Takeaways

- Macy's shares took off after beating profit and sales estimates as they increased margins, cut costs and reduced inventory.

- CEO Tony Spring said that Macy's entered the key holiday season with a 'healthy inventory position.'

- The department store chain raised the lower end of its EPS and its sales forecast for the full year.

Shares of Macy's (M) jumped more than 5% Thursday after the department store chain reported better-than-expected results thanks to improved margins, cost cutting and to the reduction of stocks.

The retailer reported its third-quarter financial earnings per share (EPS) of $0.21 in 2023, while sales fell 7% from last year to 4.86 billion of dollars. Both exceeded expectations.

Macy's said that gross margin jumped 160 basis points (bps) to 40.3%, with merchandise gross margin 110 bps higher due to lower permanent price reductions for the Macy's brand and reduction in transport costs.

The company reduced its sales, general and administrative costs from $48 million to $2 billion, demonstrating “continued spending discipline.”

Macy's has reduced its inventory by 6% and CEO Tony Spring said the company “enters the holiday period with a healthy inventory position.”

The company boosted the bottom of range of its annual results and sales forecasts. It now forecasts EPS of between $2.88 and $3.13 and sales of between $22.9 and $23.2 billion. This represents an increase from its previous guidance of EPS of between $2.70 and $3.20 and sales of between $22.8 and $23.2 billion.

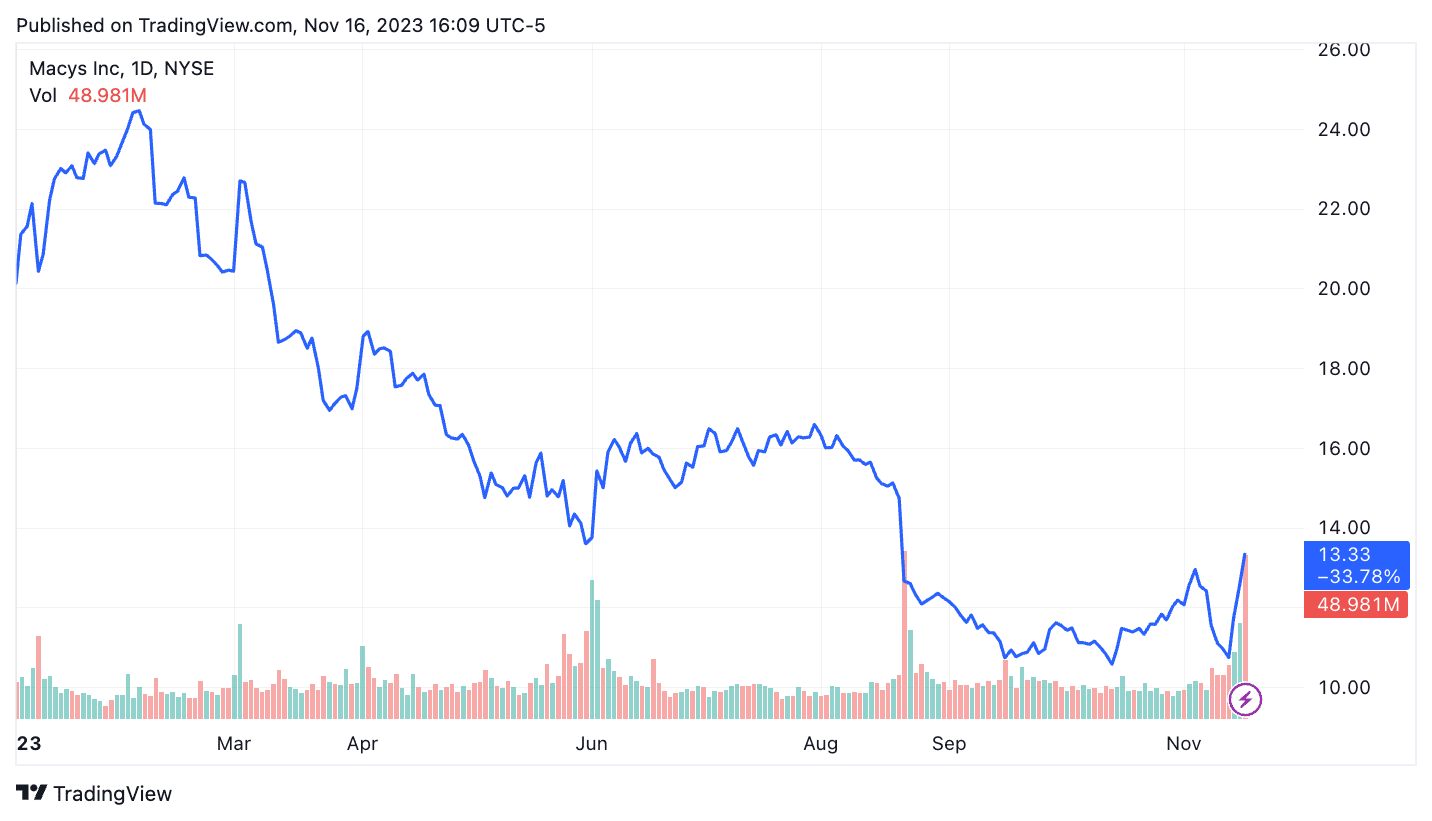

Although Macy's shares As prices rose on Thursday, they have lost about a third of their value this year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com