Goldman Sachs has raised its price target on Netflix, Inc. (NFLX) to a “high Street” $670 Friday, waiting for the streaming entertainment giant’s second quarter profits and incomes to equal or exceed the first quarter of outstanding results. Wall Street consensus on the Netflix stock has moved steadily in the “Moderate Buy” column until now and 2020, with 22 “Buy” and 9 “Hold” ratings stressing more optimistic outlook. However, four analysts are still recommending that shareholders sell their positions.

Netflix is having a great year, with shares lifting 59% of all time at over $500. This outstanding performance has caught many analysts by surprise, because The Walt Disney Company (DIS) Disney+ service, released in November, was supposed to foster a highly competitive environment in which customers are forced to choose the subscriptions within a limited budget. The pandemic has thrown that theory out the window, forcing tens of millions of dollars in extended-stays at home, which served as the basis for all kinds of digital entertainment.

In addition, in the world of cinema, tv and theatre production has slowed to a crawl, with the outbreak of the epidemic to force Hollywood, Vancouver, Bollywood and other production centers to shut down or take the extra cost of isolate actors and the team for months at a time. The cinema theatres have also been massive headwinds in their efforts to reopen, even with limited means, forcing the entertainment-seeking public to seek alternatives.

Netflix also has a vast library of content that the virus of las subscribers of the tap for months or years, if necessary. In addition, the company produces content in the world, allowing them to grow jobs in the regions of the world are less affected by the pandemic. Many of these “foreigners”, the productions have better scripts and production values of the endless series of youth-oriented comedies and dramas, allowing the company to keep subscribers glued to their screens.

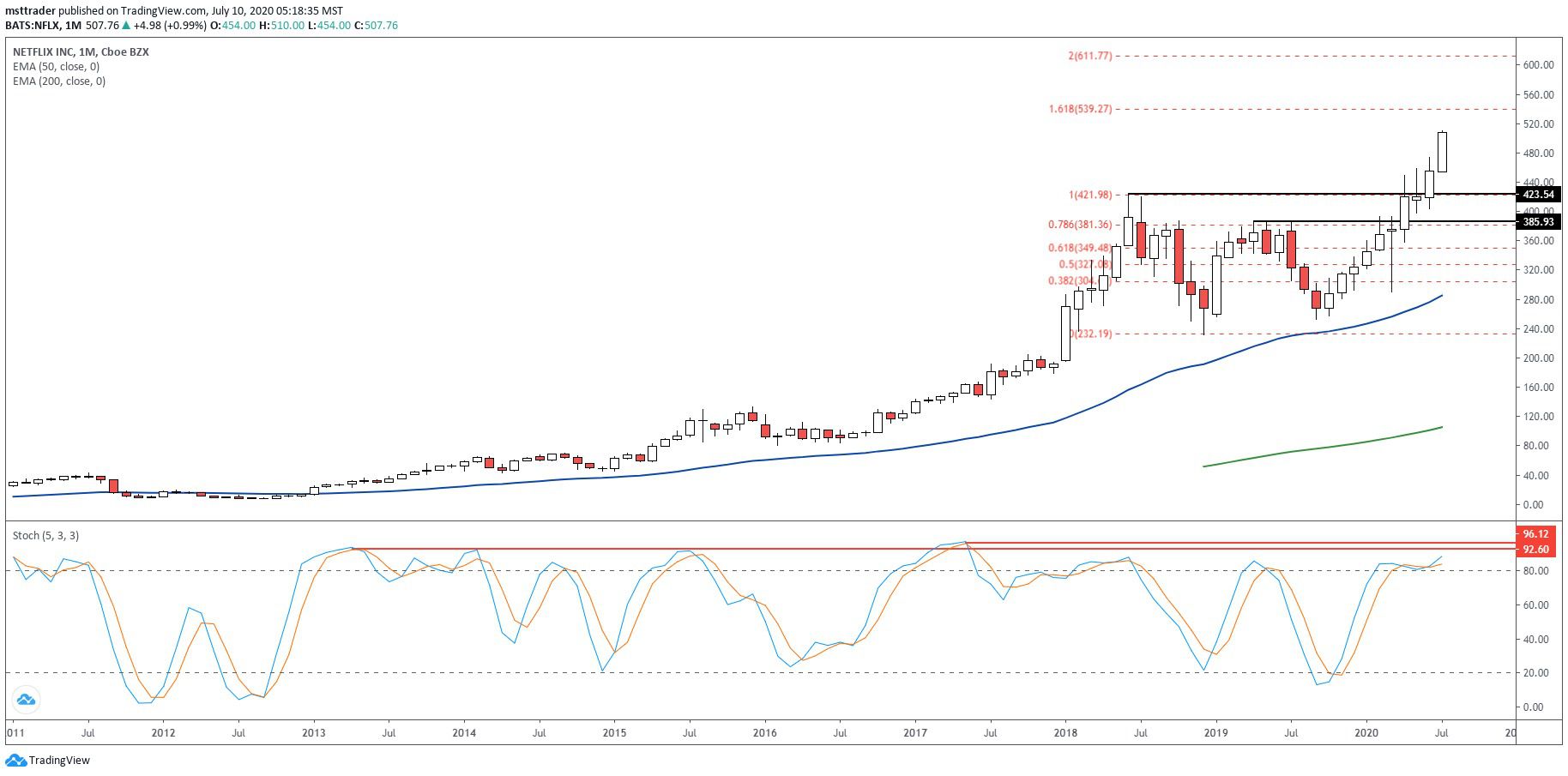

Netflix Long-Term Chart (2002 – 2020)

TradingView.com

The birth of the electronic control rental of public service came in 2002, posting an all-time low, at a split-adjusted 71 cents in October. The subsequent uptrend above $5.00 in 2004, marking a high that was not challenged until in 2008, an evasion that failed after the addition of only 16 cents. The stock held up well during the collapse of the economy, dropping to 52 week low, and has broken out above the resistance in the first quarter of 2009.

Quickly, the increased speed of the internet favored a strong upward trend in the head to the mid-$40 in 2011. It took two years to complete a round trip in this level, in front of a breakout that eventually lifted from Netflix in high-tech leadership. However, the volatility of the descendants interrupted positive price action several times in June 2018, when the powerful uptrend ended just above $400. The stock has lost almost 200 points in the next six months, finding support, in December, near$220.

Higher lows in September 2019 and March 2020 April 2020 the purchase of pulse in 2018 resistance. Netflix stock broke out immediately, but failed to make much progress until June, when the price has flied up to a sustained rise that has mounted the $500 level. Curiously, the accumulation of readings have been lagging behind the price action since mid-2019, but that has not stopped the stock from the holding of the firm is at a record high.

Two technical factors bode well for even higher prices in the next few weeks. First of all, the monthly stochastic oscillator crossed a long-term buy cycle in February and has held this level without having to lift it in the extreme readings (red lines) that have generated bearish crosses in the previous years. Secondly, the escape has not yet reached the resistance at the 1.618 or 2,000 Fibonacci extension levels. It is not surprising, Goldman’s high Street appeal is located just above the 2.000 extension, marking a logical target that Netflix could overtake him in the third or the fourth quarter.

The Bottom Line

Netflix stock has booked impressive 2020 returns as a result of the pandemic, and shows little sign of the filling or roll over.

Disclosure: The author held no position in the aforementioned securities at the time of publication.

Source: investopedia.com