The Simply Good food Company (SMPL) shares rose more than 6% during Wednesday session after the company posted better-than-expected financial results. Sales increased 54.2% to $215.1 million, beating the consensus estimates of $ 7 million, and non-GAAP EPS came in at 26 cents, beating the consensus estimates of 11 cents. The management expects to generate $790 million to $ 800 million of revenue and $ 145 million to $ 150 million of adjusted EBITDA during the year 2020. The Quest acquisition has contributed to 62.5% of sales growth.

In mid-June, William Blair has initiated coverage on Just Good Food stock with an Outperform rating. DA Davidson has also reiterated its Buy rating ahead of the financial results for the third quarter but lowered its price target from $26.00 to $24.00 per share. The analyst Brian Holland believes that the current context of nutrition practice, is weighing in on the Atkins diet of the mark, although the year-to-date weakness overestimates the long-term impact.

Food companies have outperformed the other goods of basic consumption during the COVID-19 pandemic as of consumers towards packaged food as a way of coping with restaurant closures.

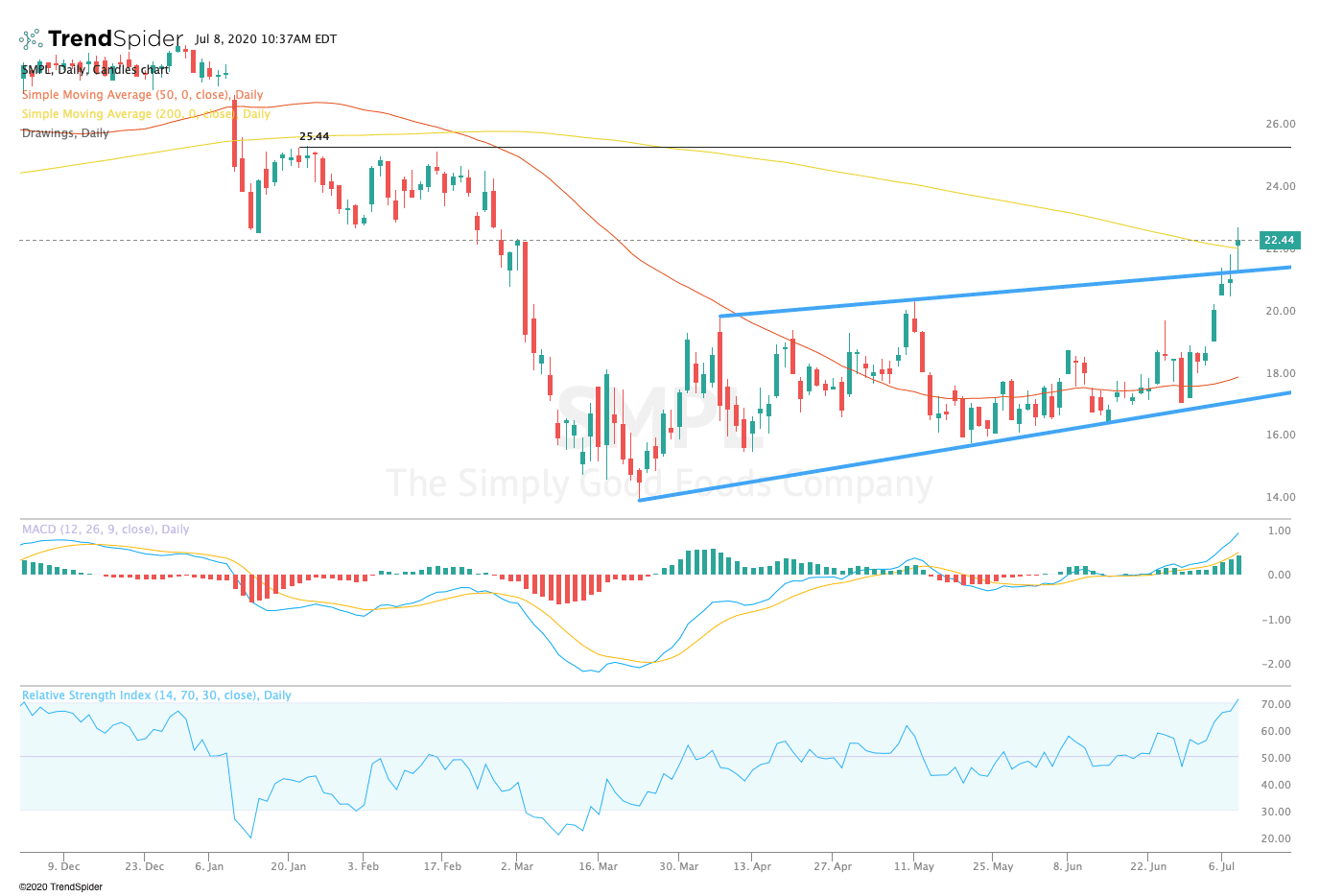

TrendSpider

From a technical point of view, the stock broke out of its 200-day moving average during Wednesday’s session. The relative strength index (RSI) moved into overbought territory with a reading of 72.00, but the moving average convergence divergence (MACD) remains in a bullish trend. These indicators suggest that the stock might consolidate before a new movement is on the rise.

Traders should watch for consolidation above the 200-day moving average and trendline support in the coming sessions, before a long move towards the front of the peaks of near $25.00. If the stock fails to maintain his escape, shares could retest reaction highs of near $20.50, or trendline support at $18.00. The earnings beat suggests that the long-term, the bias remains bullish following the Quest acquisition.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com