Key Takeaways

- The adjusted EPS of $0.76 vs $0.65 analysts were expecting.

- Monthly Active users (MAU) have recorded a net increase in year-on-year.

- Revenues have exceeded expectations.

What Happened

Activision Blizzard reported significantly better-than-expected results for the 1st quarter of 2020. Its adjusted EPS was slightly down from a year earlier but well above analysts ‘ expectations, as well as its earlier directives. Its main MAU important figure in the growth year-over-year, coming in well above expectations, which it has held onto the most of users, it has gained in Q4 2019. The company’s products, while again slightly down year-on-year, beyond expectations. ATVI’s stock has risen in after-hours trading.

(Below, Investopedia’s original earnings preview, published 5/4/20.)

What to Look for

Shares of Activision Blizzard Inc. (ATVI) have managed to avoid the worst of this year coronavirus-induced by the market to dive, ascend to a new 2020 high over the last few weeks. Investors seem convinced that, like other gaming companies, Activision Blizzard will benefit from the surge in internet traffic, even as the traditional brick and mortar businesses have been forced to temporarily close their doors. Investors will be watching closely to see how this pic in the game affects Activision Blizzard results when it publishes its results on May 5, 2020 Q1 2020. Bullish investors may be disappointed. Analysts currently expect the decreases in both adjusted earnings per share (EPS) and revenues, illustrating the brutally competitive nature of the video game market.

A key metric that investors will seek to measure Activision Blizzard’s health, the growth in monthly active users (MAU). Analysts expect the company to report its second consecutive quarterly increase in the 1st quarter on a year-over-year (yoy) basis. This is good news after you have recorded decreases in those 11 quarters from Q1 2017 to Q3 2019.

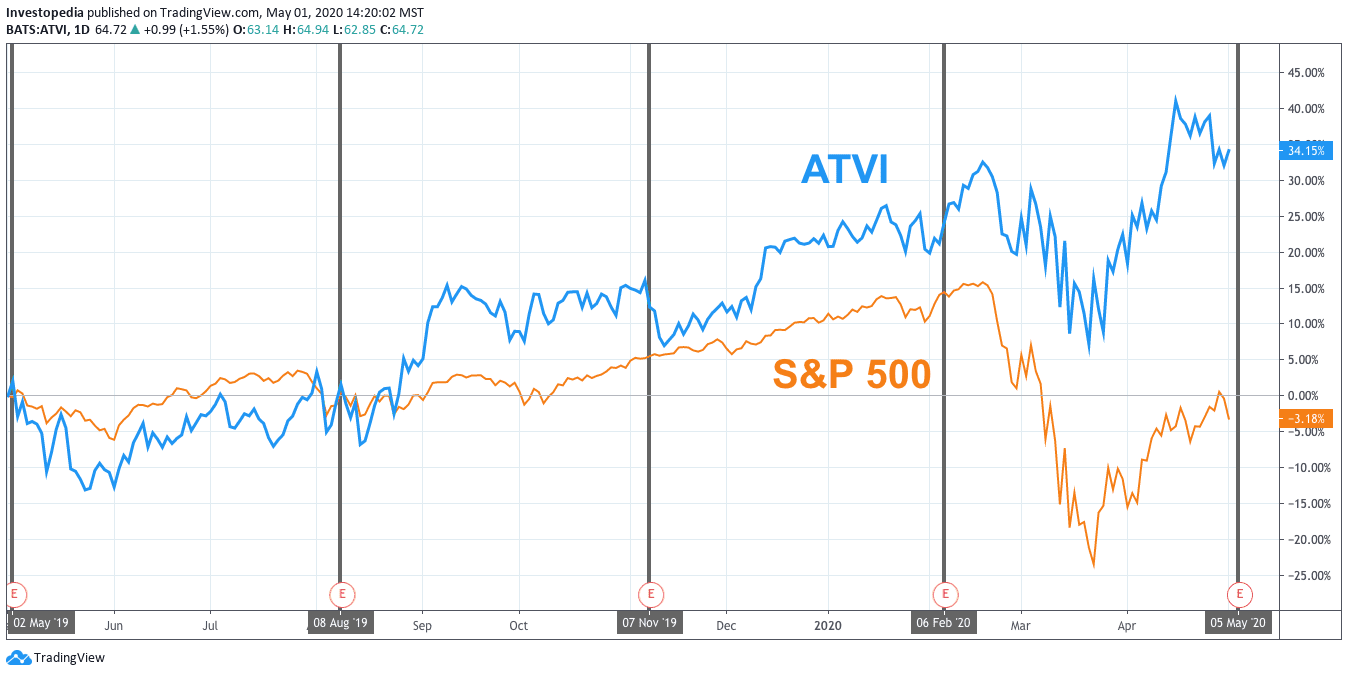

The improvement of the MAU may be why Activision Blizzard stock has mostly outperformed the market in general, despite the relatively low number result in the course of the last year. The company’s shares have provided investors with a total return of over 34% compared to the S&P 500 index total return of about -3% over the past 12 months.

Source: TradingView.

The last year has been difficult for the video game maker, at least in part due to its divestiture of the Destiny game franchise. The annual adjusted EPS for 2019 has dropped by 15.1% while revenue decreased by 13.5%, marking the first full year of declines in at least the past five years. During the last quarter of the fiscal year, adjusted EPS decreased by 31.6% and revenues declined by 16.6% compared to the 4th quarter of 2018. This is the fourth consecutive quarter of year-on-year decreases.

The adjusted EPS and revenue fell to their lowest level since at least ten quarters in the 3rd quarter of 2019. The adjusted EPS has declined 9.2% to $0.38 and revenues of 15.2% to $ 1.3 billion compared to the same quarter a year ago.

Despite a difficult year, the company’s shares continued to move higher. While the decline in the growth of the adjusted EPS and revenue is expected to continue in Q1 2020, the magnitude of these reductions should be smaller. Analysts estimate that adjusted EPS will fall of 17.0% and revenue decrease of 9.3% compared to the same quarter of the previous fiscal year. In the short term, these estimates indicate that analysts do not see immediate benefit to Activision Blizzard, the whole thrust of the Internet traffic.

Activision Blizzard’s Key Measures

The estimate for the Q1 2020

Real for the 1st quarter of 2019

Actual for Q1 2018

Adjusted earnings per share ($)

0.65

0.78

0.78

Revenue ($B)

1.7

1.8

2.0

Monthly Active Users (M)

346.6

345.0

374.0

Source: Visible Alpha

As stated, the investors will also be focused on Activision Blizzard MAU, a key measure of the overall size of the business of the database user. The metric is a count of the total number of people who have gained access to the Activision Blizzard’s games in a given month. A person who has accessed a game is considered a user, for example, while a person who has gained access to two games a month will be counted as two users. MAU has become an important measure for video game companies because it is linked with the potential for gains. These companies are generating more and more of their revenues from online subscriptions and sales of game content, as opposed to the traditional method of selling packaged, full of games.

A bit of good news from the Activision Blizzard Q4 earnings report was the increase in MAUs after 11 consecutive quarters of decline. The cuts included a 20.8% decrease in the 1st quarter of 2017, a decline of 13.5% in Q2 2018 and a drop of 8.4% in the 3rd quarter of 2019. Then, MAUs suddenly started to bounce. In the 4th quarter of 2019, the average MAUs increased from 14.9% to 409.0 million compared to the same three-month period a year earlier. It was also the highest MAU since the 1st quarter of 2017. Analysts expect MAU growth to continue, though just barely. The forecasts indicate a growth of 0.5% yoy for a total of 346.6 million for the 1st quarter of 2020.

Source: investopedia.com