Shopify Inc. (SHOP) shares rose more than 5% during Thursday’s session after RBC Capital Markets reiterated its Outperform rating and raised its price target to $1,000 per share – one of the high Street and the titles of the first four-digit price target.

Analyst Mark Mahaney acknowledges that Shopify’s share price has doubled in the year to date, but he believes that investors are still under-assessment of the company’s total addressable market, take its potential rate, and operating margin. In addition, it is estimated that the purchasing habits of consumers have changed definitively in favour of the e-commerce throughout the COVID-19 crisis.

These feelings are similar to those of other, less optimistic analysts. Earlier this week, Piper Sandler’s Brent Bracelin upgraded Shopify stock to overweight with a $843 price target, the appeal of Shopify is one of the best placed digital commercial beneficiaries of the next decade. He believes that revenue is on the point of a quadruple to $ 12 billion by 2025.

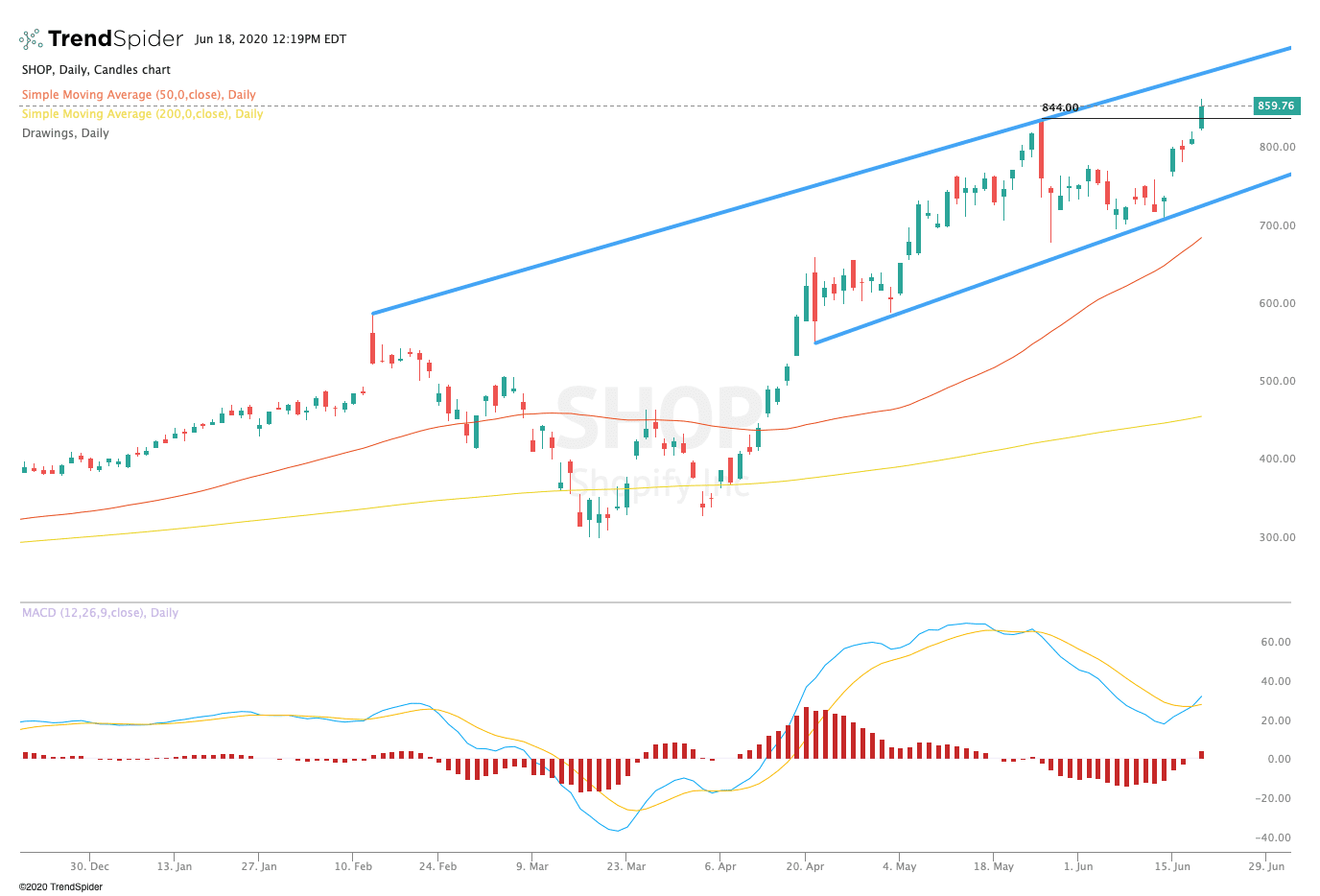

TrendSpider

From a technical point of view, Shopify stock broke out before the heights of $844.00 to the freshness of the tops in the course of the session on Thursday. The relative strength index (RSI) has increased slightly in overbought territory with a reading of 71.06, but the moving average convergence divergence (MACD) in histogram MACD has a bullish cross, which may signal the beginning of a new upward trend. These indicators suggest a consolidation before a move higher.

Traders should watch for consolidation above prior high $844.00 in the coming sessions. If the stock continues to move higher, traders could see a move to the trend line resistance at around $900.00. If the stock moves lower, traders could see a trend to the trend line support and the 50-day moving average at $691.42, although the scenario seems less likely to occur given the bullish sentiment surrounding the stock.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com