Dow component Microsoft Corporation (MSFT) is the continuation of TikTok in UNITED states, Australia and New Zealand operations in a deal that must be completed by Sept. 15. The hook-up is not a sure thing, with the Chinese of the opposition and other potential suitors considering bids. The best decision for Mr. Softee could be to walk away from a purchase that co-founder Bill Gates has recently referred to as a “poisoned gift” on par with 2016 unfortunate LinkedIn acquisition.

Key Takeaways

- Microsoft co-founder Bill Gates has called the potential acquisition of a “poisoned gift”.”

- The tech giant’s shares should continue to reward long-term investment, even if an agreement fails.

- There are already signs that the shareholders are in the closed positions.

Microsoft wants a larger footprint in the social media space, but the company is already firing on all cylinders, displaying an impressive growth during a pandemic across the world. And the shareholders are not complaining, with stock booking to an impressive 32 per cent so far this year and has reached an all-time high as recently as last week. The company has also avoided the political controversy, unlike Facebook, Inc. (FB) and Twitter, Inc. (TWTR), with the conservatives threaten to take legal measures to bias.

The best buying opportunity for sidelined investors to this point, may occur following a sell-the-news reaction if Microsoft walks away from negotiations, for any reason whatsoever. Short-term speculative capital, the success of the firm if this occurs, but the action Microsoft has been a perfect investment vehicle in the last four years and probably reached new heights as the company has not put a noose around his neck with a dubious acquisition.

Speculation refers to the act of conducting a financial transaction that has a risk of losing the value, but also holds the hope of a significant gain or other large value. With speculation, the risk of loss is more than compensated by the possibility of a substantial gain or other reward.

