Key Takeaways

- Analysts estimate adjusted EPS of $0.16 vs. $0.08 in Q2 2019.

- The gross margin is expected to increase, helped by the introduction of new products.

- Analysts expect solid revenue growth despite COVID-19 impact on the economy as a whole.

Advanced Micro Devices, Inc. (AMD) has significantly outperformed the stock market in the middle of the sars coronavirus pandemic, which has rebounded by more than 50% since the stock’s March lows and is approaching its record at the beginning of this year. One of the main drivers of this performance has been very strong and sales of new products in recent quarters.

Investors will want to know if AMD can maintain this growth in the face of a sharp and prolonged downturn of the global economy, when the company publishes its results on 28 July for the 2nd quarter of the FISCAL year 2020. For the quarter, analysts expect AMD’s adjusted earnings per share (EPS), double solid, but the deceleration of revenue growth.

Investors are also likely to focus heavily on a key AMD metric, to gross margin, which shows the degree of efficiency of the enterprise is carried on in the good times and the bad. Analysts expect AMD to report a healthy increase in its gross margin, although the size of this increase will be lower than in most neighborhoods in the past two years. The big risk is that the demand for AMD and other products could falter as the global economy shrinks, hurt by tightening margins.

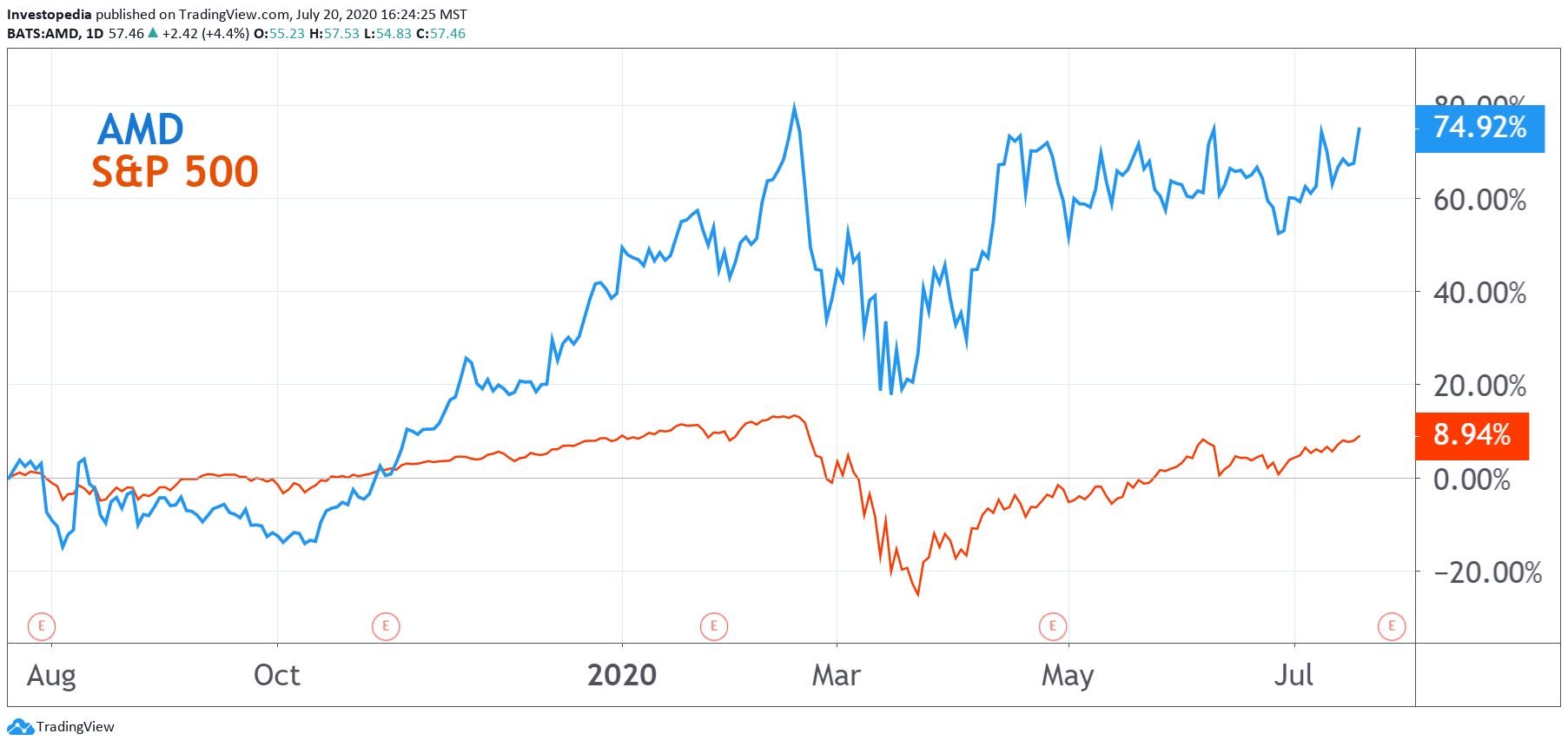

AMD strong growth in earnings, revenues and gross margins may be the reason why the shares have significantly outperformed the general market over the last 12 months, showing a total yield of 74.9%, compared with only 8.9% for the S&P 500.

Source: TradingView.

AMD shares have risen sharply in the days following its Q1 of FISCAL 2020 earnings report released on 28 April, which met the expectations of analysts. The adjusted EPS has increased by 220% to 40.4% increase in sales compared to Q1 of FISCAL year 2019. This marked the third consecutive quarter of rising earnings and revenue after two consecutive quarters in which both the top and bottom lines fell.

After an increase during the month following its Q1 earnings release, AMD’s stock has drifted down between the 20 May and 26 June, erasing most of its post-employment gains. Since then, investors have shown signs of recovery in confidence, with the stock rebounding to about 15% between 26 June and 20 July.

Looking forward to AMD’s Q2 of FISCAL year 2020, analysts estimate that the adjusted EPS has increased 103.9% to 22.1%, the gain of the one-year (yoy). These Q2 estimates look strong compared to a year earlier in the Q2 of FISCAL 2019, when the profit and the turnover has dropped. But they also represent a significant slowdown of the growth compared to the the most recent quarter, Q1 of FISCAL 2020.

