Marriott International, Inc. (MAR) reported earnings per share (EPS) of $0.68 on Monday in the first quarter of 2020 release, $0.10 worse than the market expectations, but the number of excluded of 0.42 $from “impairment charges bad debt expense, and guarantee revenue” due to the sars coronavirus pandemic. Revenue beat estimates, but fell 6.6% year on year to $4.68 billion, highlighting the income of the contraction that has continued through the first half of the second quarter.

The hotel industry has been beaten and bruised over the world since the beginning of the epidemic, the intensification of travel, closures of local and international markets. Countries and states are finally making plans to reopen, but Marriott needs more than local travel to begin the long road back to prosperity. That could take more time than stay-at-home restrictions, with many people planning to avoid air travel for the rest of the year 2020 to a minimum.

Marriott stock sold nearly 3% after the pre-placing on the market and is now inside of two weeks, a seven-point trading range. It arrived torn between mid-February and mid-March, which has lost nearly 70% in just six weeks. The subsequent rebound recovered less than half of these losses at the end of the first quarter, leaving the place to wave aside the action that has failed to break above 50-day exponential moving average (EMA), the resistance in the mid – $90.

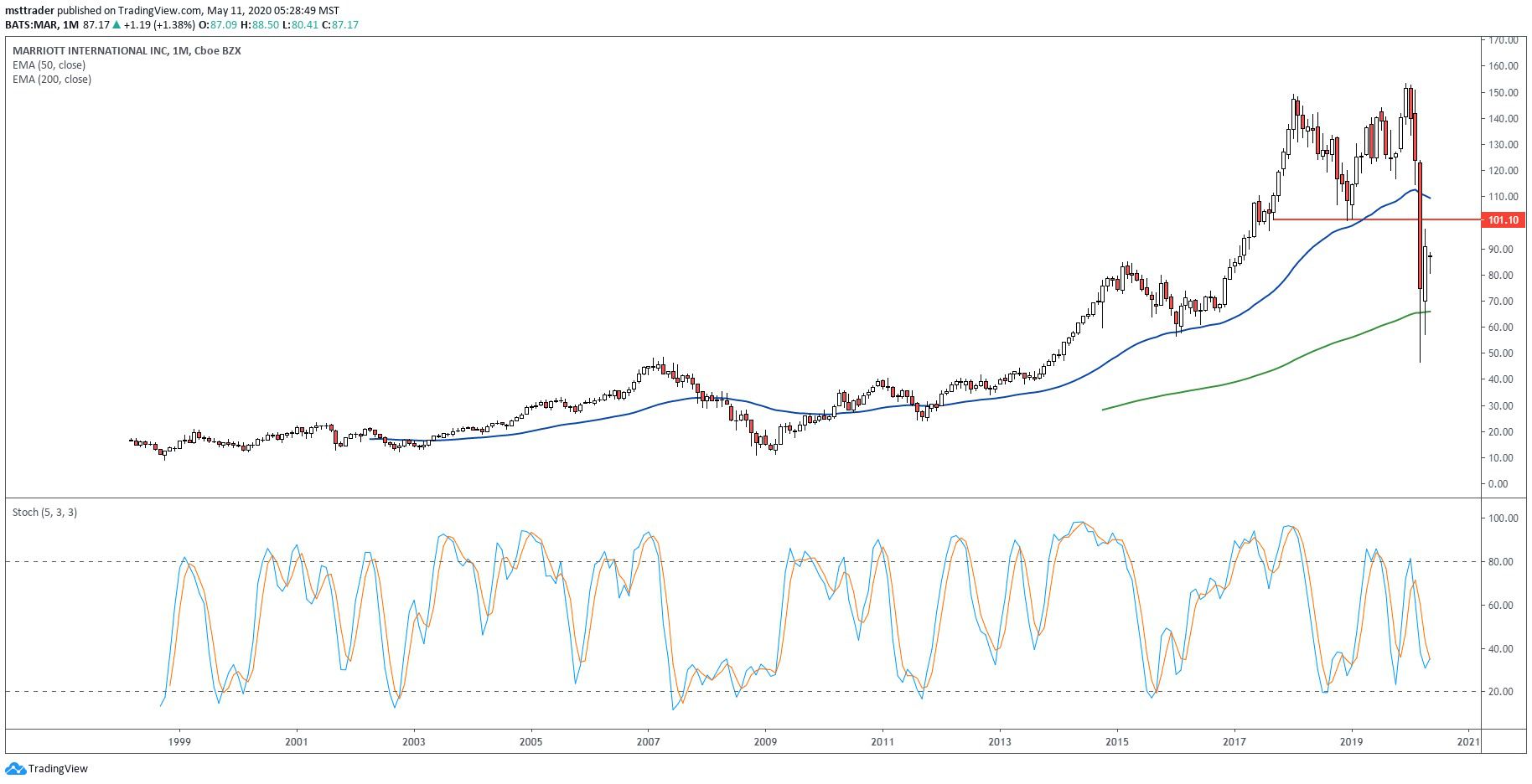

MAR Long-Term Chart (1998 – 2020)

TradingView.com

The creation of the public company, to $17.97 in March 1998 and became an immediate decrease, which has posted lower at $9.69 in October. The subsequent increase, reaching a new peak in 1999, but it has confirmed the interest of buyers not to develop, giving side of the action in the strongest rally pulse is ended at $25.25, just before the Sept. 11 attacks. Price action holding support in the low teens after the event, setting the stage for a 2003 the upward trend, which has exploded to new heights in 2004.

The stock posted impressive gains during the mid-decade bull market, lifting to $52 in 2007, in advance of an economic slowdown, which accelerated to a 10-year low in the first quarter of 2009. It took five years for the recovery that followed the wave to complete a round trip in the state of the high, which gives an immediate escape and rally that stalled in the middle of$80 in 2015. Price action cleared the barrier, after the election of 2016, triggering a final purchase of spike, which topped out near $150 in January 2018.

The evolution of prices since carved out a double top that has broken to the downside in March, setting off the major sell signals. Lower the body support to the 2016 low before reversing, while the rebound in May, stalled within three points of the new resistance to the rupture of December 2018 low just above$ 100. The monthly stochastic oscillator has gone through a cycle and sell at the same time, indicating that the bulls are running out of time to climb back on that critical level.

MAR Short-Term Chart (2017 – 2020)

TradingView.com

The balance volume (OBV), the accumulation-distribution indicator posted a new record in the fourth quarter of 2019 and entered into a distribution phase, which accelerated in the first quarter of the year 2020. OBV cut if the December 2018 low during the rout, while the purchasing power May not have managed to trace the distribution of the supports. Taken together with a strong correlation to the price action, the stock is getting closer to the confirmation of the double top breakdown, and a new secular downward trend.

The recovery was complete after seven sessions with the closely aligned 50-day EMA and the .382 Fibonacci retracement, while two April upticks failed to clear the resistance. However, the stock remained relatively close to that of the barrier, raising the odds for the final of the rally impulse bears before resuming the control of the ticker tape. This increase could mark the psychological$ 100, which is aligned with the .50 retracement. Watch OBV if this occurs, the search of the convergence or the divergence of price.

The Bottom Line

Marriott stock broke down from a two-year double top pattern in March, while the rebound in the second quarter has so far failed to rise as new resistance.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com