Halliburton Company (HAL) shares rose more than 8% during the session on Tuesday after two analysts upgraded the stock following its better-than-expected financial results for the second quarter.

Bank of America has updated the Halliburton stock to Buy with an $18 price target, citing structural changes that should increase the cash flow available. Analyst Chase Mulvehill also cited the cost control measures that should support higher margins. In addition, ATB’s Capital upgraded Halliburton stock to Sector Perform with a $14.75 price target after the lifting of 2020 and 2021, the EBITDA expectations.

During the second quarter, the oil services company reported a 46% drop in revenue to $ 3.2 billion, missing consensus estimates of $ 150 million and non-GAAP earnings per share of five cents, beating the consensus estimates of 17 cents. The management said that the company is the sketch of a “fundamentally different course” after cutting down its workforce and dividends.

The last spat of analyst upgrades comes after Cowen, Citi, Wells Fargo, and Tudor, Pickering, Holt analysts to weigh in on the last two weeks. The analysts cited Halliburton’s second quarter free cash flow, which reached $456 million, which is double the expectations – as a key factor in the upgrades and higher price targets over the coming year.

TrendSpider

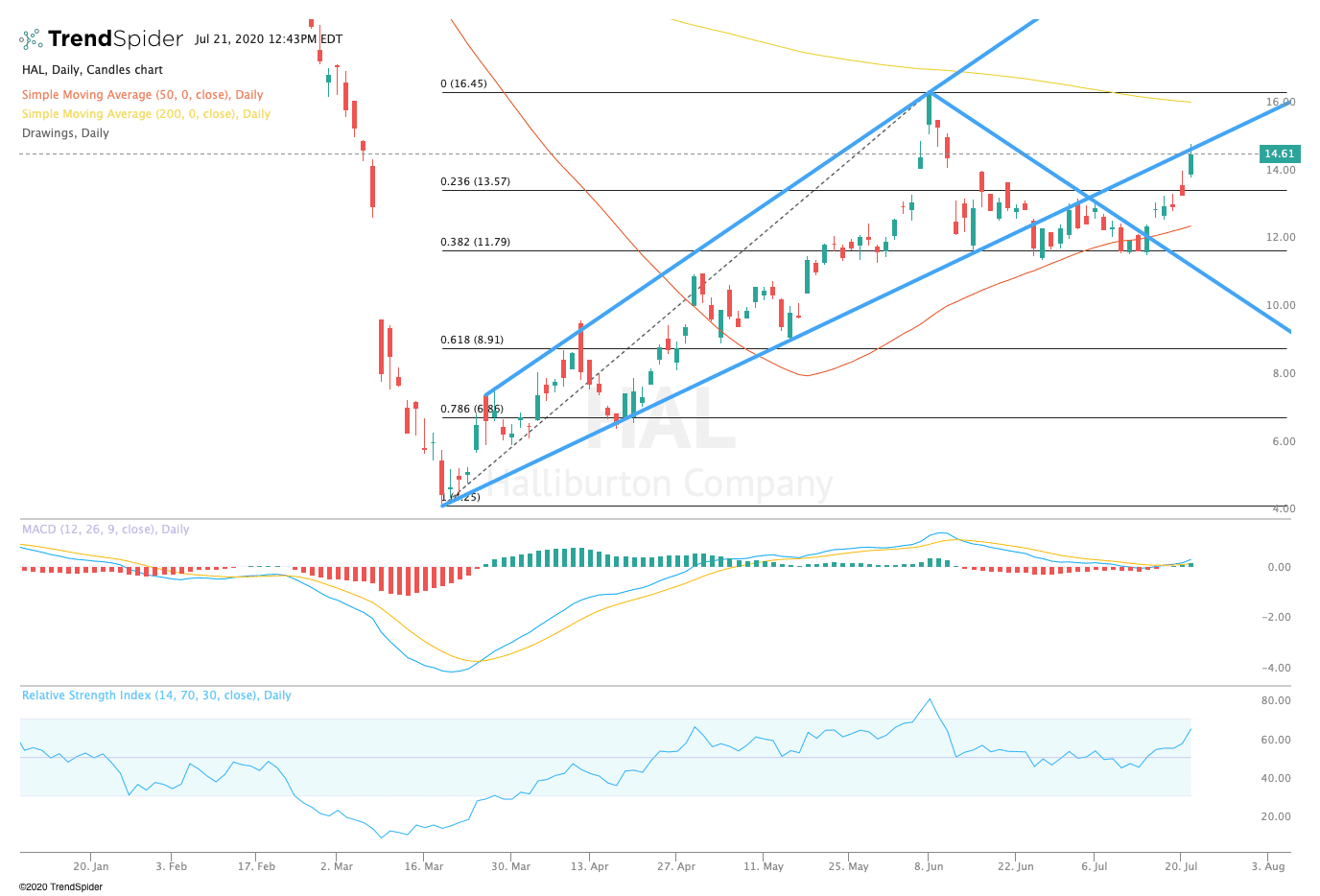

From a technical point of view, Halliburton stock has continued its rebound from mid-July in the direction of its 200-day moving average at $15.95. The relative strength index (RSI) has risen to the overbought conditions with a reading of 64.68, but the moving average convergence divergence (MACD) continues to trade on the side. These indicators suggest that the potential of consolidation to come.

Traders should watch for consolidation near the 200-day moving average at $15.95 before a potential breakout higher to retest prior highs of$ 16.45. If the stock moves lower, traders could see a move towards the 50-day moving average at $12.49 or before the low of $11.51. The volatile, but trading without suggests that much uncertainty remains in the market.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com