Even with the expected deceleration in its key indicators, the analysts are optimistic that AMD can thrive in the middle of the fierce headwinds presented by the master of the world economy. They estimate that adjusted EPS will rise from 64.9% for the entire fiscal year 2020, more rapidly than in the previous year, while posting the highest revenue growth in the five years that it increases of 25.5%.

AMD Key measures

Estimate of the Q2 2020 (AF)

Real for the 2nd quarter of 2019 (FY)

Real for the 2nd quarter of 2018 (AF)

Adjusted Earnings Per Share ($)

0.16

0.08

0.14

Revenue ($B)

1.9

1.5

1.8

Gross Margin (%)

43.8

40.7

37.2

Source: Visible Alpha

Although the semiconductor chips are complex, they are so common in today’s products in the whole world that they are now considered as a commodity, with their value based on their intrinsic properties than on the brand name of the sales company. For this reason, semiconductor companies like AMD have to make sure that their operations are run efficiently in order to remain competitive. To measure this, investors often focus on the gross margin, which is total revenue less cost of goods sold (COGS). Dividing this figure by the total revenue provides a measure of the gross margin as a percentage, allowing investors to compare the effectiveness of a company compared to another.

AMD in recent years has regularly increased its gross margin during each quarter year-over-year. The company reported gross margins of 45.9% in Q1 of FISCAL year 2020, marking an increase of about 4.9 percentage points compared to the Q1 of FISCAL 2019. The company stated that the improvement of the gross margin rate is due mainly to the continued deployment of its Ryzen and EPYC product lines, which are part of a new generation of 7-nanometer processors.

Analysts expect a 43.8% gross margin in Q2 2020. If this is true, this represents the highest margin the company has achieved during a T2 period of at least four years, and the third-highest margin achieved in any quarter over the last 14 quarters.

AMD is 43.8% of the gross margin represents a significant increase of 3.1 percentage points compared to the previous year, but it also represents a smaller gain in efficiency in each quarter in the last two years. More importantly, the estimates of the analysts showing AMD slowing of gross margin growth also reflect their prospects of slowing earnings and revenue growth in the short term. The question is whether this deceleration is simply a one quarter blip, or the beginning of a long trend.

Source: investopedia.com