ServiceNow, Inc. (NOW) the stock has increased by more than 1% during Wednesday’s session, extending its rally throughout the week. Bank of America reiterated its Buy rating on ServiceNow shares and has raised its target price from $370.00 to $408.00, calling the stock a top pick due to the increase of its relevance during the COVID-19 crisis. The analyst sees a solidify path to $ 10 billion-more revenue in the long term as ServiceNow becomes a key business continuity tool that enables remote employees to return to work.

During the first quarter, the company reported revenues that increased by 34% to $1.06 billion, beating consensus estimates of $ 40 million, while earnings per share came in at 24 cents, beating the consensus estimates of 15 cents. Subscription revenue grew 34% to $995 million, revenues grew 29%, to $ 1.1 billion, and free cash flow rose 30% to $408.6 million.

Wells Fargo has also reiterated its Overweight rating and raised its price target on ServiceNow stock form of $330.00 to $405.00 following financial results for the first quarter to the end of April. Analyst Philip Winslow said that the subscription of the billing and cash flow reductions would not be as severe as the Street feared, and that the first quarter results were driven by the closing of several large transactions.

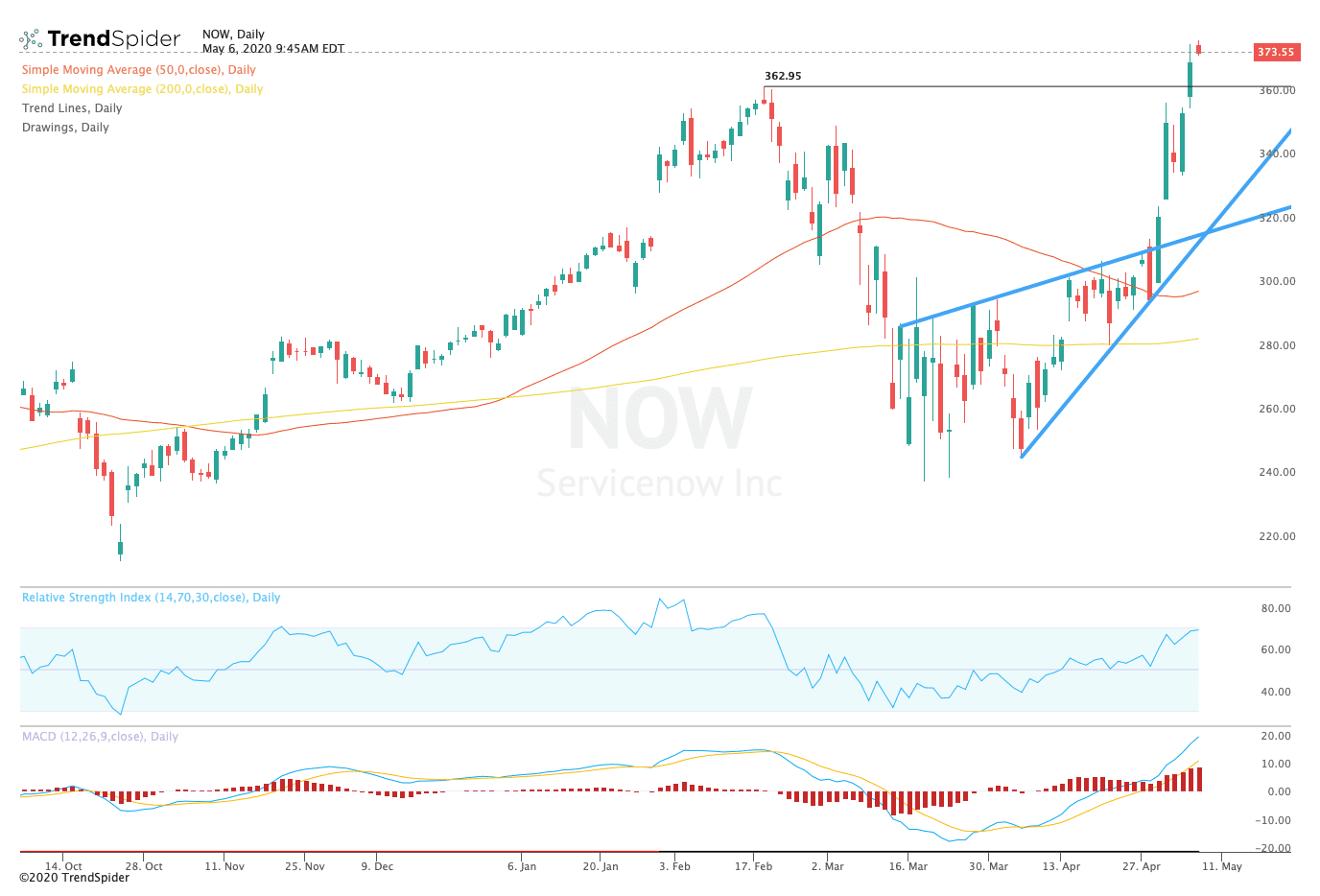

TrendSpider

From a technical point of view, ServiceNow stock broke out of prior highs of nearly $360.00 this week. The relative strength index (RSI) remains close to the levels of overbought with a reading of 69.25, but the moving average convergence divergence (MACD) remains in a strong up trend after crossing above the zero line. These indicators suggest that the stock could see a consolidation before resuming its upward movement.

Traders should watch for consolidation above trend line support levels near $360.00 in the coming sessions. If the stock rebounds more, operators could see a trend towards R1 resistance at $390.66 or R2 resistance at $429.77. If the stock breaks down from these levels, traders could see a move towards the 50-day moving average at $298.73 or the 200-day moving average at $283.82.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com