Dow Jones Transportation Average (DJTA) railway components are trading lower after the second quarter of 2020 the gains, with CSX Corporation (CSX) and Union Pacific Corporation (UNP), beating profit estimates, while coming up short on revenues. Revenue crashed by nearly 25% year-over-both operations, highlighting a recessionary environment, which can continue well into 2021. Union Pacific has warned that the year 2020 car volumes will decrease by 10% or more, from 2019, while CSX warned that the capital expenditure will come at the “low end” of the current directives.

Key Takeaways

- The transport volumes often reveal economic strength and weakness.

- Union Pacific has outperformed CSX for over a decade.

- The two companies expect strong headwinds for the rest of 2020.

The transportation stocks are “canaries in the mine” for the prospects of the U.S. economy, with shipping volume rising during periods of expansion and contraction during recessions and recoveries. We can expect similar reports from other DJTA components in the coming weeks, highlighting the impact of the pandemic. Similarly, the hopes of a quick vaccination, may maintain a supply under these issues, as it has in the market to other groups reporting dismal quarters.

The Expansion is the phase of the economic cycle where real GDP increases of two or more consecutive quarters, the passage of a trough to a peak. This is typically accompanied by an increase in employment, consumer confidence and stock markets. The Expansion is also called an economic recovery.

CSX Long-Term Chart (2006 – 2020)

TradingView.com

CSX stock has broke above the 1997 high to a split adjusted $10.41 in 2006, entering a strong upward trend in the head to the mid-$20 in 2008. A steep slide in March 2009 ended in the single digits, while the increase in subsequent wound failure of the breakthrough of support in June. Price action completed a 100% retracement in the state of the high in 2011 and eased in a long-term-side motif, and finally the higher position in 2014.

This improvement was of short duration, culminating in the upper part of $30 at the end of the year, before a major correction has found support near $20 in January 2016. The stock broke out again after the presidential election, the reservation of the impressive gains in September 2018 high of $76.24. It posted a high of four points above this level in May 2019 and completed a head and shoulders breakdown in February 2020, falling to a three-year low.

The rebound in the second quarter reversed at the .786 Fibonacci massive sale of the retracement level in June, before moving to the closely aligned 50 and 200 days exponential moving averages (EMAs). Hope to bid on the publication of the results failed to reach the previous peak, but this morning, the recession has not damaged the slightly positive technical outlook, so that buyers can come to the rescue in the coming sessions. Similarly, the weakness of the build is not conducive to much higher prices in the next few weeks.

The Fibonacci numbers are used to create technical indicators with the help of a mathematical sequence developed by the Italian mathematician, commonly called the “Fibonacci”, in the 13th century. The sequence of numbers, starting from zero and a, is created by adding the previous two numbers. For example, the first part of the sequence is 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89,144, 233, 377, and so on.

