[Todd Harrison is the cio and co-founder of CB1 Capital and a columnist for Investopedia. The opinions expressed here are those of the author and do not necessarily reflect the views of Investopedia.]

After bouncing off all time lows in March, global cannabis stocks paused to think of as a traditionally treacherous summer season has started. The Bloomberg Global Cannabis Index lost 9.5% in June and arrived in the horizon 2020 mid-down 29% YTD. It remains our opinion, that the half of this year will be the catalyst rich and although many variables remain, the scene is apparently set.

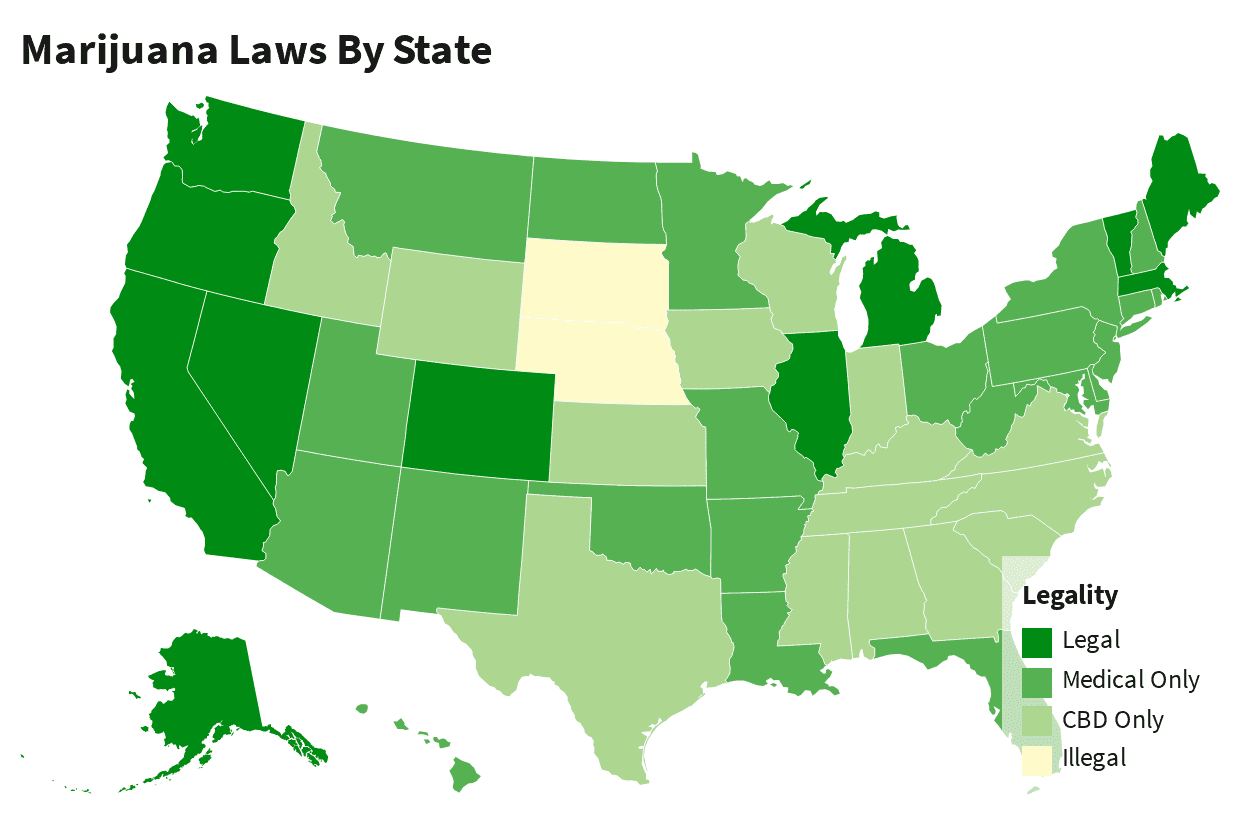

In our last column, we walked through a multitude of dynamics, including how COVID-19 and the social justice movement has crystallized the need for a legal framework and regulated in the UNITED states cannabis market; more and more States are turning to cannabis for tax revenue and job growth; the implications of the next election; the potential for the reform of the banking sector; and in December, at the meeting of the UNITED nations.

In the future, several forces drive the sector through the remainder of the horizon 2020:

The November Election

At the beginning of July, Joe Biden, the campaign for the release of their cannabis policy project , which includes plans to defer to the adult, to schedule medical and decriminalization of the two. Especially, it would be to leave the question of legalization in different states, many of which have existing infrastructure for turn-key of the growth. The Senate race is of particular importance, as it is the bottleneck for the bulls in recent years.

