Stock of laptop, desktop, and printer giant HP Inc. (HPQ) trading in a familiar pattern for the stock market. After the coronavirus related to the sale, many stocks have rebounded, with some moving all the vertices, but others, like HP, have not been able to bounce much at all.

Instead, HP’s stock has stagnated well below its recent highs. This has created is an ascending triangle pattern, and it does not bode well for the shares of HP.

Triangle patterns are great to follow because they tell us a lot about the stock. First of all, a model of a triangle tells us in what direction we can think that the break occurs. We know this because triangle patterns are usually continuation patterns. This means that the stock generally head in the direction of where he was at the head before the pattern formed.

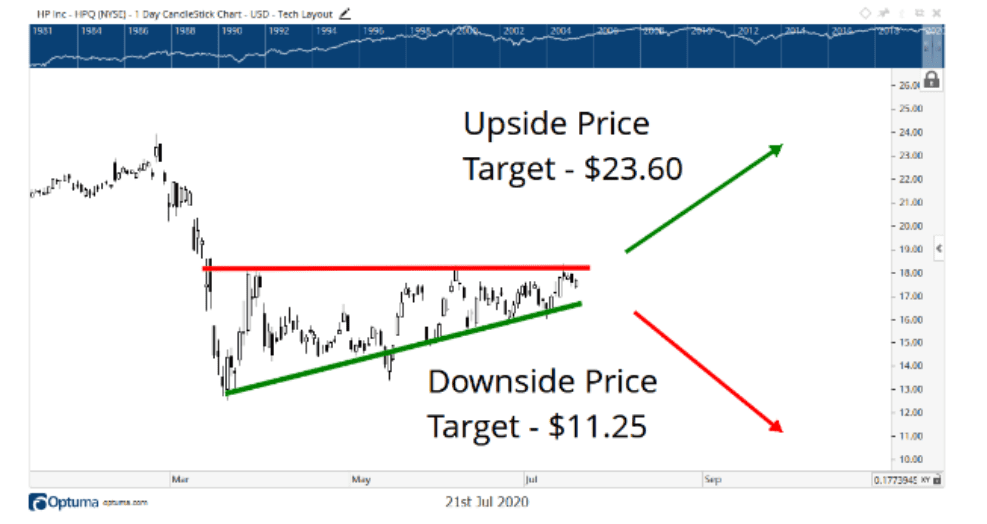

For HP stock, this direction was weaker. Take a look:

Optuma

The peak on the price chart is around $23 per share at the end of February. Then, the pandemic has struck, and the stock dropped to $12. This decrease was that most of the stocks experienced during this fast sale.

And then the rebound follow-up, but HP’s stock retraced 50% of the decline. This is a key level in the future, and it has been the point of resistance in the ascending triangle pattern (in red). The rise of the curve, in green, highlights the key support level for the price change.

Stick to the assumption that the triangle patterns are continuation patterns, I expect the stock to fall to a target price of$ 11.25, or 32% drop from current prices, in the coming weeks. The measured prices at the height of the triangle, about $5.40, it is expected that the move.

Once the clear support and resistance levels are broken, then you know how to trade the stock market. Now, the movement is put in place for the stock surge, or plunge, for $5.40. It is almost a 30% move to the upside or to the downside.

It could go anyway, even if the model says to wait for HP’s stock to head lower. After the resistance or support level is broken, that is when you want to capitalize on the rest of the expected move of the reading.

The Bottom Line

HP stock is stuck in an ascending triangle pattern for the moment. While the model suggests that the stock will head lower, to hit a price target of$ 11.25, I know to wait until we get a break of the support or resistance level before placing a trade. Then we’ll have a chance to capitalize on the 30% move, if it is towards the top or towards the bottom.

Source: investopedia.com