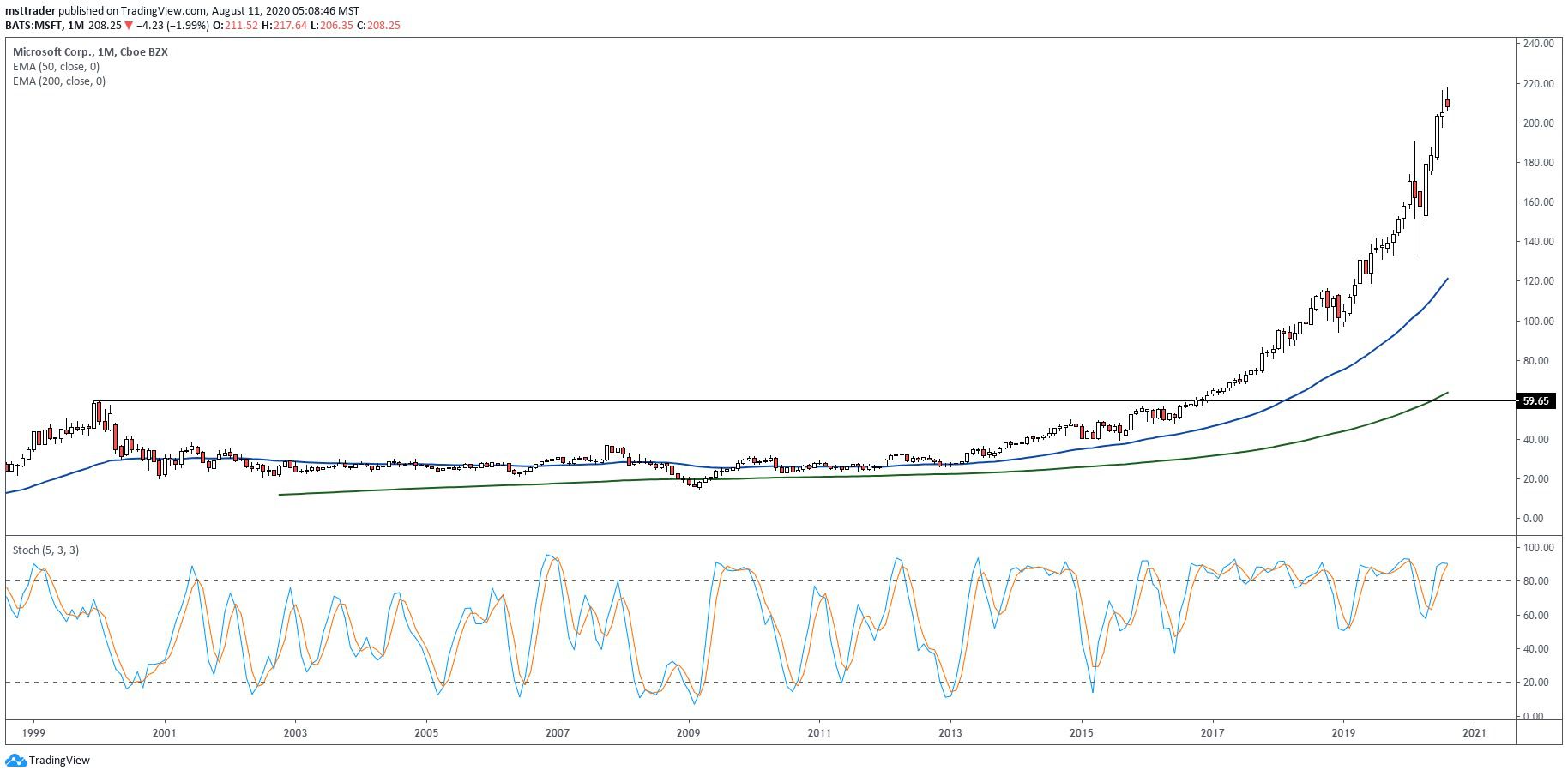

Microsoft’s Long-Term Chart (1999 – 2020)

TradingView.com

A multi-year uptrend is ended at a split-adjusted $59.97 in December 1999, which represents the highest value for the next 16 years, and entered a sharp drop which found support of the upper part of adolescence. Microsoft stock behaved badly through most of the mid-decade bull market finally breaking above the resistance in the low $30 in 2007. The rally failed in the first quarter of 2008, leaving the place in a aggressive selling, which eventually led to a 10-year low in 2009. The subsequent rebound has taken four years to complete a 100% retracement to the high of 2007.

The stock made steady progress in 2016, to finally snap to, only three points below the 1999 peak. It broke out after the presidential election and softened in a channeled slightly higher, supported by broad retail and institutional sponsorship. 2018 fall bought aggressively at the beginning of 2019, adding points in February 2020 high at $190.70. It was then sold to the world market, dropping 59 points in a seven-month low.

Microsoft In The Short-Term Chart (2018 – 2020)

TradingView.com

The rebound in the second quarter followed the angle of the state of the drop, a sculpture in the form of V model of recovery which reaches to within a few points of the first quarter of the top in May. It completed a cup and handle breakout around six weeks later, the resumption of a bull market, the advance which has posted a record high of $217.64 in August. 3. However, the rally of the momentum has now declined, which gives a rectangular consolidation with support at the 50-day exponential moving average (EMA) at$198.

The balance volume (OBV), the accumulation-distribution indicator posted above, on July 10 and drove in a distribution wave that is still ongoing, despite recent speculative interest. In turn, this divergence suggests that the shareholders have to make profits, potentially setting the stage for lower prices. Sidelined investors looking to get on the board of directors could use the downturn to their advantage, with the possibility of a decline in the $180s if the negotiations fail.

A cup handle and the price movements on the price of a chart title is a technical indicator that looks like a cup with a handle, where the cup is in the shape of a “u” and the handle has a slight downward drift. The cup and handle is considered to be a bullish signal, with the right side of the model generally experience a lower volume of transactions.

The Bottom Line

Microsoft stock is to be sold under the surface despite TikTok negotiations, indicating that shareholders have mixed feelings about a possible transaction.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com