Dow component The Walt Disney Company (DIS) has reached the resistance level of the price is negotiable before the month of April 2019 historic breakthrough, which failed on the heavy volume in March. This indicates an almost ideal short sell set-up, in advance of a possible reversal and the slowing, which could generate the high-percentage of the profits. Other techniques work well with this formula downward, increasing the chances that it will proceed as planned.

The descent of the 200-day exponential moving average (EMA), broken two weeks in advance of the failure of the escape, is closely aligned with the new resistance between $118 and $124. In addition, the accumulation of readings of the slumping badly, cutting off the March lows a week earlier. At the same time, the relative strength of the cycles have not managed to respond to the increase, maintaining long-term selling cycle, which has now entered its seventh month.

Disney challenges have been well documented, with the production of films, theatres, theme parks, and cruise ship lines stop around the world. Disney+, ESPN+, and Hulu streaming services have performed well during this period, picking up millions of new subscribers, but this division is only a small part of the entertainment giant massive $206.6 billion stock market capitalization.

The theme parks are reopening slowly, with measures of social distance, indeed, but the film remains stationary, with the Southern California, lockdown, it is expected to remain broadly in force in mid-June. Older and wealthier consumers are likely to avoid the big crowded places, like theme parks and movie theaters, for months after openings are completed, compounded by an entertainment pipeline which will take at least a year to restore.

More importantly, it is difficult to underestimate the effect of heat on the pandemic, with the probability of a second wave of the fall and winter. That raises the prospect of new quarantine areas at the same time people become complacent, and to take the next step towards standardization. If the scenario follows the path of the Spanish Flu deadly second wave in the fall of 1918, Disney stock could easily sell for 2012 support in the $40.

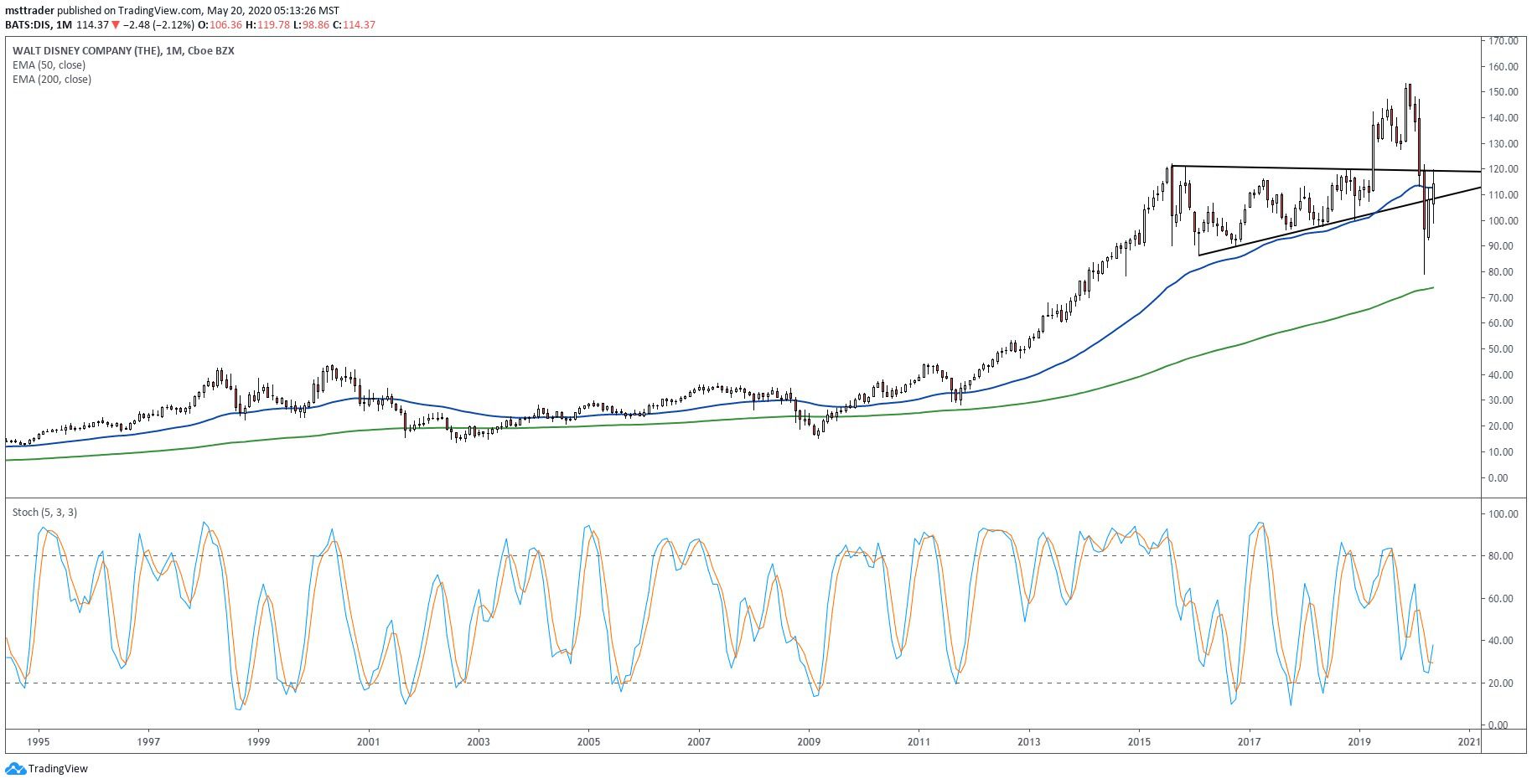

SAY Long-Term Chart (1998 – 2020)

TradingView.com

A multi-year uptrend topped out at $42.75 in 1998, the establishment of a level of resistance that has refused to bypass attempts in 2000, 2007 and 2011. The stock finally emptied barrier in 2012, the seizure of an historical progress that has stalled at $122 in July 2015, when the company posted an unexpected downturn in ESPN audience because of the cord cutting phenomenon. A drop in February 2016 completed the first step of a huge symmetrical triangle that is carved higher lows in 2017 and 2018.

The stock broke out in April 2019, after the company announced the fourth quarter release of the highly anticipated Disney+ streaming service. The rally unfolded through three waves, culminating in November 2019 all-time high at $153.41. Profit taking then took control, generating an orderly decline that has accelerated in a near-panic when the virus has been making headlines. The next rout sliced through the 200-day EMA in February, and in small groups the first week of March.

SAY Short-Term Chart (2018 – 2020)

TradingView.com

The balance volume (OBV), the accumulation-distribution indicator garnished with prices in 2015 and has entered into a distribution phase that ended after the presidential election of 2016. A slow upward movement has reached the resistance in April 2019, before July bypass, which was completed in November. OBV pulled back to new support and is broken down with prices in the first quarter, to fall to the lowest since June 2018, before a rebound in April failed, which gives a new low a week ago.

The two months of the wave is now back in the bottom of the triangle is at $107 and retraced 50% of decline, reaching the April 2019 breakout level of$ 118, which has generated a buy spread of$ 125. The 200-day EMA is going down rapidly in this area of price and future, in close coordination with the failure of the escape, setting off on short-selling signals predict that bears will soon wrest control of the ticker tape.

The Bottom Line

The short sellers are rounding the wagons on Walt Disney, with the stock reaching a high level of resistance to the first quarter break.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com