Dave & Buster’s Entertainment, Inc. (PLAY) shares has increased approximately 10% during Friday’s session despite a bearish market first quarter financial report after Thursday’s close. Revenue fell 56% to $159.8 million, missing consensus estimates of about $ 8 million, while the GAAP net losses hit $1.37 per share, which was 54 cents for the worst waiting for it. EBITDA decreased 129.3% year over year to a loss of $ 26.1 million driven by the closing price of places because of the COVID-19 epidemic.

The company’s cash flow is $ 157 million after drawing down its credit facility and raising $ 75 million at the market offering. Like a week ago, the company has opened 28 stores and plans for the 48 stores open in 15 states under the reduction of hours of operation and the limited capacity this week.

Analysts were cautiously optimistic on the stock, despite the result of the first quarter to be missed. SunTrust analyst Jake Bartlett updated the stock to Buy with a target price of $22 per share, citing the reopening of the plans, the constant improvement of the sales to the reopening of shops, and a new flexible operating model capable of driving additional profits to low-volume with a potential long-term savings.

Meanwhile, BMO Capital analyst Andrew Strelzik raised its price target from $13 to $15 per share and reiterated a Market Perform rating. Any near-term comp expectations are “too optimistic”, the analyst believes that the beginning of the comp progression is to benefit from the dynamic of the competition.

TrendSpider

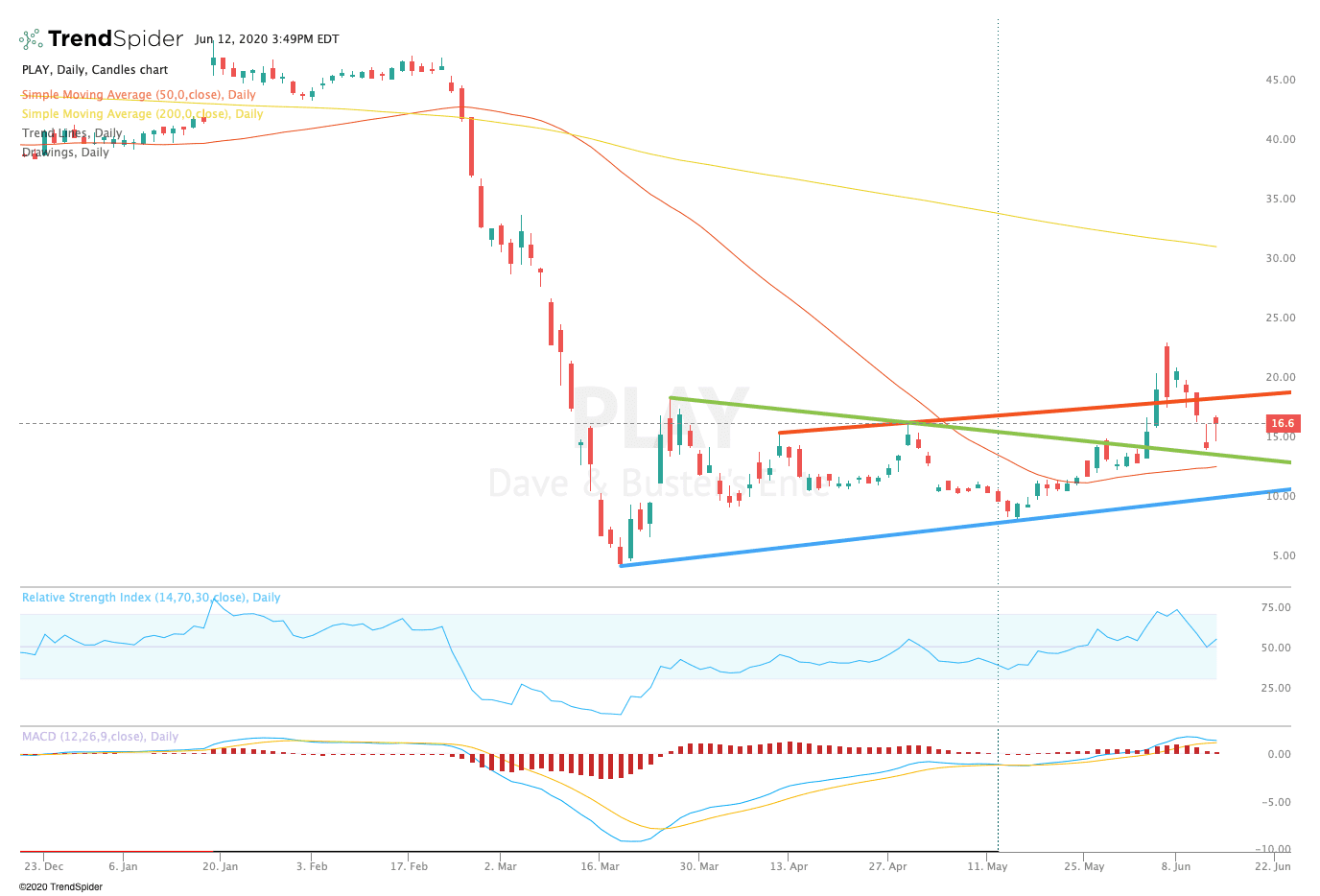

From a technical point of view, the stock market has rebounded from the reaction of the bottom to the top around $23.00. The relative strength index (RSI) remains neutral with a reading of 54.45, but the moving average convergence divergence (MACD) remains on the cusp of a bearish cross. These indicators suggest that a great deal of uncertainty surrounding the actions of the next movement.

Traders should watch for the stock to test the reaction highs near $23.00 in the coming sessions. If the stock breaks out, traders could see a move towards the 200-day moving average of $31.34. If the stock moves lower, traders should look for support near the 50-day moving average of $12.96 or trendline support near $10.00 per share.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com