Sonos, Inc. (SONO) shares have fallen more than 15% after the company posted a wider-than-expected third-quarter loss. Revenue decreased 4.2% to$ 249.3 million, beating the consensus estimates of $ 14.9 million, but the losses amounted to 52 cents per share, missing consensus estimates of 28 cents.

The revenues were affected by the closure of retail stores around the world, but the damage has been mitigated by the success of direct-to-consumer strategy. During the third quarter, the management stated that direct-to-consumer revenues have almost tripled over the year and that positive demand for the products that exceeded the expectations of the company.

The gross profit margin decreased 110 basis points to 44% during the quarter due to the introduction of tariffs in September 2019. To the exclusion of the rates, the gross margin would have increased 60 basis points to 45.7% and were even higher when excluding expedited freight costs to increase inventory levels to fulfill orders on hold and answer higher-than-expected demand.

Before the presentation of the results, Raymond James downgraded Sonos stock to Strong Buy Market Perform and removed its price target. Analyst Adam Tindle said in a July 19 note that this was a tactical time to step aside, given that new versions of the products, have little chance during the second half of the year amid cost-cutting efforts.

TrendSpider

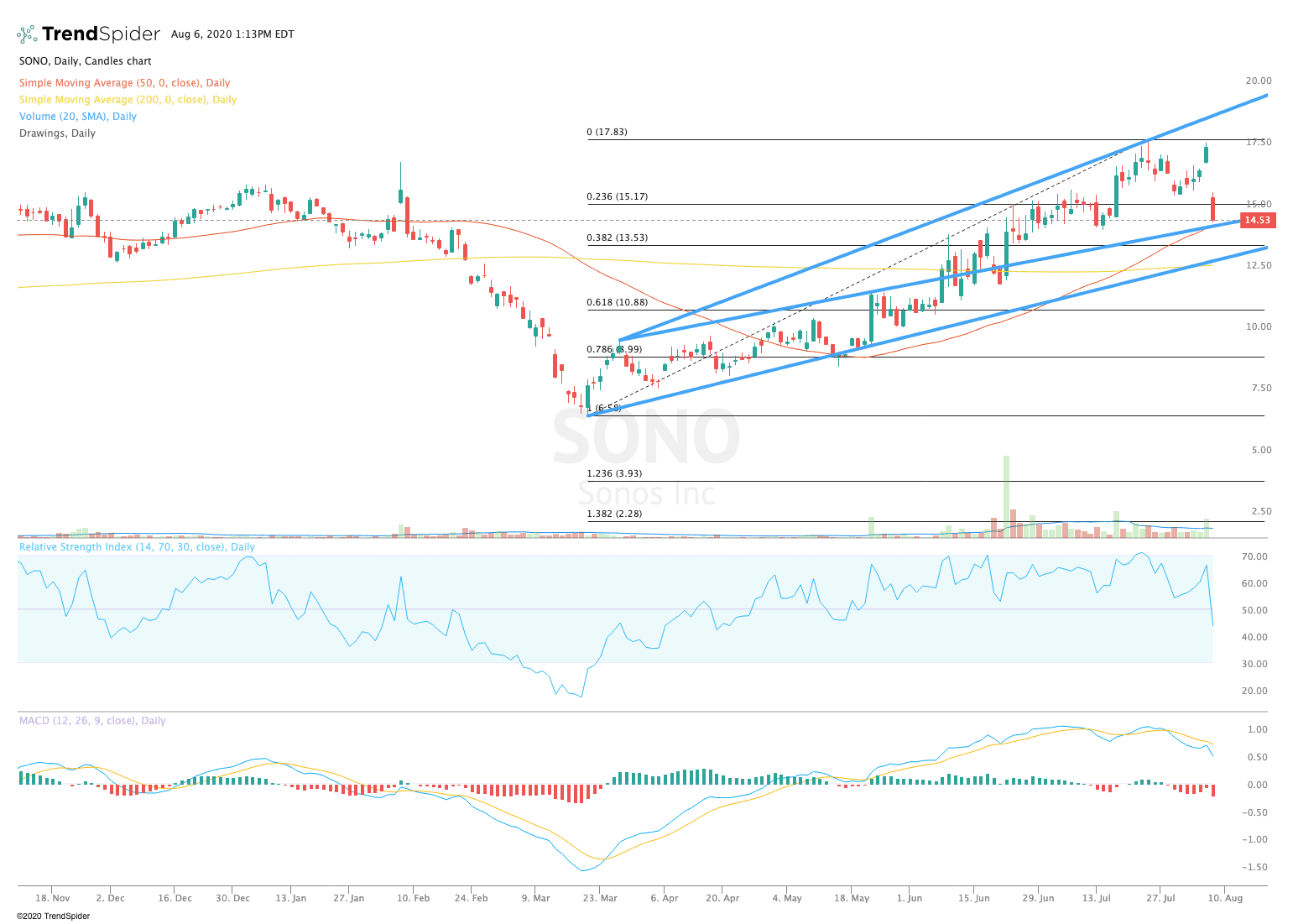

From a technical point of view, Sonos stock fell sharply lower towards the 50-day moving average at $14.65 in the course of the session on Thursday. The relative strength index (RSI) fell to moderate levels of 44.31, but the moving average convergence divergence (MACD) continued to trend downward. These indicators suggest that the stock could continue to give up ground.

Traders should watch for a break of the 50-day moving average to the 200-day moving average of $12.69 in the coming sessions. If the stock rebounds more, traders could see a movement to retest the highs at $17.83. Upper trend line resistance stands at$ 19.00, although these levels appear to be less likely to be achieved in the short term.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com