NVIDIA Corporation (NVDA) reports earnings after Thursday’s closing bell, with analysts expecting a profit of $1.53 per share on $3.0 billion in the first quarter of 2020 sales. The stock has rallied 7% after NVIDIA beat top and bottom line estimates in February, with four sessions later, just before 136 points of sale in mid-March. The increase in subsequent recovered 100% of such losses in May, before bursting an all-time high last week.

The graphics card giant, has benefited greatly from stay-at-home and quarantine orders, with millions of rest, the Americans and the Europeans who have much free time to update their computers and video games. The broad PHLX semiconductor Index (SOX) has done well since the March lows, but NVIDIA is at the cutting edge, outperforming other chip stocks, as it has done since the middle of the last decade.

The trend advance to book substantial upside in the coming months, with the breakout above 2018 resistance to the generation of a measured target near$ 450. A decline of $300, or it may offer an opportunity to purchase before getting to this noble peak, so that the investors and traders who have missed the session may want to keep this rocket on their watch lists, waiting for a revival that shakes the hand weakness of the dynamics of the buyers.

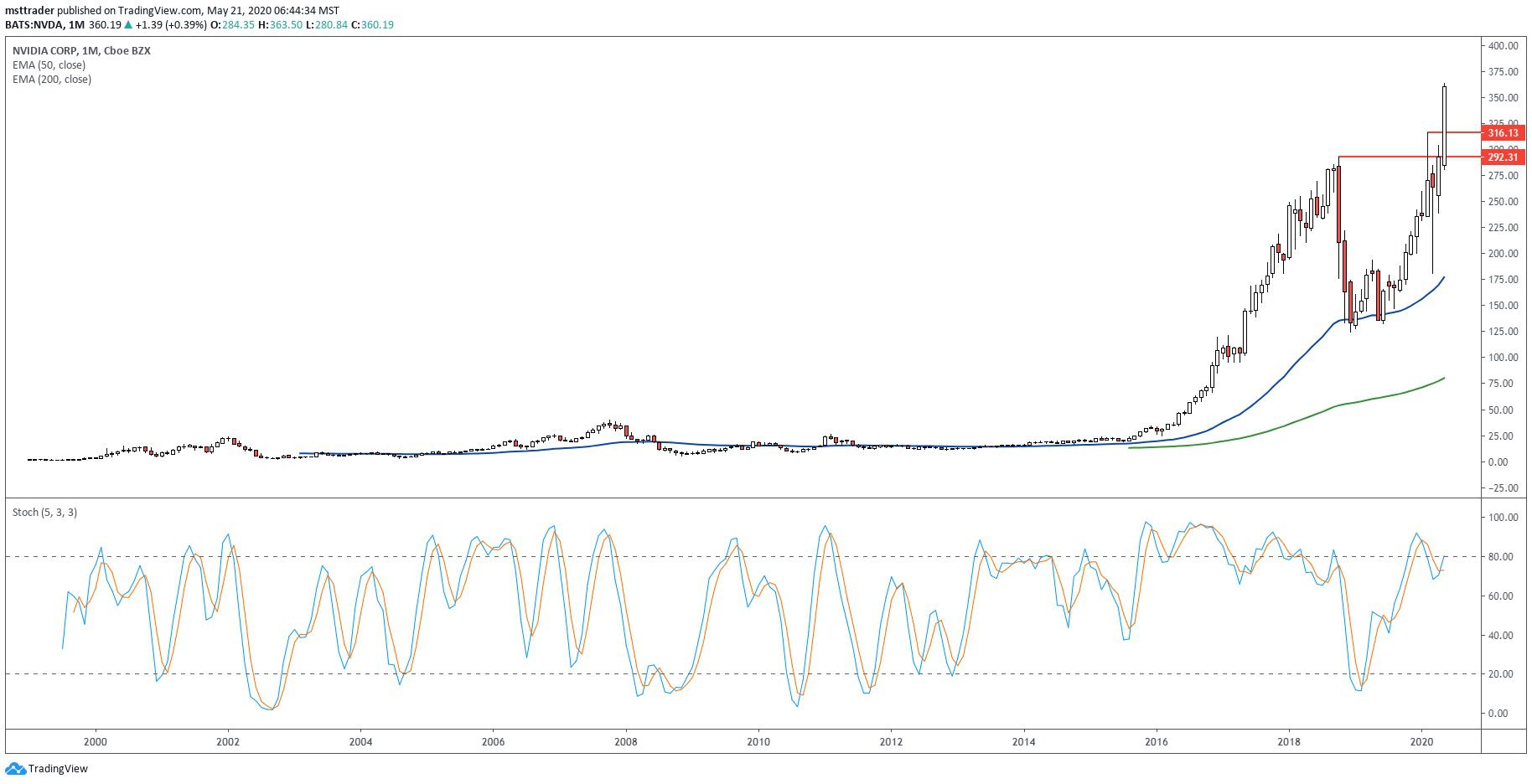

NVDA Long-Term Chart (1999 – 2020)

TradingView.com

In January 1999, the initial public offering (IPO) has opened at a split-adjusted $1.83 and relaxed in a trading range between $2.19 and a low of $1.43. In November, a breakout generated healthy interest from buyers before stalling in the mid teens in June 2020, before a steep correction which has declined more than 65% of the value of the share at the end of the year. It broke out of quality, at the end of 2001, but the rally failed, which gives a decline that found support for a three-year low.

The subsequent rebound failed, given the success of 2004 retest and double bottom, which marked a new upward trend. The stock has broke above 2002 of resistance in 2007 and recorded a new high at $ 39.67 a few months later, marking a vertex that has not been put to the test for the next nine years. It held up relatively well during the economic collapse of 2008, but buying interest faded in the new decade, leaving the place to the narrow range bound action during the roaring bull market.

Bitcoin mania woken up in the stock from the death in the second half of 2015, triggering a dynamic fueled by advance that the lifting of NVIDIA in the leadership on the market in 2016 and 2017. The upward trend has finally ended at $293 in October 2008, paving the way for a sharp decline, which shook several shareholders before finding support in the $120s in December. The subsequent rebound completed a return trip in 2018 high in February 2020, leading to a rebound that has failed during coronavirus deaths were reported in the Seattle metro area.

NVDA Short-Term Chart (2018 – 2020)

TradingView.com

The balance volume (OBV), the accumulation-distribution indicator returned to February 2018 resistance when the rally stalled in October and reversed in a distribution phase, which has hit 52 week low, a month later. It tested this level in May 2019 and turned over, entering into a sustained period of buying pressure, which reached new highs in October, well before the price. OBV peaked with prices in February 2020 and is now back at this level, but for the moment, at least, the indicator has failed to confirm the breakout.

In turn, that raises the stakes in the topic Thursday after a report on the market due to a OBV reversal after the news may indicate a failure of the escape or decline that reached the 50-day exponential moving average (EMA) is now rising by way of$ 290. On the other side of the coin, a Friday rally gap that holds prices through at least one session should also raise the flag above resistance, confirming the escape, while supporting the continuation of the increase to $400.

The Bottom Line

NVIDIA has exploded to an all-time high ahead of this week’s first quarter earnings report, but the volume has not yet confirmed the escape.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com