Key Takeaways

- Analysts estimate adjusted EPS of $0.72 vs. $1.05 in Q3 of FISCAL year 2019.

- The gross margin is expected in the fall.

- Revenue is expected to rise as COVID-19 sparks demand for memory chips are in the middle of the expansion of distance work.

Micron Technology Inc. (MU), one of the leading manufacturers of DRAM and NAND memory chips, is getting a boost from an unexpected effect of the COVID-19 pandemic: the increase of the working distance of the economy. Social-distancing measures that have forced millions of employees to work at home, have helped to sustain demand for Micron memory chips despite bans on large swaths of the global economy. This demand has eased a massive industry oversupply of memory chips, which is hammered price.

Investors will be watching to see if the positive effects of the pandemic can outweigh the negatives when Micron reports earnings on June 29, 2020 for the Q3 of FISCAL 2020. Analysts currently expect adjusted earnings per share (EPS) for diving despite the healthy revenue growth.

One key metric investors will focus on is the gross margin, an indicator of the effectiveness of operating at Micron and other memory chip manufacturers. Analysts currently expect the company’s gross margin to fall year-on-year (yoy), though it will be an improvement over the state of the three-quarters.

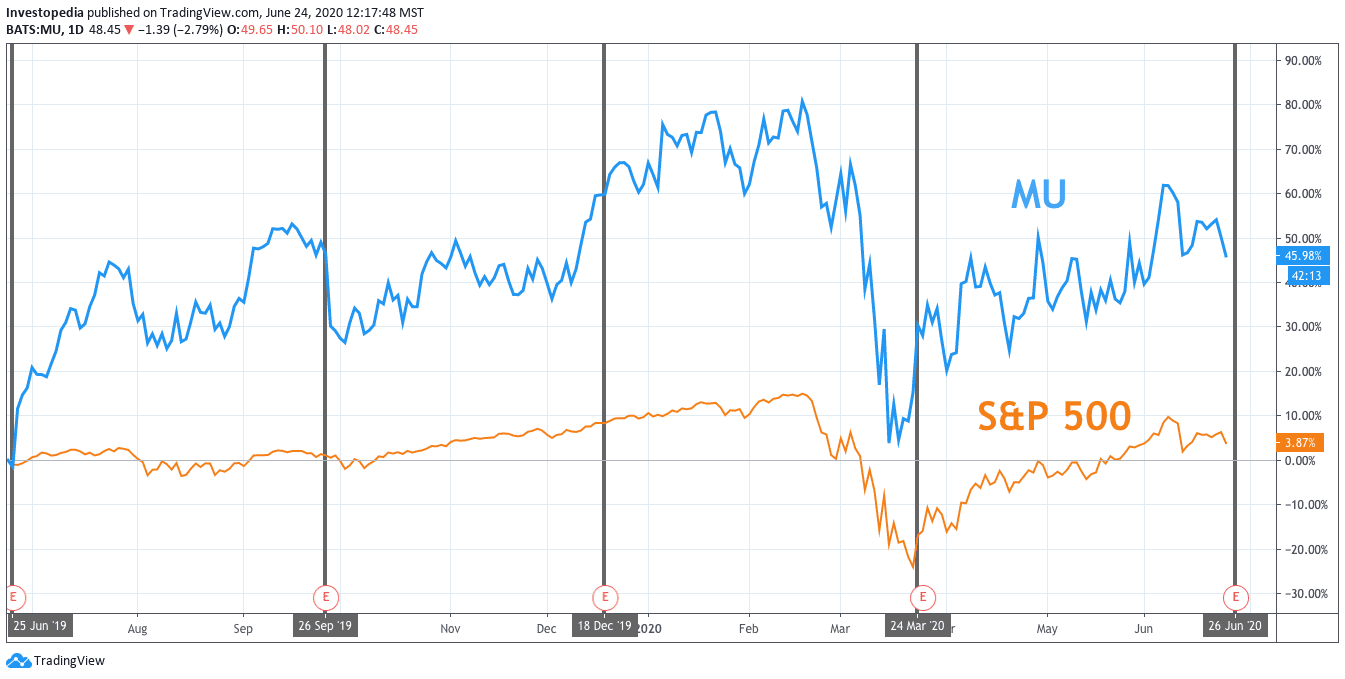

Micron stock has significantly outpaced the overall market over the last year. In spite of crashing, this spring, in the first months of the sars coronavirus pandemic, the company’s shares have provided investors with a total return of 46.0% compared to the S&P 500 index total return of 3.9% over the last 12 months.

Source: TradingView.

Micron has struggled with declining income and revenue over the past five quarters, mainly due to the industry of the glut of memory chips. However, the chipmaker only managed to beat analysts ‘ expectations of 21.6% when it reported earnings for the 2nd quarter of FISCAL 2020, ending February 27, 2020. The corporation’s 2019 fiscal year ended August 29, 2019.

Micron posted declines of adjusted EPS and revenues of 73.5% and 17.8%, respectively, for the second quarter. It marked the fifth consecutive quarter of decline for both metrics. The company noted that the average selling prices of DRAM and NAND memory chips in 2019 had fallen to 30% and 47%, respectively, compared to the 2018 prices.

In the future, the Micron management, said at the end of March, short-term, one would expect a strengthening demand for data centres due to the distance work, and increases in gaming and e-commerce activity. Analysts expect revenues to increase from 8.6% for the Q3 of FISCAL year 2020, marking the first increase in 6 quarters, from the 1st quarter of FISCAL year 2019. However, adjusted EPS is expected in the fall of 31.8%, continuing the series of EPS decreases.

Micron performance should be much worse for the entire 2020 fiscal year ending at the end of August. These results include two quarters extending from March to August, when the consequences of the pandemic should be strong. The analysts believe that the adjusted earnings per share to slide from 62.2% to 12.3% drop in turnover compared to the YEAR 2019. Micron is estimated to be $ 20.5 billion of turnover for the YEAR 2020 would be about $ 10 billion less than two years earlier, in the course of the YEAR 2018.

Micron Key Measures

Estimate of Q3 2020 (AF)

Q3 2019 (AF)

Q3 2018 (AF)

The Adjusted Earnings Per Share

$0.72

$1.05

$3.15

Turnover (in billions of dollars)

$5.2

$4.8

$7.8

The Gross Margin

32.3%

38.2%

60.6%

Source: VisibleAlpha

The decline in memory chip prices has also weighed on the Micron of the gross margin, also called gross profit margin of the industry. This key metric that reflects the gross margin is sales less cost of goods sold, as a percentage of total sales. A company can increase its gross margin, either by increasing sales or reducing costs, or a combination of the two. The memory chips are primarily goods, with little quality differentiation between components manufactured by different companies. This means that manufacturers have little pricing power, so that the main way to increase the margins by reducing costs, particularly in periods of weak sales.

Micron’s gross margin has fallen dramatically by more than half from its recent peak of 61% in the 4th quarter of FISCAL year 2018 to 26.6% in Q1 of FISCAL 2020. However, this key metric rose to 28.3% in Q2 of FISCAL year 2020, marking the first increase after five sequential quarters of decline. Analysts expect Micron’s gross margin to continue to improve, rising from 32.3% for the Q3 of FISCAL 2020. But there still will be a decline of almost six percentage points compared to the same quarter a year earlier. Continuous improvement will depend on the strength of the global economy, it recovers from the impact of the pandemic, and if the pandemic induced by the spike in demand for memory chips that can be sustained in the long term.

Source: investopedia.com