Nikola Inc. (NKLA) shares rose more than 10% during Monday’s session after Deutsche Bank issued a short term buy recommendation ahead of the results, and the Executive Chairman Trevor Milton partial update on the company’s balance sheet.

Deutsche Bank analyst Emmanuel Rosner added the electric vehicle maker for the company in the short term “Catalyst Appeal of shopping List” ahead of its second quarter earnings report, due out tomorrow. Without the focus on short-term profit, Rosner believes that the company could use the result of a much anticipated business update on its BEV truck customers, Badgers partner of production and reserves, and commercial partner for its hydrogen stations.

Before the short-term buy recommendation, Rosner has an outlet rating and $54 price target on the stock. It’s called the stock one of the few pure-play ” zero-emission commercial trucks, but has warned that the actions of the valuation (July 16) bear witness to more of the mid-term opportunity to minimize the risks.

Executive chairman Trevor Milton has also tweeted that Nikola has $881 million in cash on his account with a sum of 60 million dollars of more to come in the form of warrants. In addition to these developments, Lordstown Motors, Inc. (RIDE) has announced it will go public at $ 1.6 billion in value through a special purpose acquisition company (SPAC) transaction. The company’s Endurance collection has already received 27,000 orders, primarily from commercial fleet operators.

TrendSpider

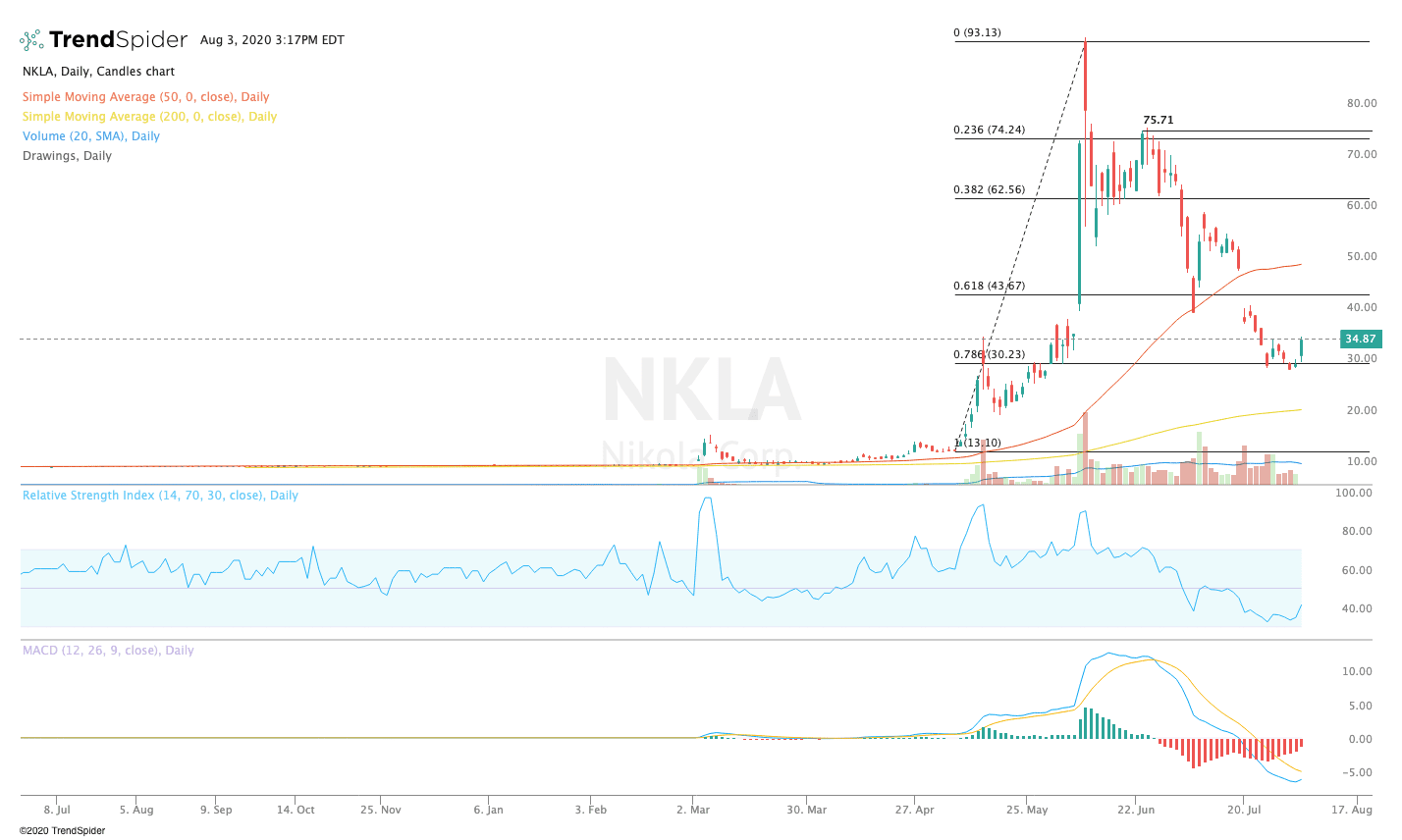

From a technical point of view, Nikola stock market has rebounded from the reaction lows of almost $30.00, suggesting that its downward trend may be reversing. The relative strength index (RSI) has been moved out of its lowest-yet-somewhat-oversold levels 41.77, while the moving average convergence divergence (MACD) could see short-term bullish crossover. These indicators suggest that the stock could see a bottom if the income prove to be a positive catalyst.

Traders should expect to see a move higher to the 61.8% retracement of $43.67, or the 50-day moving average of $49.57 in the coming sessions. If the stock moves lower, traders could see a move to retest the 78.6% retracement at $30.23, or an extension of rupture towards the 200-day moving average at $21.17, although this seems less likely to occur given the bullish momentum to move in the result of the call.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com