The Clorox Company (CLX) fell 2% on Monday, despite beating top and bottom line in the fourth quarter of 2020 estimates, but shareholders have not suffered so far in 2020, the once sleepy defensive play to post a special of 50%. All those who have tried to buy the bleach on Amazon.com, Inc. (AMZN), or at their neighborhood market between March and May, includes the recovery, with the disinfectant to fly off the shelves to protect against COVID-19 on the surfaces of the house.

Key Takeaways

- Clorox stock has posted 50% since the first trading day in January.

- The technical indicators are now in favour of a reversal and multi-week decline.

- Effective COVID-19 vaccine could put an end to the upward trend.

Sales have continued at a torrid pace in the third quarter, with people anywhere in the world, storage up to the front of the fall and winter months, which could ignite a feared “second wave” of the pandemic. Similarly, an effective vaccine could put an end to the upward trend in the coming months, making it risky to pick up Clorox shares at these lofty levels, especially with the before dividend narrowing to 1.91%. This is less than the most durable consumer plays in this low-yield environment.

Wall Street has grown more cautious about Clorox stock, given the lack of long-term sources of profits, maintaining a “Hold” ranking is based on two “Buy” and three “Hold” and “Sell” recommendation. Price targets currently range from a low of $185 high Street$ 269, while the stock is set to open Tuesday’s session on $16 above the median $217 target. Additional gains may be hard with this placement, at least until the outbreak is overwhelming health care systems.

A before dividend is an estimate of dividends for the year expressed as a percentage of the current stock price. The year’s projected dividend is measured by taking a stock’s most recent dividend payment and annualizing it. The forward dividend yield is calculated by dividing the value of a year of future, payments of stock dividends current share price.

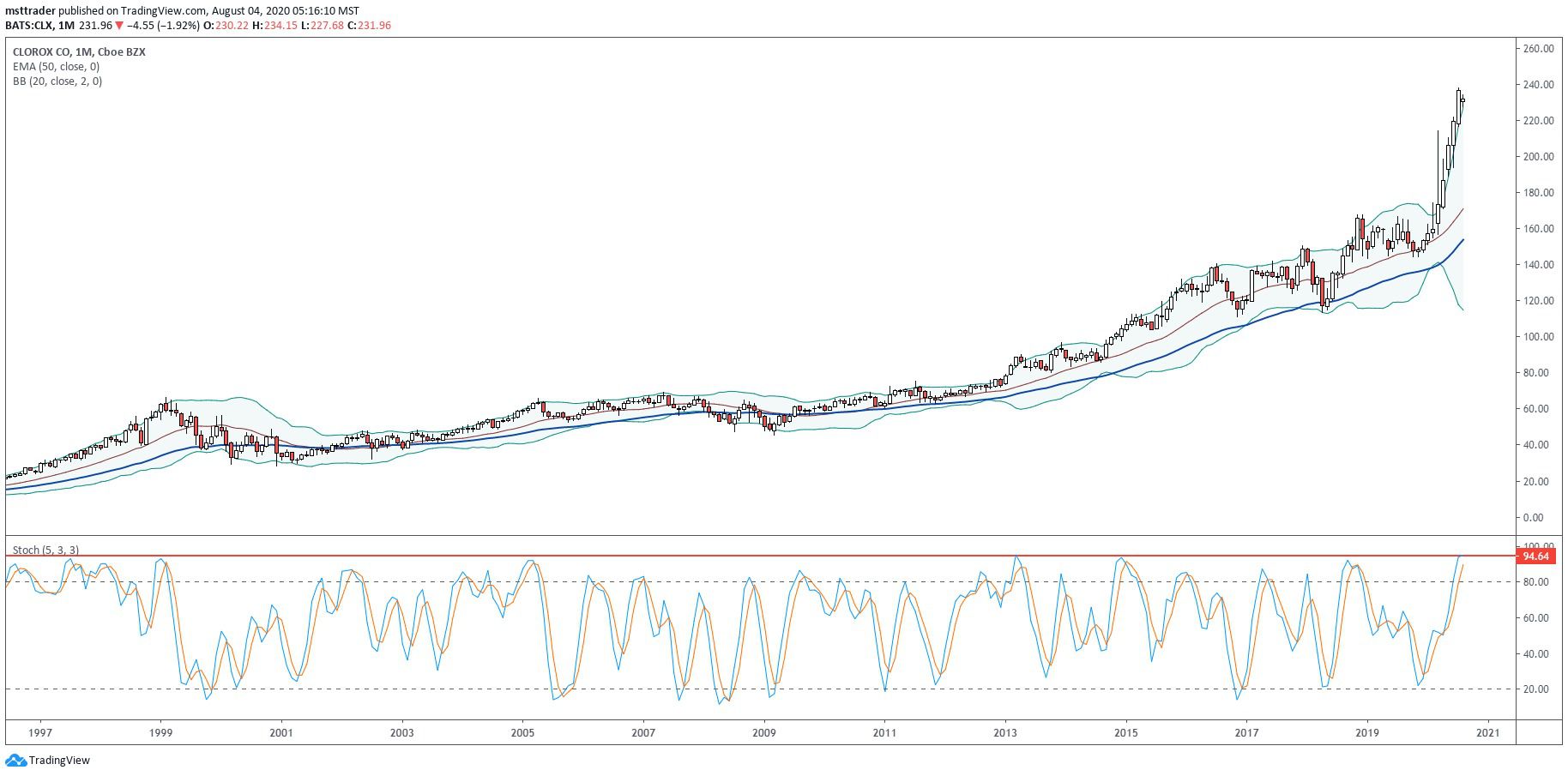

Clorox Long-Term Chart (1990 – 2020)

TradingView.com

The stock of arrow higher in the 1990s with the fall of communism to the opening of new markets around the world. The rally topped out at $66.47 in 1999, leaving behind a massive sale that has found support in the upper $20 in December 2000. The stock completed a round-trip in the state of the high in 2005, but failed in several attempts to escape in 2007 and overturned, falling to a five-year low during the economic collapse of 2008.

A 2013 breakout attracted healthy buying interest, lifting the stock in a strong uptrend that has stalled above $140 in the summer of 2016. Choppy price action has taken control in the second quarter of 2018, with investors rotating into growth issues, after the President of Trump election. The buyers then returned to sculpture, an advance which stalled at the end of the year. It is finally mounted at this level, in March 2000, with panicked investors pay in the event of a pandemic plays.

A growth stock is any share in a company which is expected to grow at a pace that is clearly above the average growth for the market. These stocks, generally, do not pay dividends. This is because the issuers of growth stocks are generally companies who wish to reinvest their earnings, they come back in order to accelerate growth in the short term.

Clorox Short-Term Outlook

The rally stretched outside the top 20-month Bollinger Band® in March and has held above the barrier for the last four months, ushering in a very overbought technical reading that predicts a decline lasting several months at a minimum. The long-term, the stochastic oscillator adds to this caution theme, displaying the most extreme overbought reading since 2013. Taken together, the reward-to-risk profile has changed decisively against new long positions, which indicates to the shareholders to take defensive measures to protect profits.

The stock carved a bird ascending triangle in the second quarter and broke out in June, the establishment of a new support between $205 and $215. The inevitable downturn can offer an opportunity to purchase in this price zone, but a better slide is likely, with the psychological $200 level for the provision of a magnetic target. The longer-term technical outlook will remain bullish if the price fails to hold the 20-month exponential moving average (EMA), currently up in the $170.

The Bottom Line

Clorox is close to all the time after a history of the uptrend, but the stock is now the most beloved and in need of a drop to shake the weak hands.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com