Shopify Inc. (SHOP) shares rose more than 5% during Monday session after the company joined forces with Walmart Inc. (WMT) to open a Walmart Market. The new integration will allow Shopify sellers to list their items on Walmart.com with the objective of integration of 1 200 vendors this year.

Piper Sandler updated Shopify stock from Neutral to overweight with a $843 price target following the announcement of partnership. Analyst Brent Bracelin analysis weekly of downloads suggest that the improvement in merchant and consumer trends in April have accelerated in May and June.

In addition, Bracelin suggested that the digital commerce penetration rate of 15% could double or triple by 2030 in a post COVID-19 world. The pandemic could permanently change consumer purchasing behavior, and Shopify is one of the best placed digital commerce beneficiaries.

Shopify has also been expansion into new markets. In May, the company announced plans to offer business accounts for the self-employed, enterprises and entrepreneurs. Shopify Balance will give traders access to financial products is required to start, run, and grow their businesses.

TrendSpider

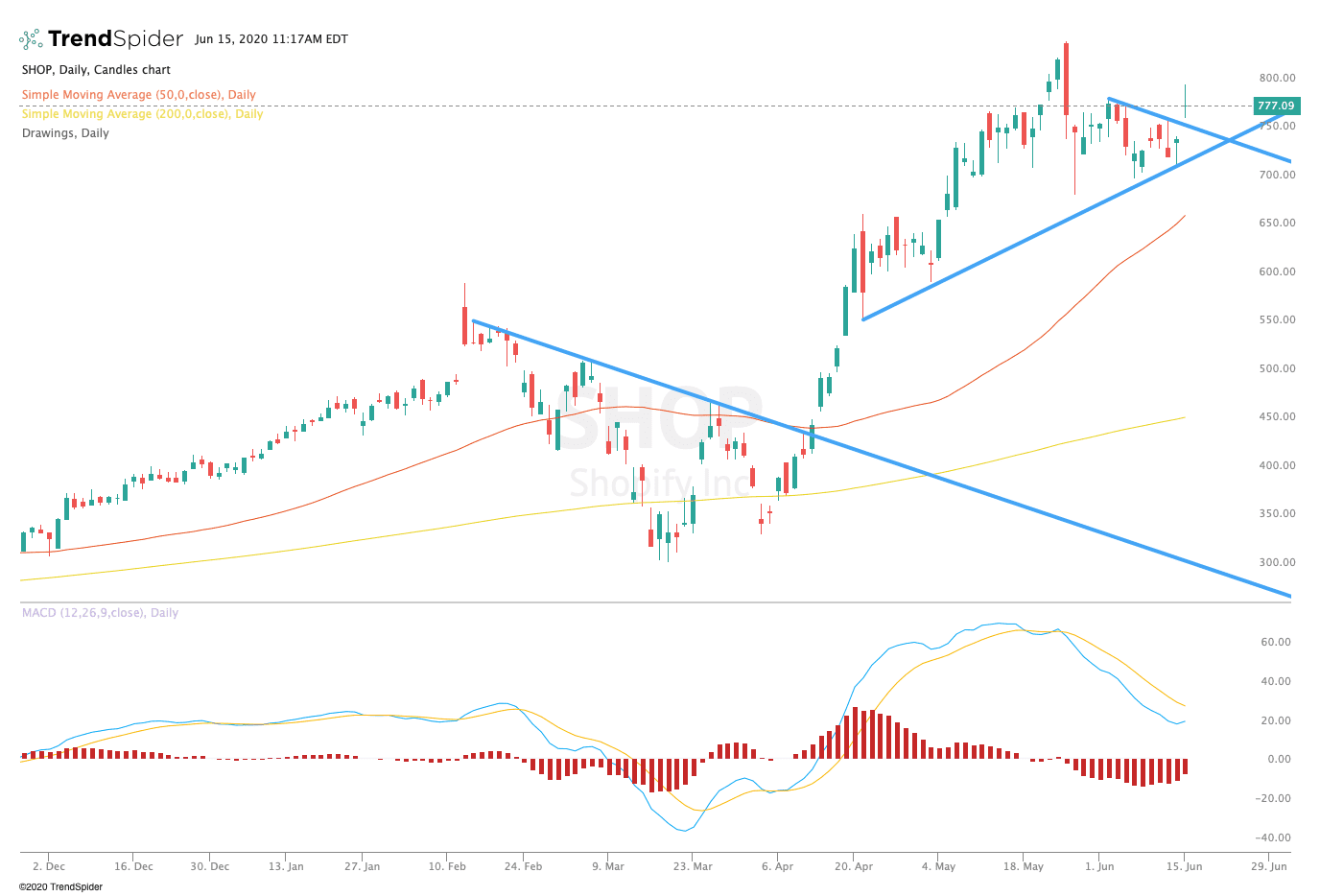

From a technical point of view, Shopify stock broke out of a short term trend curve of the resistance to its highs of around $850 per share. The relative strength index (RSI) has increased from 61.21 but remains below the levels of overbought, while the moving average convergence divergence (MACD) could see short-term bullish crossover. These indicators suggest that the stock has more room to run in the rally.

Traders should watch for a move to the prior highs of $850 in the coming sessions. If the stock breaks out, traders could see a move to new highs. If the stock breaks lower trendline support, traders could see a move to retest of the 50-day moving average at around $663.90 in the coming sessions, although this seems less likely to occur given the upward trend in the wind back over the last few weeks.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com