Dow component The Walt Disney Company (DIS) is trading flat in Tuesday pre-market after reporting a 58% drop in the first quarter, the operating income result of theme park, cruise line, and the film production closures in response to the sars coronavirus pandemic. Streaming services income offered the only glimmer of hope in a bleak report with the Disney+ paid subscriber base increase of $ 33.5 million. The company is the suspension of the first half of the payment of the dividend to raise additional cash.

The entertainment giant posted earnings per share of$ 0.60, well below the consensus estimates of$ 0.90, while the turnover has increased by 20.7% to $18.01 billion. ESPN+ added an impressive streaming services tonnes, an increase of $ 2.2 million to 7.9 million subscribers. Shanghai Disneyland is set to reopen on 11 May, with little density, but the company has not offered any estimates when the UNITED states and other international operations would resume.

Studio entertainment increased 18% to $254 billion, but of living and of animation production at Disney, Pixar and Marvel came to a grinding halt, with no return dates on the calendar. This will affect revenues for multiple quarters, because studios are less and less movies at the release when the theaters finally open and less content for distribution to subscribers. In addition, the shutdown will affect a very cost-effective sales and rental in the months following the theatrical releases.

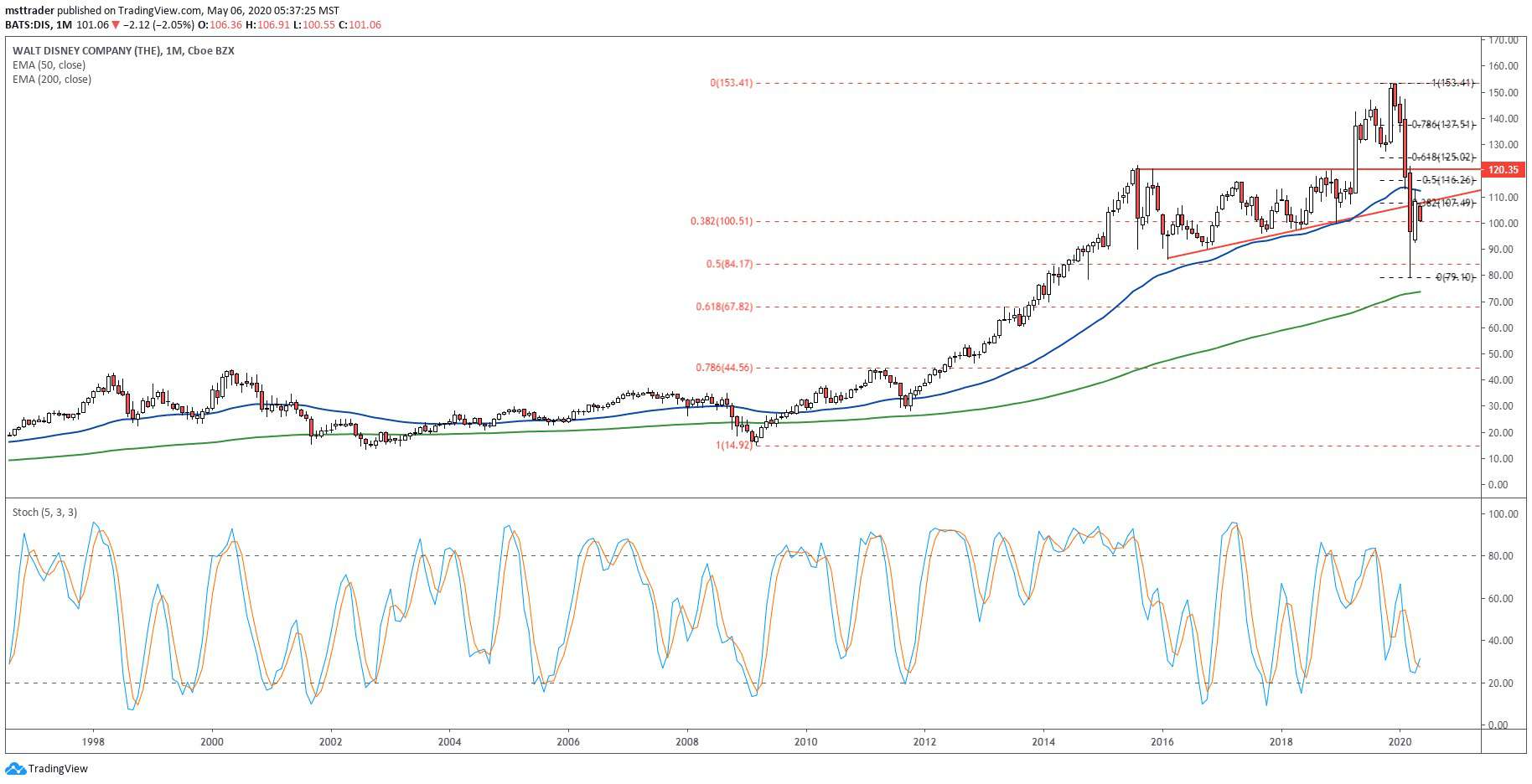

Disney stock failed to a multi-year breakout in the first quarter and dropped to a five-year low in the upper part of $70 in March. He added about 20 points since a moment, but did not go up a single level of support broken during the sell-off, saying it informed the market players that the downward trend that began in November 2019 remains intact. As a result, renewed selling pressure that tests, or even breaks the low depth cannot be excluded.

SAY Long-Term Chart (1998 – 2020)

TradingView.com

A multi-year uptrend topped out at $42.50 in 1998, before a failed 2000 attempt to escape, which has completed a double top failure after the Sept. 11 attacks. The decline ended at a seven-year low in the mid-teens in the fourth quarter of 2002, paving the way for the modest increase that has stalled in 2007, more than seven points below prior resistance levels. The stock tested the 2002 low during the economic collapse of 2008, the ownership of less than two percentage points above the level in the month of March 2009 lows.

A good bounce completed a round trip to a multi-year resistance in 2011 as a 2012 breakout sparked a lot of interest from buyers. The stock posted the most prolific of the gains of the century in July 2015, rising to $122.98 and turning in sharp decline in February 2016. The price action held with only eight months of trading in April 2019, carving an ascending triangle pattern which broke to the upside after the company announced the Disney+ release date.

The stock carved three highest in November all-time high at $153.41 and pulled back in a shallow decline accelerated to the downside in mid-February. He failed to escape, at the beginning of the month of March and the triangle of the increase of the trend line less than two weeks later. The rebound in April has reached the broken trendline near the end of the month, the generation of a reversal that strengthens the resistance above$110.

SAY the Short-Term Outlook

The monthly stochastic oscillator has entered in to a complex selling cycle from the overbought zone in September 2019 and has not yet reached the oversold zone, despite a sell-off of over 70 points. This divergence of the wave additional red flag, indicating that it will take relatively little effort for aggressive sellers to dump the stock in the crook of March. More importantly, the current cycle of sell will have to cross in the oversold zone at this time or the risk of a break that drops Disney stock in the 200-month exponential moving average (EMA) and .618 Fibonacci rally retracement in the upper part of $60.

The Bottom Line

Disney stock is trading lower after earnings, the continuation of the bearish trend that has the potential to break the depth-of-Mars-low in the upper part of $70.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com