© Reuters. In THE UNITED STATES, ROSENGREN calls INTO QUESTION The INFLATION TARGET OF THE FED

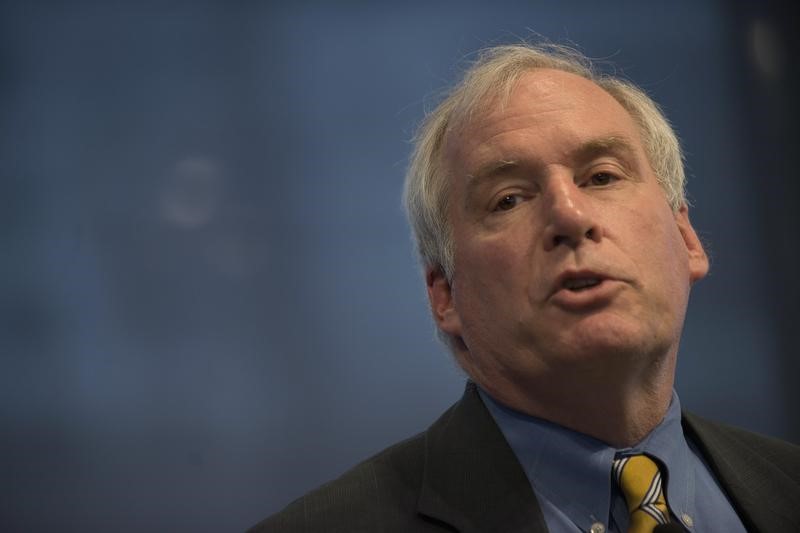

WASHINGTON (Reuters) – The recent decline in unemployment in the United States could trigger a rise in inflation which, having regard to the framework in which the policy of the federal Reserve, could result in rate hikes likely to lead to a recession, warned Friday the president of the Boston Fed, Eric Rosengren.

“I am not in agreement with this framework”, he said in San Diego in California, in reference to the “balanced” approach to the Fed intended to achieve the objective of 2% inflation and full employment. The Fed has adopted this framework six years ago and has reaffirmed every year since.

Today, while Jerome Powell was preparing to replace Janet Yellen to head the Fed, a growing number of officials from the central bank want to rethink this part.

The comments of Eric Rosengren clarify the debate, suggesting that the target of 2% may force the Fed to curb the growth via increases in drastic interest rate if the unemployment rate, currently at 4.1%, continued to decline. This rate is already lower than what many economists consider sustainable without that it will create inflationary pressures.

Inflation remaining persistently below 2% up to the present, has enabled the Fed to raise rates gradually, but this could change, he cautioned.

“My fear is that if we digress too much of what we see as an unemployment rate that is viable in the long term, and that we keep the current framework, then we arrive at a situation in which we will need to raise rates quickly enough so that it becomes then very difficult to return to full employment without cause of a recession.”

Eric Rosengren suggested that the inflation target of 2% in a range between 1.5% and 3%.

(Ann Saphir; Juliette Rouillon for the French service)