Tesla, Inc. (TSLA) shares have risen 270% so far this year amid strong demand and expected profitability. Given the strong increase in the stock price, some analysts are beginning to question whether the electric car manufacturer’s financial performance justifies its assessment.

Bernstein analyst Tony Sacconaghi downgraded Tesla stock of the difficulties of the Market Perform during Tuesday’s session, saying that the shares are overvalued at their current levels. With Tesla the value of the company corresponding to Toyota Motor Corporation (TM) and Volkswagen AG (VWAGY) are combined, the analyst believes that the assessment is unprecedented for a large-cap shares outside of the technology bubble.

Other analysts are convinced that Tesla is going to find new ways to monetize its electric vehicle technology. For example, the Ark of the Research analyst Tasha Keeney believes that the company could launch a ride-hailing service at a price greater than $4.00 per mile, approximately 50% EBTIDA margins, and to become a competitor of Uber Technologies, Inc. (UBER) and Lyft, Inc. (LYFT).

TrendSpider

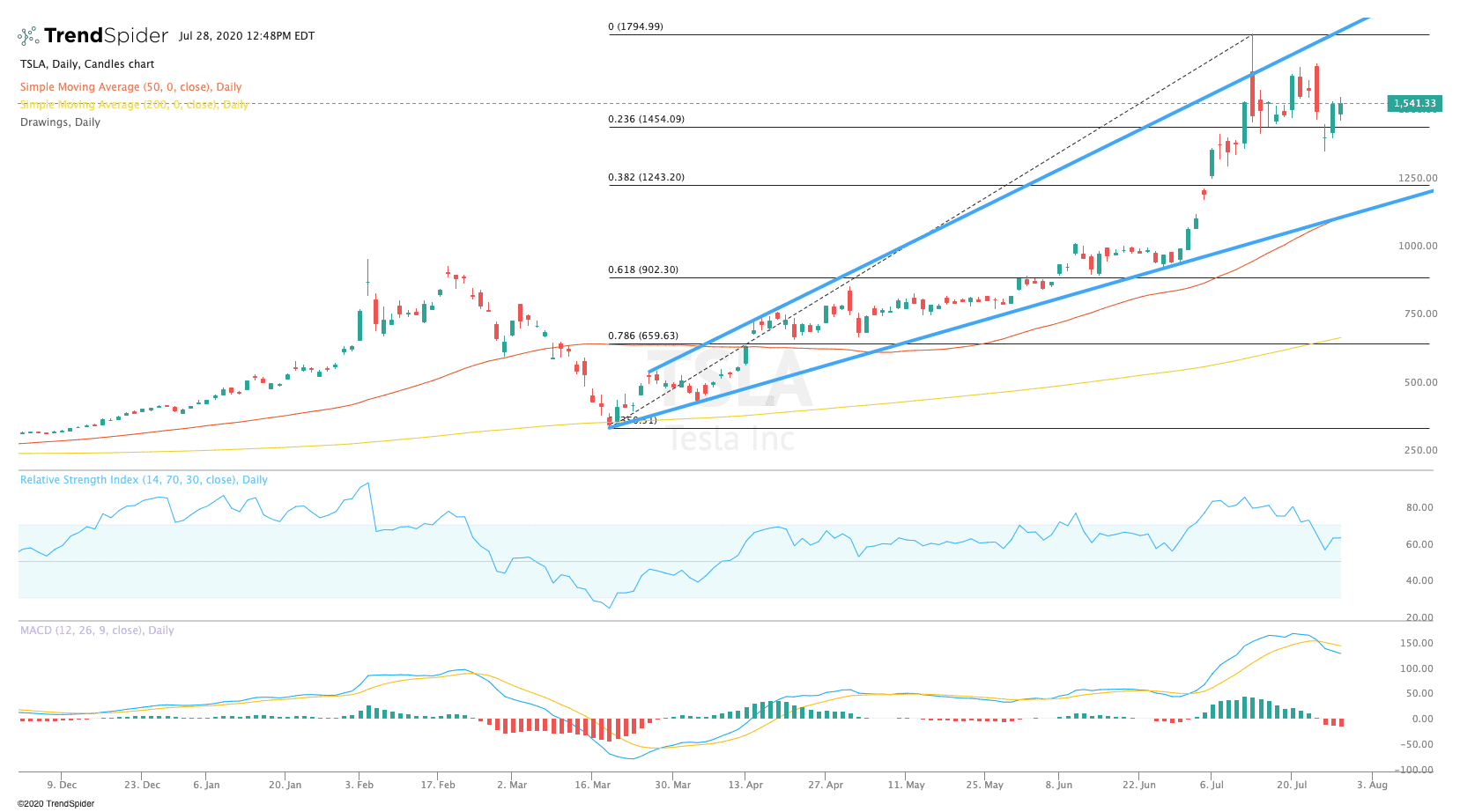

From a technical point of view, Tesla’s stock briefly fell about 3% in early trading in Tuesday’s session, before recovering ground to a modest gain. The relative strength index (RSI) remains below the levels of overbought with a reading of 62.68, but the moving average convergence divergence (MACD) remains in a bearish trend. These indicators suggest that the stock could continue to trend sideways or lower before making another move higher.

Traders should watch for consolidation between the high of trend line resistance at around $1 830 and bottom of the trendline support and Fibonacci levels of around $1,250 in the coming sessions. If the stock breaks out higher, traders could see a fresh move for all vertices. If the stock breaks support, traders could see a move towards the 200-day moving average at around $686.00, although the scenario seems less likely to occur given the bullish momentum.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com