Netflix, Inc. (NFLX) shares fell more than 3% during the session on Thursday, after the streaming giant announced that it would begin the closure of inactive accounts. The management said that these inactive accounts represent less than half of 1% of all of its members amounting to a few hundreds of thousands, and the movement was already factored into its financial guidance.

At the same time, the analyst of Wedbush Dan Ives has warned that antitrust a momentum is created between the regulatory bodies. Ives remains bullish on the FAANG companies, saying that the major crises could prove to be difficult for the regulatory agencies, but has warned that the acquisition could be a slippery slope that regulators may be more apt to examine the transactions of M&A.

Netflix and a lot of other stay-at-home theater underperformed during the market rally earlier this week. Federal Reserve chairman Powell stated that the central bank was prepared to intervene to support the economy, then the vaccine hope raised optimism that the world would eventually be able to go beyond the COVID-19 epidemic.

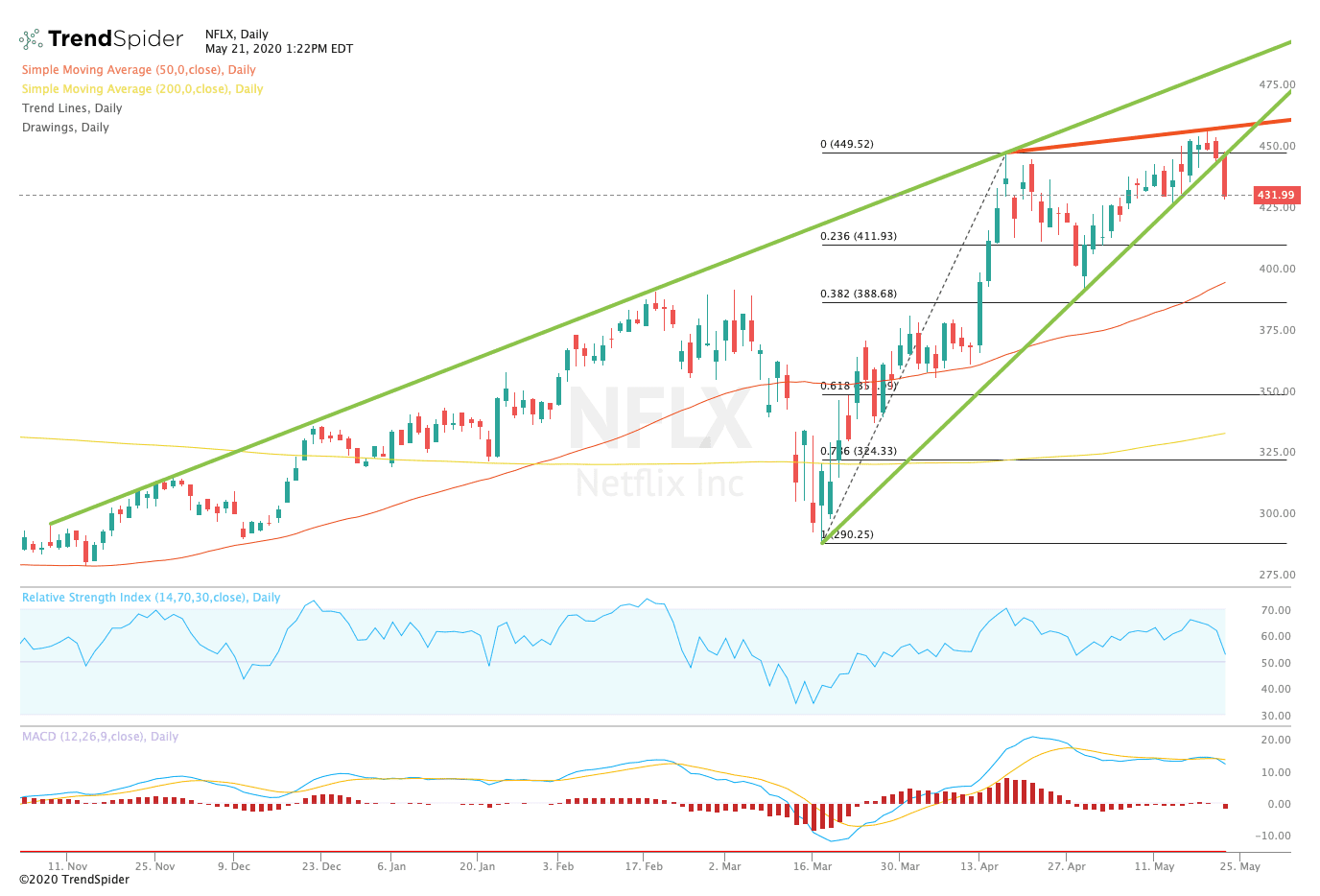

TrendSpider

From a technical point of view, Netflix stock extended its move lower to the pivot point and the 50-day moving average. The relative strength index (RSI) fell to neutral levels of 52.86, but the moving average convergence divergence (MACD) continues to trade on the side. These indicators suggest that the stock may continue to decline in the coming sessions.

Traders should watch for a move lower to the pivot point and the 50-day moving average near $400.00 in the coming sessions. If the stock rebounds more, traders should look for a breakthrough of the front highs and the R1 resistance is at $460.41 during the next session. Despite the short-term move lower, the stock remains on the rise since hitting lows in mid-March.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com