Key Takeaways

- Analysts estimate adjusted EPS of $1.69 for Q1 2021 versus $0.88 in Q1 2020.

- The gross margins are likely to increase year-on-year.

- The company should continue its successful deployment of new GPU and software products.

What to Look for

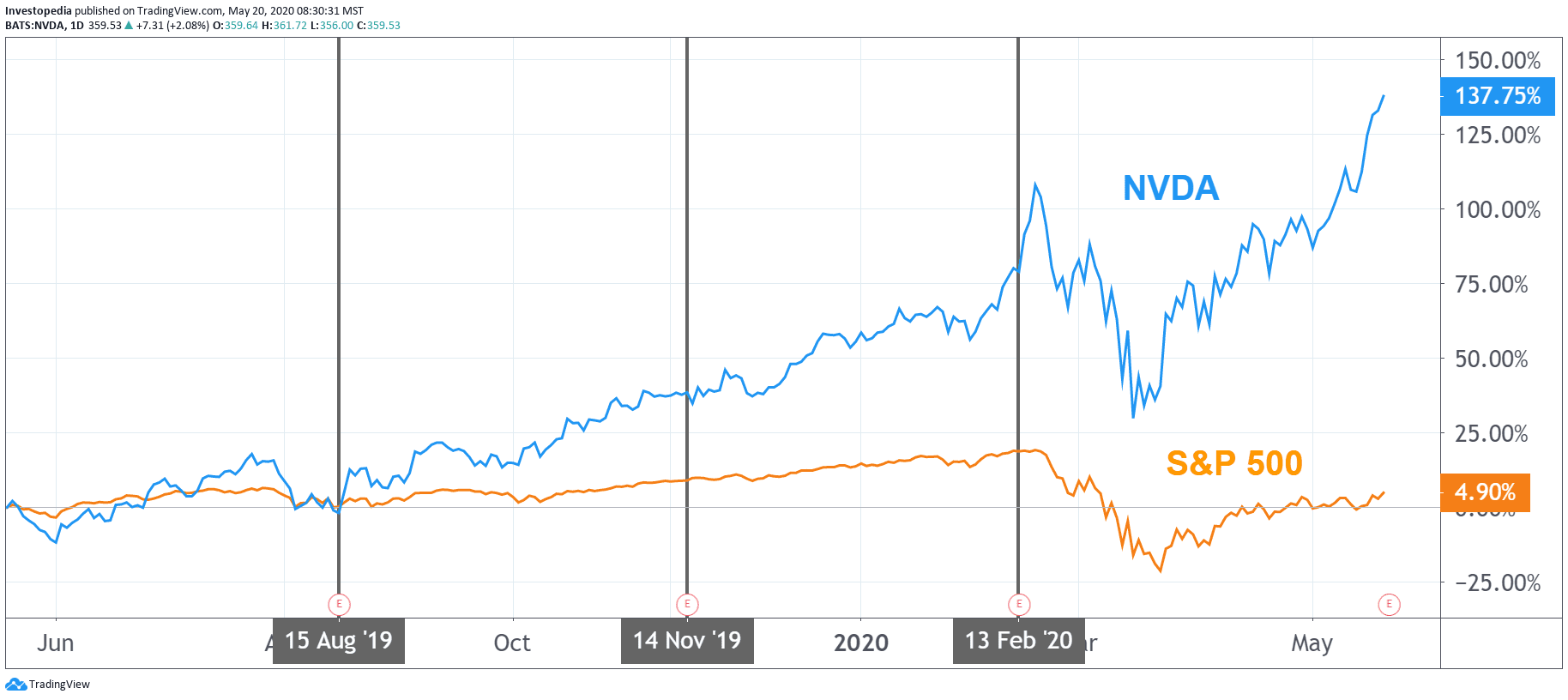

Chipmaker Nvidia Corporation (NVDA) has long been a well-known brand on the market for graphics processing units (Gpu). Historically, Gpus have been widely used by customers who want to run graphically intensive video games. In recent years, however, the market for Gpus has been expanded to include a wide range of applications, including cryptocurrency mining, professional design, and artificial intelligence (AI). In the last 12 months, the company has significantly outperformed the S&P 500, up more than 130%.

Source: TradingView.

Nvidia’s revenues have also increased significantly, as it has developed new products to meet these markets. In addition to its gamer-oriented GeForce Gpu, Nvidia Quadro are focused on professional designers, while its Tesla Gpu—no relationship with the automaker—are oriented to the needs of advanced AI researchers. Between 31 January 2017 and 31 January 2020–Nvidia end of the fiscal year in January– Nvidia has reported revenue increased to $6,910,000 in $10,918,000, an increase of nearly 60%. Its market capitalisation has also increased significantly during this period, from an average of nearly $ 90 billion in 2017, at a little over 215 billion as of May 18, 2020.

Nvidia has said that its Q4 FY2020 results on February 13, 2020. In this report, Nvidia has published adjusted earnings per share (EPS) of $1.89, exceeding its Q4 FY2019 adjusted EPS of$ 0.80. Nvidia’s share price has increased approximately 20% between 13 February 2020 and on May 18, 2020.

May 21, 2020, NVIDIA will report its results for the first quarter of 2021 fiscal year. Going into the earnings report, analysts have a consensus for adjusted EPS of $1.69 per share, which represents an increase yoy of over 90%. Of particular importance to many investors of the company’s gross margin, which were 59.01% in 1q FY2020. Looking forward to the next week of the presentation of the results, analysts expect to see substantial year-over-year margin improvements, with a consensus estimate of 65.36%.

Nvidia Key Measures

Estimate for Fiscal Q1 2021

During Q1 2020

During The Q1 2019

The Adjusted Earnings Per Share

$1.69

$0.88

$2.05

Turnover (in billions of dollars)

$3.0

$2.2

$3.2

The Gross Margin

65.4%

59.0%

64.7%

Source: Visible Alpha

The gross margins are especially important for NVIDIA because of the highly competitive nature and the cyclical nature of the industry. In order to maintain stable profitability, NVIDIA needs to keep as much money as possible from every dollar of revenue that it produces. At the same time, Nvidia and other chip manufacturers must continuously maintain and improve their operational efficiency in order to remain competitive with their peers.

Given that the gross margin is commonly used as an indicator of the overall efficiency of a company, investors should watch closely on this critical figure.

Source: investopedia.com