State Referendums

Bloomberg Intelligence recently published an article, “New Jersey, the Legalization May Ignite the North is the Buzz,” which echoes many of our fundamental assumptions. “If New Jersey voters approve adult-use of marijuana in November,” they wrote, “we could, in the short in order to create one of the nation’s largest legal pot markets and potentially triggering a five-state in the North-east of the block value of more than $7 billion a year in sales.” In addition, they have an overall estimate of U.S. cannabis sales could surge 50% by 2020 in spite of the disturbances caused by the COVID-19.

Investopedia 2020.

Regulatory Trade-Offs

Cannabis companies cannot bank a commercial or to access capital, given the current regulatory landscape, but the law has already been passed by the U. S House of Representatives that could change all that; and if the SAFE Bank provisions are contained in other pending legislation, such as the Bank Secrecy Act, Anti-Money Laundering (BSA/AML) bill that is expected to pass before the election, it would be an immediate game-changer that lowers the cost of capital and accelerating the adoption general.

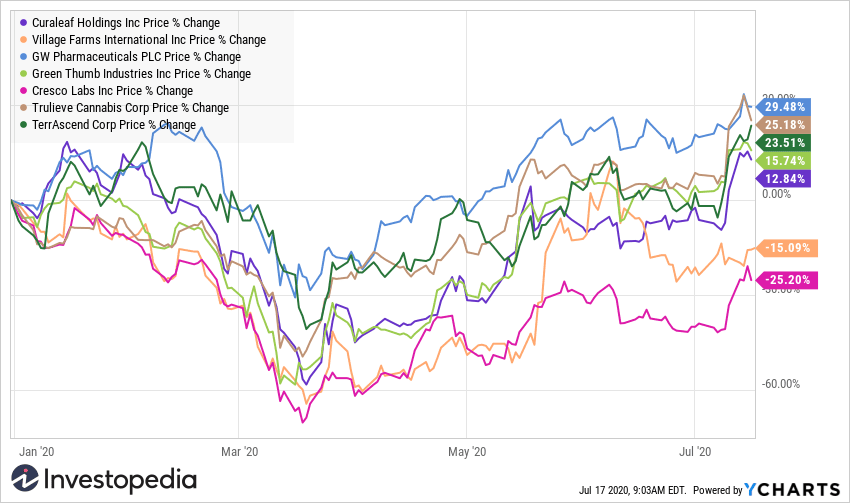

Who are the Winners?

With the North-east of the dominoes set-up for the Fall, and the voters of Arizona on the point of spend in the adult-use in the West, many U.S. operators are expected to benefit-in-kind, including Curaleaf Holdings, Green Thumb Industries, Cresco Partners, Trulieve of Cannabis, and Terrascend Corp, which holds more than 20% of the Pennsylvania wholesale market and has a New Jersey footprint, as well.

YCharts.

Where We are in the Cycle

To appreciate where we are, we must understand how we got here. In the interest of time, I’m going to go beyond 30 000 years, with a range of cultures have benefited from the huge well-being properties of this amazing plant, and I’m going to breeze through the ban when the UNITED states government militarized “marijuana” as an immigration tool, and in their War against Drugs.

The industrial evolution of cannabis, which is relevant to this discussion and even more relevant for our financial future, has three distinct phases:

The Cannabis 1.0: Canadian culture enjoyed spectacular gains in 2016 and 2017 before the bursting of the bubble, leading to a 92% decrease in the stock of cannabis from January 2018 until March of this year. Canadian LPs remain mired in over capacity and put in check by a slower than expected deployment at the international level, but we see the best opportunities of the north, including the low-cost producer Village Farms.

The Cannabis 2.0: towards the US consumer packaged goods (CPG) that the use of cannabinoids as ingredients will be the engine of the next stage of this upward trend in the market. We are at the beginnings of this phase that consumers learn about new products and different form factors, including beverages, nutraceuticals, cosmetics, and vanity, and pet supplements, as well as the industrial use cases.

The Cannabis 3.0: the Effectiveness of tailored solutions will allow you to solve puzzles medical through a wide range of indications and ailments and finally change the public perception of cannabis from a drug with a solution of well-being; one with a treasure of active pharmaceutical ingredients (API). This will be followed by a biotech pathway, where success medical clinic of the adoption, and GW Pharmaceuticals (GWPH) is the leader here.

One can juxtapose these buckets against the three phases of any market move: the denial, migration and panic. The great slaughter of 1.0, and the exodus that followed the most followers of the industry in the denial of recovery, and even less a new bull market, is possible. The banking reform will be, in our view, to trigger the migration towards the space as institutional investors chase organic growth; and demonstrated effective agility should, over time, to turn end-of-cycle adopters in the panic of the buyers in the well-being of the thesis.

This is the future, we expect. Until the plumbing is fixed, however, until the legislation allows pension funds and other institutions to invest in the domestic secular growth story—AMERICAN cannabis companies will remain listed on the stock Exchange in canada, in private, a handful of hedge funds and abused by an army of retail stock jockeys. We expect that this change; and we look forward to the time when he does it.

(Todd Harrison and his firm may hold positions in the stocks mentioned.)

Source: investopedia.com