Semiconductor company Advanced Micro devices, Inc. (AMD) has formed a classic wedge pattern on its price chart. The wedge pattern suggests a period of uncertainty for the stock. It is formed as the investors are not sure of the supreme leadership actions are directed.

We can all agree that there is a lot of uncertainty in the stock market at this time – global tensions, economic recessions, pandemics, riots, etc., And the stocks move over each small piece of information that comes from outside.

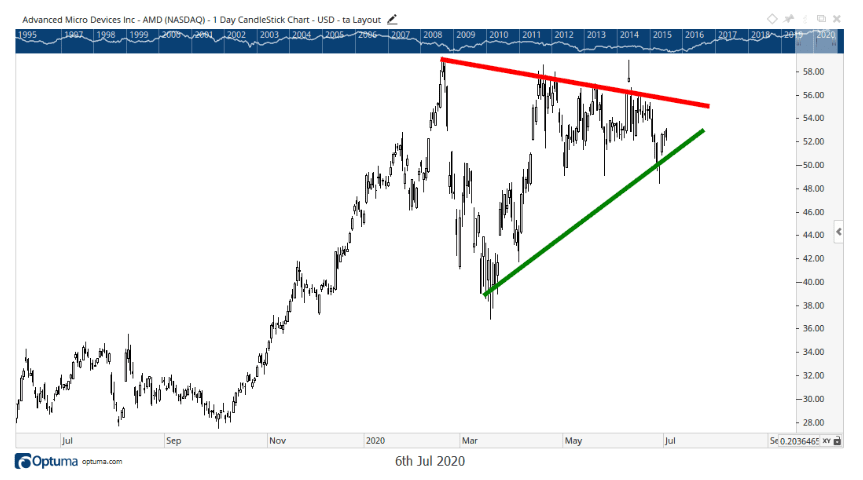

But when we follow the technical models, we have not taken in all that noise – the graphics do the talking for us. In a corner of the model, each rally is stopped by a key resistance level (in red), and every sale is met with a strong increase of the support zone (in green). Take a look:

Optuma

When a storm occurs, the height of the pattern is the shift of approximately $20 per share, in this case. With the stock sitting around$ 53, this is a 37% expected to move in both directions in the coming weeks.

Most of the consolidation of the models end up breaking in the same direction as the stock was heading in before it consolidated. In the case of Advanced Micro devices, the stock was clearly on an upward slope before the peak at the end of February. Then the wedge that started to form.

On 10 June, the stock has experienced a false breakout. While the stock closed above the resistance level, it has opened in the corner pattern the next day. It was a shooting star bearish candlestick on June 10. Now that the stock has fallen from there, it bounced off the support once more and remains stuck trading in this corner of the model.

Seeing that the resistance level has been tested three times, and it was a false breakout, we know that there are buyers who try to push this stock even higher. While the smart play would be to jump once an escape occurs, and to capitalize on the 37% of the expected move, all signs point to a breakout to the top at this point.

The Bottom Line

Advanced Micro devices stock is in a position of power surge or a fall of 37% in the coming weeks. The corner of the model indicates that an increase of the derivation is the most likely outcome, but the best way to trade, it is a once a break occurs. 37% expected move leaves us a lot of room for profit.

Source: investopedia.com