Domino’s Pizza, Inc. (DPZ) stock rallied above 2018 resistance to $300 in February, but the increase of failure in a 28% fall in the first quarter of the pandemic driven by swoon. He has now recovered and is in the process of secondary derivation that could lift the stock well above $500 in the next few months. The main rivals could add to the gains as well, with the virus of the super-charge American appetites for the classic tomato pie and all of its wonderful variations.

The company just noted a “significant increase” in the UNITED states same-store sales from the fifth to the eighth weeks of the second quarter compared to the first four weeks, with a stay-at-home orders of lifting throughout the united States and Europe. Total sales increased 14% so far this quarter, with the consumer behaviour is evolving at a rapid pace. Many shops are closed across the two continents, increasing the potential for further strong increase in sales at the end of June.

On 12 May, more than the S&P 500 index has triggered massive purchases of activity that instantly cleared the technical damage incurred during the first quarter, the lifting of the accumulation of readings to all the vertices. This bodes well for the rise, with a steady tailwind after the stock clears February resistance in the $380. Domino’s stock is currently trading at about 20 points below the barrier, but the optimism fuelled by this morning’s bullish metric of Papa John’s International, Inc. (PZZA) could support short-term buying power.

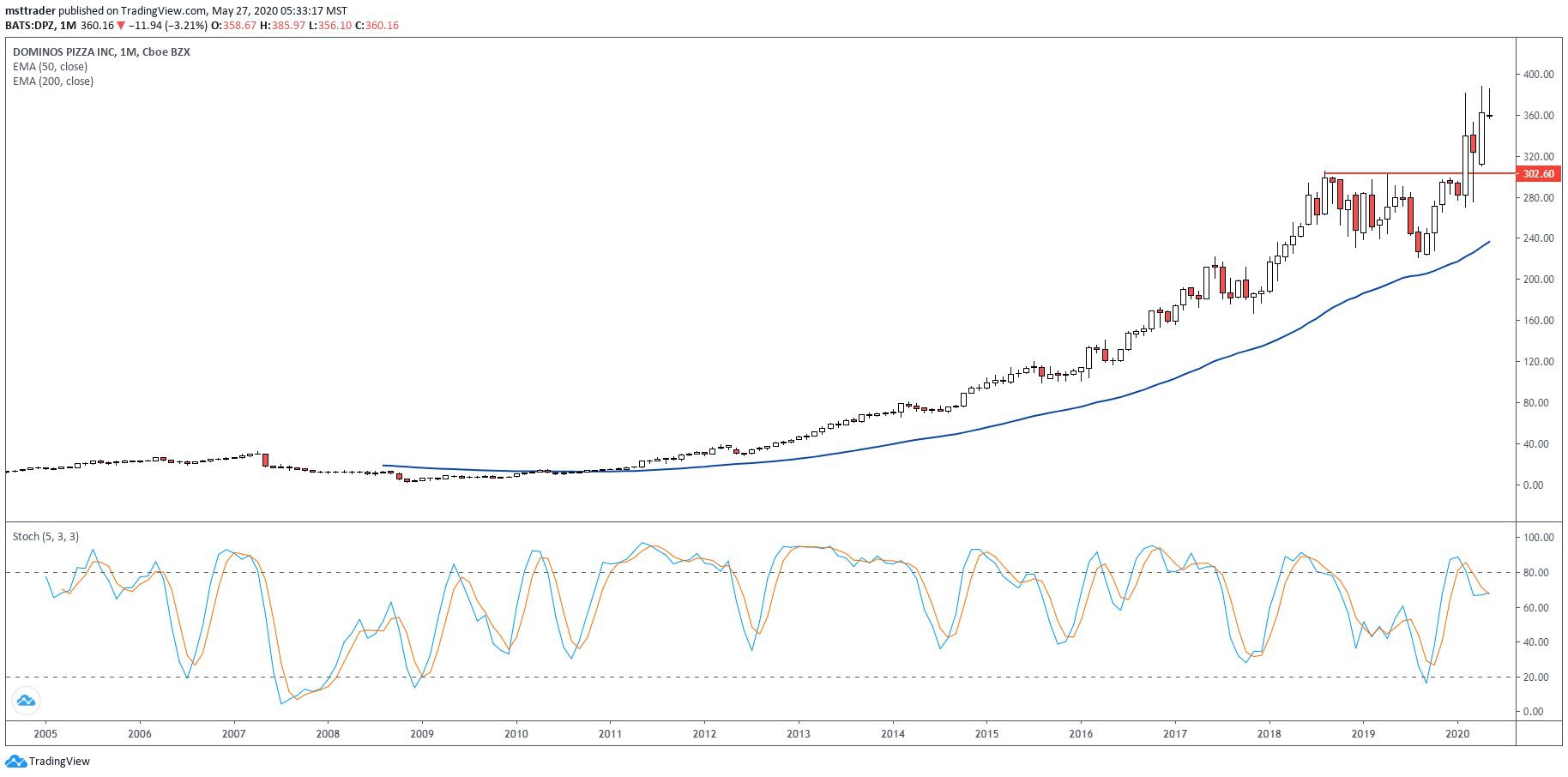

DPZ Long Term Chart (2004 – 2020)

TradingView.com

Domino’s Pizza came public at $7.61 in July 2004 and entered into an upward trend, which has posted an elegant series of highest and lowest in April 2007, when it topped out at $19.24. A July breakout attempt has failed, leaving the place to an orderly decline that has accelerated in vertical free fall during the economic collapse of 2008. The sell-off posted an all-time low of $2.42 in November 2008, before a resumption of the wave which took two and a half years to complete a round trip in the front-top.

Immediately breakout attracted the interest of buyers, easing quickly into a rising channel that contained price action in 2014. The upward trend then entered in a staircase model, with a more energetic rally waves interspersed with several-month correction that shook out weak hands. The increase which began in November 2017 and has been particularly strong, adding nearly 140 points in just nine months.

The rally topped out above $300 in August 2018, which gives a volatile decline that found support at $221, before 2019 bounce that has reached the resistance in December. The month of February 2020 breakout lasted a session before you turn the tail in a vertical slide that bridged a gap of over 60 points, and violated new support before finishing off at $275. The stock market rebounded in April, to reverse once more right after the release of all-time just six points above the February peak.

DPZ Short-Term Chart (2018 – 2020)

TradingView.com

The company has beaten top and bottom line estimates in February for the fourth quarter of 2019 earnings report, triggering a huge breakout gap, but buying interest dried up immediately. The subsequent downtick filled the gap, on the 12th of March, but the stock continued their downward trend, finding support 25 points below this level, a few days later. The subsequent rebound took place in two waves, the recovery of the escape, before nose above the February high to the April 23. The price action over the past month has been constructive, potentially the carving of the handle in the three-month cup and handle pattern.

The balance volume (OBV), the accumulation-distribution indicator equalled or exceeded to the upside of the evolution of prices since the month of August 2018 the top, to break the three-month future prices in November 2019. On 11 May, the S&P 500 new generated one day of the rally which has published more than six times the average daily volume, the onset of a new OBV breakout, which has created a bullish divergence, predicting that prices will soon follow.

The Bottom Line

Domino’s Pizza stock has carved three-month evasion model in February of the bull market high, setting the stage for an upward trend, which could eventually reach$500.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com