Key Takeaways

- Analysts estimate adjusted EPS of $1.77 vs $1.99 in Q2 of FISCAL year 2019.

- Monthly active users (MAU) to provide for an increase in average revenue per user (ARPU) is falling.

- Revenue growth is expected to slow substantially in the middle of the pandemic.

Facebook Inc. (FB) is facing one of the most difficult periods of the 16-year history as hundreds of advertisers to boycott the social media web site in the middle of heated criticism about the hate speech posted on its platform. Even as Facebook’s monthly active users (MAU) totaled in the middle of the COVID-19 pandemic, the boycott and the slowdown of the economy could lead to the fall of advertising, Facebook’s main source of income. The boycott began at the end of the month of June that Facebook was already struggling with the consequences of the pandemic.

Investors will be looking for the last signs of the way in which Facebook is the alteration of the pandemic when it reports earnings on July 30, 2020 for the 2nd quarter of the FISCAL year 2020. Analysts estimate the company’s adjusted earnings per share (EPS) will decrease with the growth of revenues slows down significantly. While the impact of the boycott on Facebook, the results will be limited since it began towards the end of the quarter, investors want to hear from the management how the boycott of assigned revenue in July, the first month of the quarter.

Investors will also be looking on Facebook the growth of the MAU and the average revenue per user (ARPU) in Q2. These two key indicators to measure the extent to which the company is to attract and retain new users, and how it is to monetize its user base, mainly through attracting advertising. Analysts forecast the MAU will, while the decline in the ARPU for Q2.