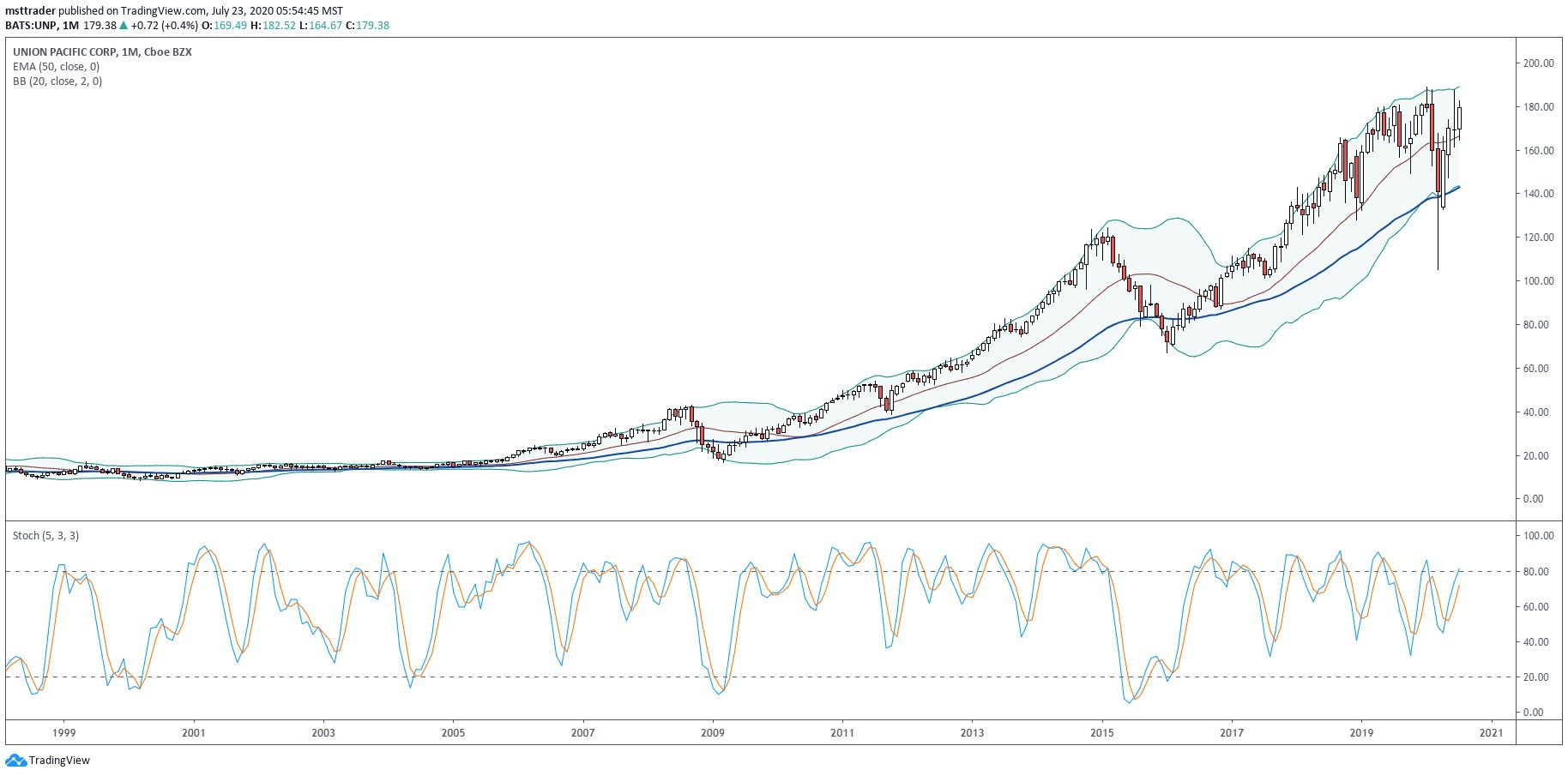

Union Pacific’s Long-Term Chart (2006 – 2020)

TradingView.com

Union Pacific has outperformed its sector rival over the last 15 years, also break above 1997 of the resistance in 2006. The stock sold to the escape of support during the economic collapse of 2008 and bounced back strongly in the new decade, the publication of new peaks in the fourth quarter of 2010. It reserved historic gains in the middle of the decade, raising $124.52 in 2015, fell to a three-year low in January 2016.

December 2017 breakout carved a series of new highs in January 2020 all-time high at $188.96, paving the way for a drop vertical which gave up more than 84 points in March. The increase in subsequent exceeded CSX, barely missing the 100% retracement before a June recovery installs itself on the closely-aligned with the 50 and 200-day EMAs. The stock is trading about 10 points in June of the resistance after the news, thanks to a strong accumulation promoting the rising prices.

The Bottom Line

Railroad stocks are selling at the Thursday pre-market after key players posted dismal second quarter of 2020 sales and has warned about the continuation of contrary winds.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com