Southern Corporation (NSC) and the rest of the U. S railroad industry will be likely to catch the attention of traders in the weeks to come. The reason of this table is of such interest to active traders, is the fact that it is moved above a key level of resistance as well as being close to the important support of 200-day moving average.

Technical traders will also want to take note of the bullish crossover between the 50-day and 200-day moving average, known as the cross of gold, because, as we discussed above, it is a common, long-term buy sign and is likely signaling the beginning of a great long-term bullish trend. From a risk management perspective, stop-loss orders will probably be placed below $179.72 in the case of a sudden change in market sentiment or sector fundamentals.

StockCharts.com

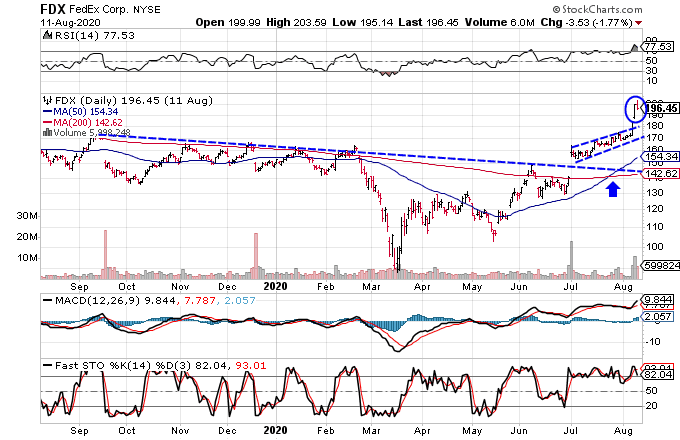

FedEx Corporation (FDX)

One of the most well-known shipping companies, which also happens to be one of the best of the holding of the IYT ETF is FedEx Corporation (FDX). Taking a look at the chart below, you can see that the bears were in control of the greater part of the past year, but small at the beginning of July, reported that the trend will reverse and that the bulls have taken control of the amount of movement.

The strong price action in recent weeks, has also triggered a bullish crossover between the long-term moving averages. This will probably be used to confirm the reversal of trend and traders will most likely want to place their orders as close to the one of the dotted lines, the trend curves as possible in an attempt to optimize the risk/reward.

The Bottom Line

The transportation stocks have been brought to the attention of active traders in the last few weeks, because the prices of the North America have moved above key levels of resistance and have triggered a long-term buy signals. Close to the level of support to provide an additional level of comfort for those who seek to minimize the risks.

At the time of writing, Casey Murphy did not own a position in any of the assets mentioned.

Source: investopedia.com