Dave & Buster’s Entertainment, Inc. (PLAY) shares declined 2% during Tuesday’s session after the company named KKR Director-general John Hockin its board of directors.

Kohlberg Kravis Roberts, better known under the name of KKR an investment firm specializing in private equity, energy, infrastructure and real estate. With nearly 8% of the equity of Dave & Buster’s, KKR is a major shareholder. Mr. Hockin brings valuable perspective and a depth of financial and investment experience to the board of directors.

Earlier this month, Dave & Buster’s stock fell sharply after the company issued 9.6 million shares at $10.44 per share to strengthen the capital in the middle of the course COVID-19 epidemic. The below-market, providing downward pressure on the stock, which has stabilized at around $10.50 per share in recent sessions.

The company reported better-than-expected in the fourth quarter of $347.16 million and earnings per share of 80 cents. It is continuing discussions with the owners and providers to reduce spending, extend payment terms, and to obtain other concessions in the face of the economic crisis.

TrendSpider

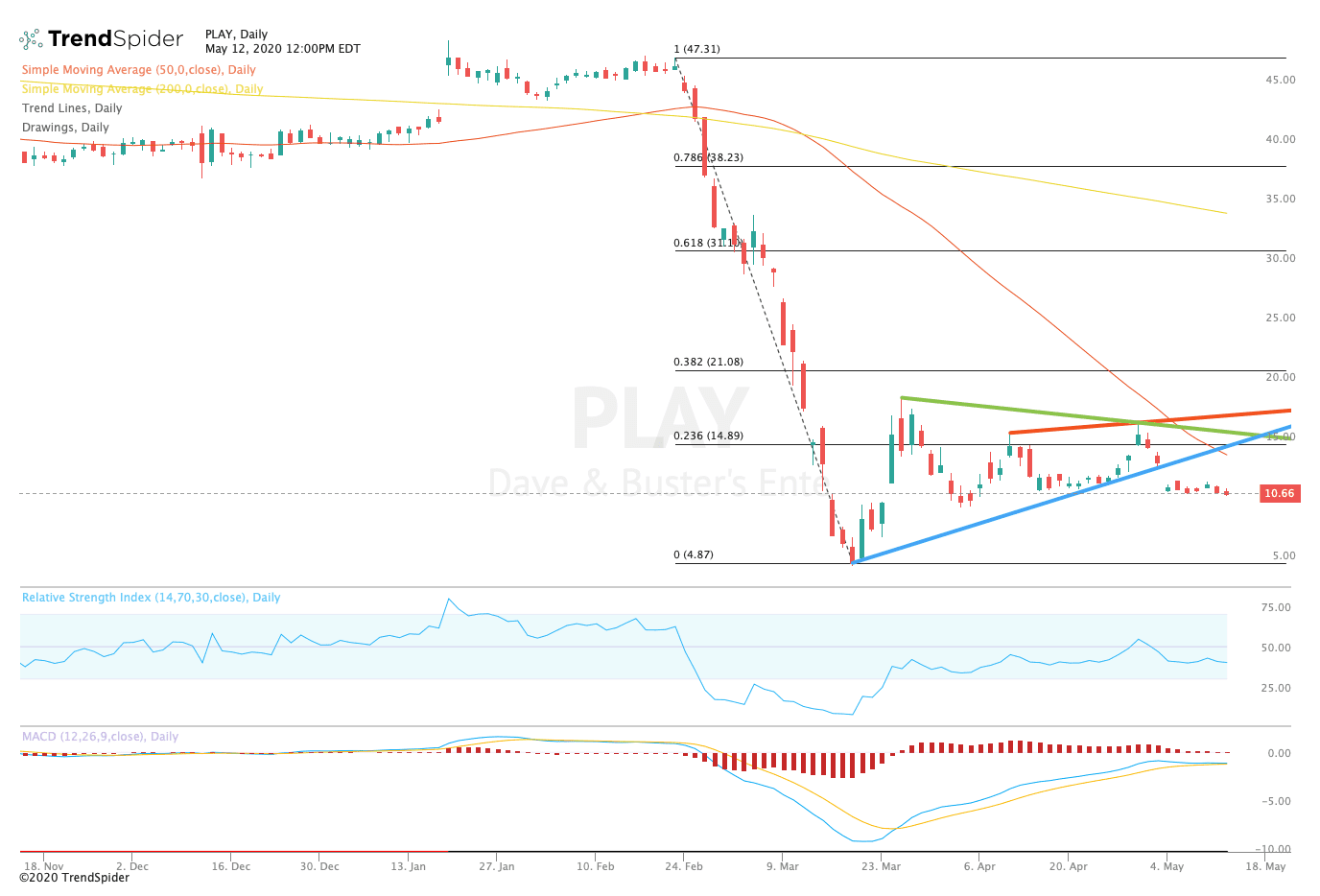

From a technical point of view, the stock has formed a base at around $10.50 per share during the past two weeks, and continues to trade in a band of € 10.00 to$ 17.50. The relative strength index (RSI) appears neutral with a reading of 40.1, but the moving average convergence divergence (MACD) is starting to lose its bullish momentum and could see a bearish cross.

Traders should watch for a breakdown prior lows at around $10.00 to make a new test of the lower of $5.00 or an upward movement of the 50-day moving average of $13.94 on or before the peaks of around$ 17.50. While KKR participation could become a catalyst to the upside, future price action is likely to depend on the progress of the economy in the reopening and how the restaurants to be in the picture.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com