Micron Technology, Inc. (MU) reports earnings next week, with analysts expecting an earnings per share (EPS) of $1.05 in the third quarter of fiscal 2020 sales of $5.05 billion. The stock ran up after beating top and bottom line second quarter estimates in March and added four points between then and now, stuck around the mid-point of the first quarter of decline. Similarly, pre-earnings speculation is building, with the company having the potential to beat the current consensus estimates ranging from $0.40 to $0.70 in EPS and $ 4.6 billion to $5.2 billion dollars in sales.

The PHLX semiconductor Index (SOX) has carved a dramatic recovery off the March low, making a return in the first quarter of the top at the beginning of June. A breakout in the next session posted an all-time high at 2,030.47 before turning tail in a rally failure reinforces the range resistance around the psychological 2,000 level. Micron is well positioned to benefit from industry tailwinds, but a growing concern about the DRAM, the prices have kept a lid on gains until this quarter.

Wall Street was mixed to about a Micron perspectives in the last three months, with upgrades to BoA/Merrill, Cascend Research, and the Cleveland Research, counter-balanced by raids of Needham, Goldman Sachs, Wedbush, BMO Markets, and the Cleveland Research, which has switched in the middle of the quarter. UNITED states government restrictions on Huawei have also weighed on the Micron stock, with the potential loss of revenue. Micron has offered a few updates on the progress quarterly, adding to the uncertainty of the heading in the report.

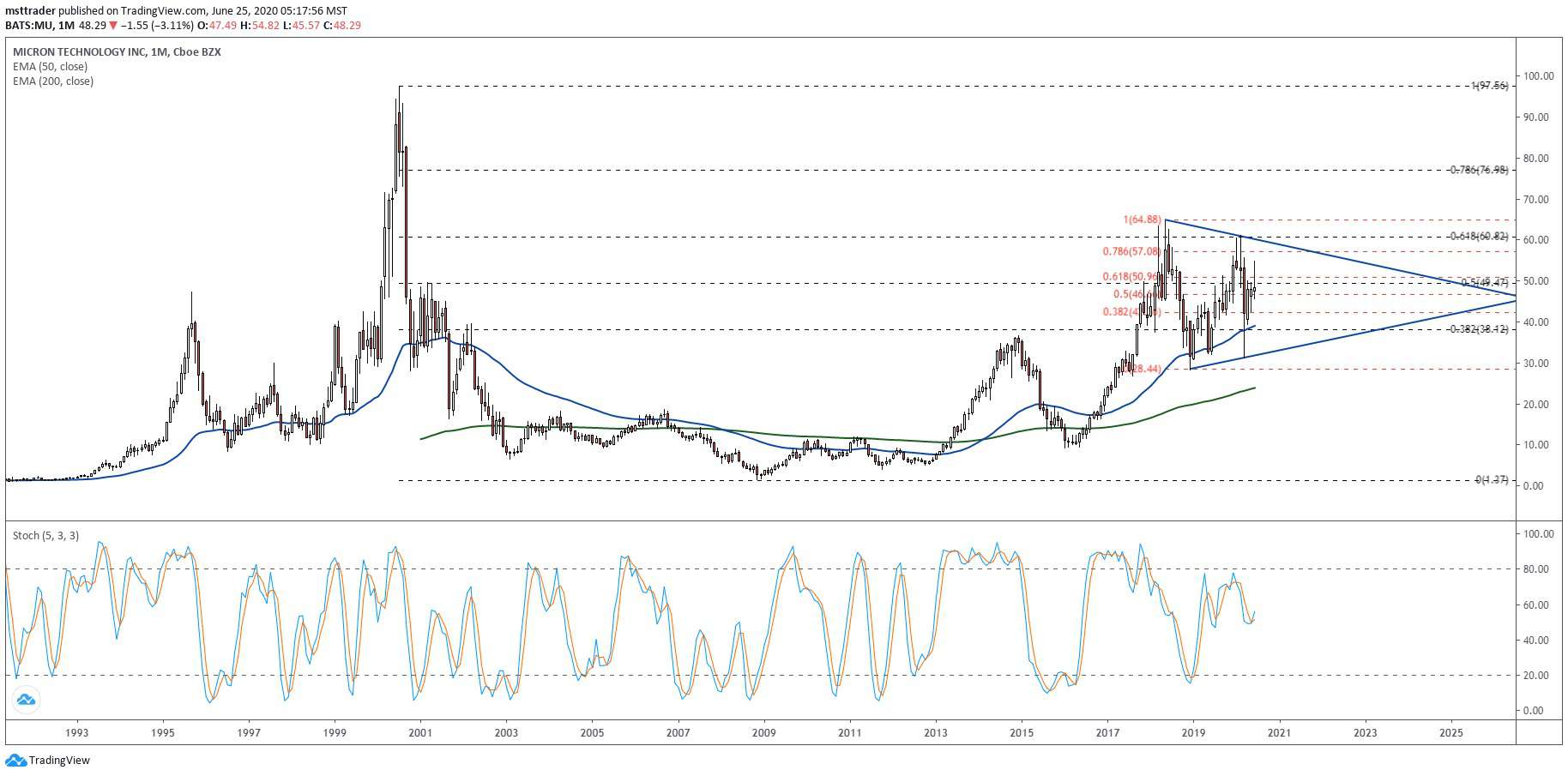

Micron’s Long-Term Chart (1992 – 2020)

TradingView.com

A multi-year low has led to a new trend in 1992, generating an impressive dynamic fueled by advance, which featured two splits in 1995 high at $47.38. In 2000, escape, doubled the value of the action in less than six months, a cap at$ 97.50, a high that has not been challenged in the last 20 years. The downturn has given all the gains made in the final advance before finding support at the bottom of nine years in the single digits in the first quarter of 2003.

A slow movement of the bounce by the middle of the decade, made little progress, stalling in the upper part of adolescence, before renewed selling pressure that has hurt the’2003 low during the economic collapse of 2008. Selling pressure eased to $1.59 at the end of the year, marking the end of the eight-year downtrend, in front of a two-legged bounce that ended in the lower part of the adolescence in 2010. It took three years to build the barrier in a purchase of surge that ended in the mid-$30’s in 2014.

In October 2017 breakout reached $64.55 in the second quarter of 2018, marking the highest in the past two years, before a fast descent that reached the upper $20 at the end of the year. The stock has traded within these ranges limits in the last 18 months and is currently located in the middle of 2000 to 2008 and 2018, the negotiation of the beaches. This signals a neutral perspective, neither the bulls nor bears control long or short-term price action.

Micron Short-Term Outlook

The monthly stochastic oscillator has slowed down, going to buy a bike, a side ground in June 2019, corresponding to the neutrality of the price action. This period of detention is not going to last forever, but it looks like a bilateral scenario in which one side of the market will eventually be trapped in a dynamic tendency to move higher or lower. Given that the company is cyclical reputation, the short side looks like a better bet at this time, given the rapid deceleration of the global economy.

The sideways pattern also contains some elements of a symmetrical triangle in its early stages, can be delay of an escape or failure, for two or three more years. In turn, and make all of the current positions little more than “dead money” because there are a lot of better buy and sell opportunities at this time. This is particularly true in light of Micron’s monthly chart, which has rarely rewarded in the long-term trend followers.

The Bottom Line

Micron stock went into a holding that could not move after next week’s earnings report.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com