Dow component Mcdonald’s Corporation (MCD) has suspended the reopening of the dining room in the services in the united States for at least 21 days because of the push at the national level in COVID-19 case, supported by an out-of-control epidemic in the south and South-western states. War-weary investors are taking the news in stride, with the stock running up in advance of the July 4 holiday, but already the weakness of the technique of positioning can take its toll ahead of the July 28 earnings report.

The fast-food giant is unlikely to conduct reopenings after three weeks of pause, given the current trajectory of the infections, the addition of a new charge for the third quarter of profits and income. More importantly, the decision could induce other channels to follow, even in places that have re-opened successfully. Taken together with the new term of city and county-level closures, it could trigger a new surge of unemployment in the hospitality industry, the cancellation of the second quarter of progress.

Mcdonald’s is facing an additional burden, because he rents the properties to 85% of franchises, put them on the hook for direct monthly payments. He had to provide programmes of support to keep the weakest, the franchise from bankruptcy during the stop, further eroding profitability. And while many restaurants are now running successful pick-up and delivery operations, almost all of them have reported loss of income, without the benefit of dining services.

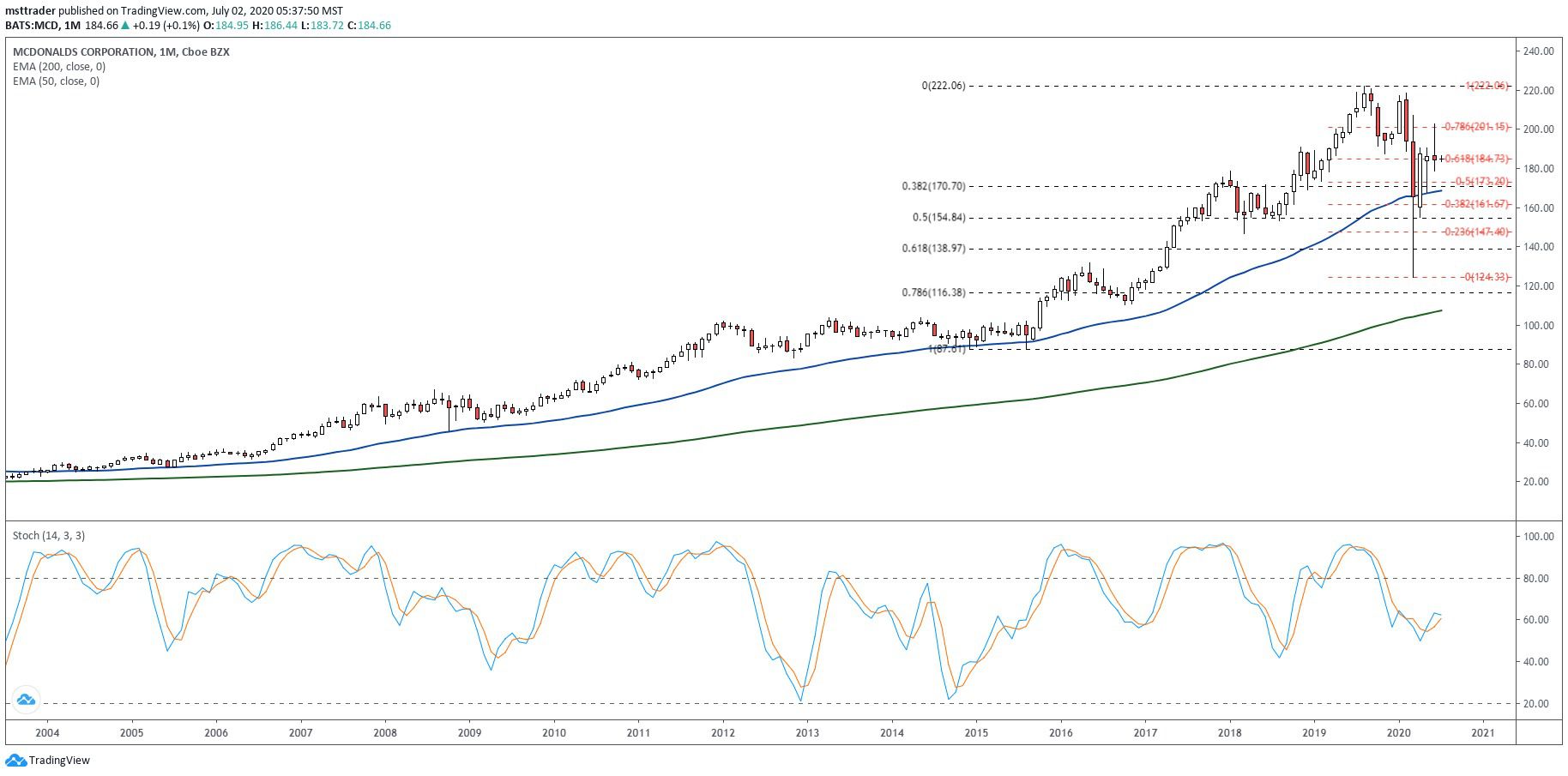

MCD Long Term Chart (2007 – 2020)

TradingView.com

The stock completed a return trip in 1999 raised to $49.56 in the second quarter of 2007 and erupted, stalling up to $60 in August 2008. It held up well during the economic collapse, the holding of a new holder after a 22-point slide. Positive price action has reached the previous peak in 2010, a strong upward trend which have shown impressive gains in front of the trim just above $100 for the first quarter of 2012.

Failed escape attempts in 2013 and 2014 and carved a rectangular correction that was terminated in October 2015, when Mcdonald’s launched the very popular “all-day breakfast” initiative. The subsequent breakout awakened the interest of purchase, the sculpture of a well-defined Elliott five-wave advance in July 2019 all-time high of $221.93. He then drilled a double top pattern with support near$ 190, breaking with the global markets in February 2020.

The decrease recorded over a three-year low, to $124 just above the .786 Fibonacci rally retracement level and bounced back in the second quarter, stalling at the .786 sale massive retracement level from the beginning of June. Price action has now reached around the .618 retracement, slightly bearish position that has just been carried out on a monthly basis, a candlestick reversal. Look for a continuation of the holding company in this price zone, may be sustainable in the end of July income.

MCD Short-Term Chart (2018 – 2020)

TradingView.com

The balance volume (OBV), the accumulation-distribution indicator surmounted by two months after the month of August 2019 all-time high and posted a little earlier in February 2020. The subsequent distribution of the phase has dropped OBV the weakest since October 2017, highlighting an aggressive shareholder exodus that will take time to rebuild. Unfortunately, the months of March, June rebound has not contributed to the effort, with limp purchasing power, failing to break into the middle of the first quarter downdraft.

During this time, the stock has settled just above the January 2018 high, the defense of the November 2018 breakout at$ 180. It has been through the 50 and 200-day exponential moving average (EMA) on several occasions since the month of April, but has failed to be reassembled is level. The forces of gravity could take control in these circumstances, but this morning the reaction to Wednesday’s bearish news suggests that the time has not come yet.

The Bottom Line

Mcdonald’s stock is stuck like glue to the 50-and 200-day EMAs, despite a decision to stop the re-opening plans for at least three weeks.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com