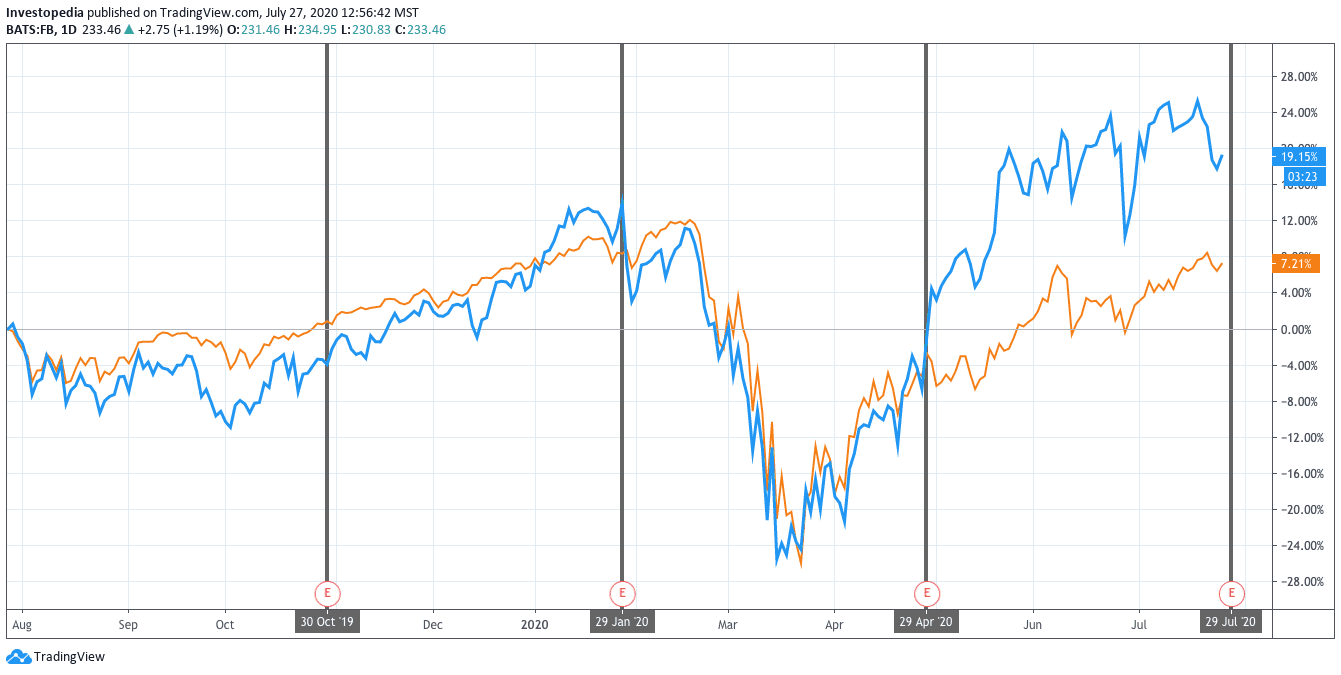

Shares of Facebook have been keeping pace with the broader market for most of the past year, crashing in tandem with the market this spring, as fears mounted over the spread of the coronavirus. But Facebook has surpassed the middle of the market’s rebound of the accident. The announcement of the boycott led to a brief dip in the end of June. The stock has provided investors with a trailing total return of 19.2% over the last 12 months compared to the S&P 500 index total return of 7.2%.

Source: TradingView.

Facebook shares got a boost following its Q1 of FISCAL 2020 earnings report, which seems to have quelled the fears of investors on how the company should perform in the course of the pandemic. Adjusted EPS increased 21.4%, which represents the fastest growth since the Q4 of FISCAL 2018. Turnover increased by 17.6%, it has the lowest growth for at least the past 17 quarters, the continuation of the slowdown that began years ago.

During the 4th quarter of FISCAL year 2019, Facebook is the adjusted EPS increased 14.1%. Outside of two consecutive quarters of falling revenue in the first half of the year, it marked the slowest profit growth in at least 16 quarters. The revenue grew by 24.6%, a little less than half of the speed at which the turnover has increased by three years earlier in the 4th quarter of FISCAL year 2016. The company’s shares fell on the news, and then rebounded in the following weeks, before you dive in the middle of the coronavirus-induced collapse in the market.

Facebook shares have rebounded since the crash, but they have moved the most since the end of May. For the next Q2 the YEAR 2020, the analysts expect a 10.8% decline in adjusted EPS, which would be the worst performance gains in at least 18 quarters. While the EPS fell in the other two quarters for more than four years, the estimated decline in Q2 of FISCAL year 2020 EPS is much steeper. The turnover is expected to grow by 2.1%, the weakest quarterly performance in more than four years.

Facebook Key Metrics

Estimate of the Q2 2020

Q2 2019

Q2 2018

Adjusted Earnings Per Share ($)

1.77

1.99

2.09

Revenue ($B)

17.2

16.9

13.2

Monthly Active Users (B)

2.6

2.4

2.2

The Average Revenue Per User ($)

6.66

7.05

5.97

Source: Visible Alpha

For social media companies such as Facebook, monthly active users, or MAU, is an indicator that allows you to track the number of unique individual users to visit a site in a period of one month. Facebook has not stopped MAU growth every quarter for at least the past three years. However, there has been a general slowdown in the rate of increase. A year at the (annual) growth of the MAU ranged from 15% to 17% during the four quarters of the year 2017, 9 to 14% in 2018, and from 8% to 9% in 2019. Analysts estimate MAU will increase by 9.4% in the 2nd quarter of FISCAL 2020, slightly above the average rate throughout the previous year. This above average growth can come from the home of the world’s consumers strongly to the increase of their online activity due to the pandemic. Despite this increase, the overall pattern of slowing growth is to be expected since Facebook already has a significant global reach and there are a finite number of potential users in the world.

Just as important as MAU is how much revenue Facebook can generate from its users, in large part, in the form of advertising, which is measured by the average revenue per user, or ARPU. The ARPU growth has also slowed in recent years, although the decline has been more dramatic. The growth of the ARPU varied between 24 and 28% in 2017, 19% and 31% in 2018, and by 16 to 19% in 2019. That the slowdown in growth of 8.4% in Q1 of FISCAL 2020. Now, for the 2nd quarter of the FISCAL year 2020, the analysts expect a decrease of 5.6% in the ARPU, the first quarterly decline in at least 16 quarters.

Source: investopedia.com