Marriott International, Inc. (MAR) shares got pummeled in March, falling to a six-year low in the middle of$40, but the stock has rebounded sharply in the second quarter. The rally from the oversold zone stretched more than 60 points in 5 June, when the stock reversed from its 200-day exponential moving average (EMA), which was broken in February on heavy volume. The adjustment raises the odds that three months of gains has come to an end, with a big dose of reality undermine the optimism.

This international society is dependent on business travelers to meet profit and revenue estimates, but the air transport is unlikely to fully recover for at least two years, keeping a heavy lid on stock gains. More importantly, the pandemic stops could be the signal of a permanent change of paradigm in which hundreds of companies rely on video conferencing to conduct day-to-day business rather than expensive travel.

The stock has not recovered to the technical scope of the damage in spite of the advance and is trading below the December 2018 low, which is closely aligned with the moving average above$ 100. This level also marks the division from a two-year double top pattern, the building of strong resistance. It gapped down from the triple digits earlier this week, undercutting the 50 day EMA, signalling may be the final push over $100 a month or more.

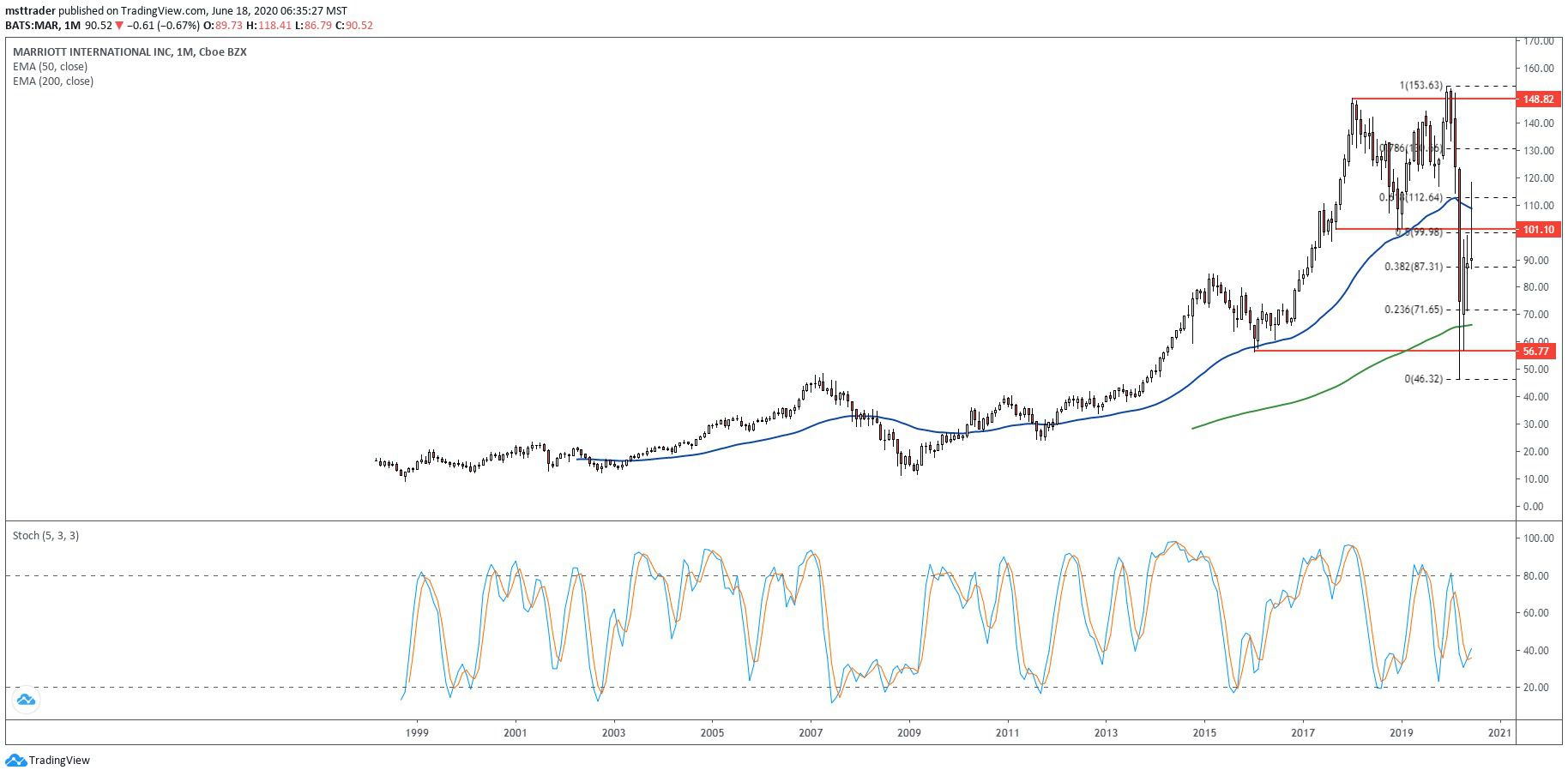

MAR Long-Term Chart (1998 – 2020)

TradingView.com

The creation of the public company of nearly $18 in March 1998, the entry of an immediate decline, which has posted lower at $9.69 in October. The increase in subsequent new highs in the first quarter of 1999, topping $22 a few months later. He has posted a bit further up above $25 in 2001 and has held the support of the fork in the lower part of adolescence until the end of the bear market. Committed bulls, and then jumped out of the touch line, that underlie the remarkable progress made through the mid-decade bull market.

The upward trend ended near $50 in early 2007, marking the highest for the next seven years, before a cascade of decline that found support for only two points above the 1998 low in November. A rebound in the new decade has failed to reach the state of high, stalling in the low $40 during the establishment of the resistance, which took three years to overcome. 2014 breakout reached the record level of 2007 quickly, setting off immediate uptrend that has reached the mid-$80 in 2015.

An escape after the election of 2016 trimmed nearly $150 in the first quarter of 2018, with the trade-war threats to undermine the travel business with the South-east Asia. A decline in end-of-year nearly$ 100, the establishment of the lower end of a trading range that has held intact until December 2019 breakout after the failure of the addition of only four points. The month of February, down cut through the range support like butter, to come to rest at the lowest since the first quarter of 2014.

MAR Short-Term Chart (2017 – 2020)

TradingView.com

The balance volume (OBV), the accumulation-distribution indicator trimmed in eight months after prices in 2018 and broke out of a modest new high in December 2019. Selling pressure picked up in February 2020, the abandonment OBV of a three-year low, which is still relatively high in the five-year range. The buying pressure throughout the second quarter shows modest progress, with gains proportional to the price change.

A Fibonacci grid extends over the first quarter, the decline places of the .618 retracement level right at the 200-day EMA, while the December 2018 low is closely aligned with the .50 retracement. This symmetry underlines a fierce resistance at these levels, which must be mounted to restore the optimism regarding the long-term prospects. That seems less likely by the day, with market players to come to terms with the fallout from COVID-19 and protests around the world.

The Bottom Line

Marriott rebound from oversold may have come to an end, setting the stage for a lot less than the price of the shares.

Disclosure: The author held no positions in the aforementioned securities, at the time of publication.

Source: investopedia.com